U.S. stock index futures slid on Thursday on the last day of a dismal first-half of the year on worries that central banks determined to tame inflation will hamper global economic growth.

Market Snapshot

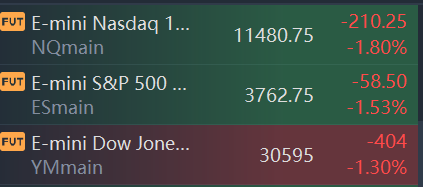

At 7:51 a.m. ET, Dow e-minis were down 404 points, or 1.30%, S&P 500 e-minis were down 58.5 points, or 1.53%, and Nasdaq 100 e-minis were down 210.25 points, or 1.80%.

Pre-Market Movers

Walgreens(WBA) – The drug store operator earned an adjusted 96 cents per share for its latest quarter, 4 cents above estimates, with revenue also beating analyst forecasts. Walgreens also reaffirmed its full-year guidance, forecasting low-single-digit adjusted earnings growth. The stock fell 2.7% in premarket action.

Constellation Brands(STZ) – The spirits producer beat estimates by 14 cents with adjusted quarterly earnings of $2.66 per share, and revenue that was above estimates as well. Constellation also gave an upbeat full-year forecast and the stock added 1% in the premarket.

Acuity Brands(AYI) – The maker of building management systems saw its stock jump 5% in premarket trading after it beat top and bottom-line estimates for its latest quarter. Acuity’s results were driven by strength in its lighting business.

RH(RH) – RH slid 7.7% in premarket trading after the home goods and furniture retailer lowered its full-year financial guidance. The company formerly known as Restoration Hardware cited a deteriorating economy and a slowdown in home sales.

Xerox(XRX) – Xerox Chief Executive Officer John Visentin died at age 59 due to complications from an ongoing illness. The printer and copier maker named Chief Operations Officer and President Steve Bandrowczak interim CEO. Xerox fell 1% in the premarket.

Nexstar Media(NXST) – Nexstar is poised to win control of the CW TV Network, according to the Wall Street Journal. The paper said the TV station operator is near a deal to buy a 75% stake in the CW from current co-ownersWarner Brothers Discovery(WBD) andParamount Global(PARA).

Spirit Airlines(SAVE) – Spirit delayed a shareholders’ vote on its proposed merger withFrontier Group(ULCC) until July 8. The postponement comes asJetBlue(JBLU) continues to push Spirit to accept its rival bid. Spirit rose 1.2% in the premarket, while Frontier Group added 1.8% and JetBlue slid 3%.

Pfizer(PFE),BioNTech(BNTX) – The drug makers signed a $3.2 billion deal with the U.S. government to provide 105 million doses of their Covid-19 vaccine. That would include supplies of an updated vaccine centered on the omicron variant, pending FDA approval. BioNTech added 1.1% in premarket trading.

Booz Allen Hamilton(BAH) – The Justice Department has sued to block the proposed merger of security contractors Booz Allen Hamilton and Everwatch, contending the deal would drive up prices and create a monopoly situation for critical security services.

Market News

Tesla ramps up Gigafactory Texas to thousands of units per week, adds new Model Y version

Tesla has managed to ramp up production at Gigafactory Texas to thousands of units per week, adding production of the Model Y Long Range on top of the Standard Range version.

The automaker is being secretive about data on its production ramp at Gigafactory Texas.

U.S. watchdog to audit FAA oversight of Boeing 787, 737 production

The office of the inspector general of the U.S. Transportation Departmentwill auditthe Federal Aviation Administration's (FAA's) oversight of Boeing 737 and 787 production, it said on Wednesday.

The watchdog said it would review the FAA's processes for "identifying and resolving" production issues and "addressing allegations of undue pressure within the production environment."

Samsung Elec starts 3-nanometre chip production to lure new foundry customers

Samsung Electronics Co Ltd(005930.KS)said on Thursday it has begun mass producing chips with advanced 3-nanometre technology, the first to do so globally, as it seeks new clients to catch far bigger rival TSMC(2330.TW)in contract chip manufacturing.

Compared with conventional 5-nanometre chips, the newly developed first-gen 3-nanometre process can reduce power consumption by up to 45%, improve performance by 23%, and reduce area by 16%, Samsung said in a statement.

Disney unveils first new cruise ship in a decade, dips toe into metaverse

Chief Executive Bob Chapek introduced Walt Disney Co's(DIS.N)first new cruise ship in a decade on Wednesday, the culmination of the first project the former theme parks executive championed to the company's board of directors.

The launch of the 4,000-passenger Disney Wish is a bright spot for Chapek, who became Disney's CEO in February 2020 and secured a three-year contract extension on Tuesday following recent controversies that prompted questions about his tenure.

Comments