July 15 (Reuters) - Wells Fargo & Co reported a fall in second-quarter profit on Friday as the bank set aside more money to cover loans that could sour if the U.S. pandemic recovery gives way to a recession.

The company bolstered its loan loss reserves by setting aside $580 million, compared with a release of $1.26 billion a year earlier, when aggressive monetary stimulus measures cushioned a blow from the pandemic and propped up the economy.

Last quarter, the bank's reserve release helped offset a decline in its mortgage lending business. This quarter, however, soaring interest rates have dampened demand for mortgage originations, denting home loan growth.

After hiring tens of thousands of staff between 2018 and 2020 to handle surging mortgage originations and refinancings driven by low interest rates, the mortgage sector is downsizing.

U.S. banks including JPMorgan Chase & Co and Wells Fargo have started cutting staff, with more industry layoffs expected in coming months, said analysts and economists.

A slump in dealmaking activity because of Russia - Ukraine war in February and fears that an economic recession is looming has also dealt a blow to major U.S. banks, including Wells Fargo.

The fourth-largest U.S. bank has also been in the regulators' penalty box since 2016 for governance and oversight lapses related to a series of sales and other scandals.

It remains under the Federal Reserve's $1.95-trillion-asset cap, which has curtailed loan and deposit growth that Wells needs to boost interest income and cover costs.

The fourth-largest U.S. lender reported a profit of $3.1 billion, or 74 cents per share, for the quarter ended June 30, compared with $6 billion, or $1.38 per share, a year earlier.

Analysts on average had expected a profit of 80 cents per share, according to the IBES estimate from Refinitiv.

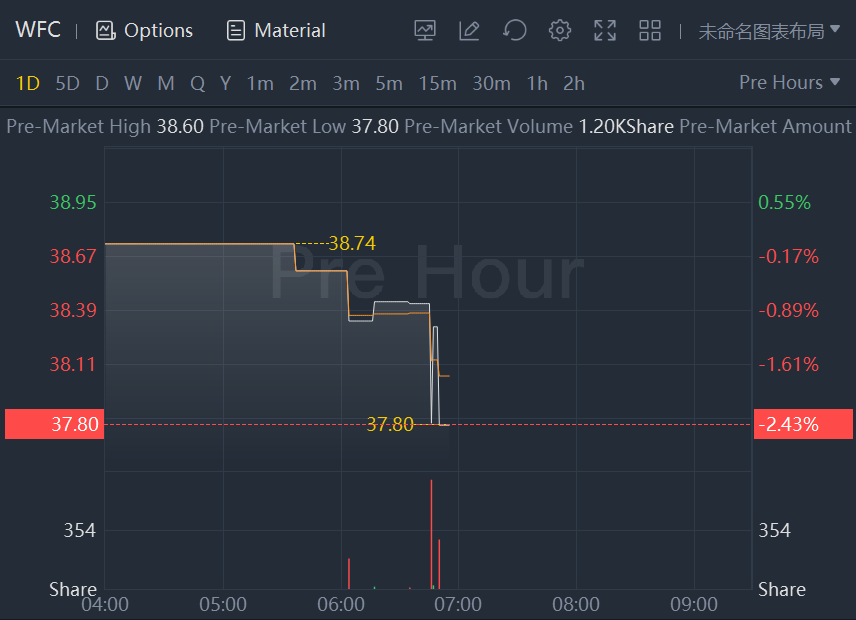

Wells Fargo shares fell more than 2% in premarket trading after quarterly results.

Comments