Market Overview

U.S. stocks extended their rally on Tuesday, kicking off the final week of 2023 with expectations that the Federal Reserve will begin cutting interest rates as soon as March.

The Dow Jones Industrial Average rose 0.43%, the S&P 500 gained 0.42%, and the Nasdaq Composite added 0.54%.

Regarding the options market, a total volume of 26,728,982 contracts was traded, down 30.78% from the previous trading day.

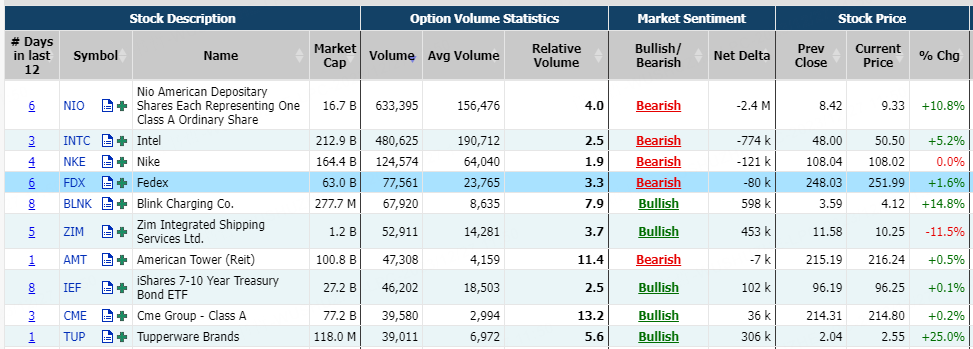

Top 10 Option Volumes

Top 10: SPDR S&P 500 ETF Trust, Invesco QQQ Trust, Tesla Motors, iShares Russell 2000 ETF, NIO Inc., Apple, NVIDIA Corp, Intel, Advanced Micro Devices, Marathon Digital Holdings Inc

NIO Inc. jumped 10.81% on Tuesday as it launched its new flagship ET9 EV over the weekend, a premium executive car aimed at “the new generation of high-end business users.”

There were 636.1K NIO Inc. option contracts traded on Tuesday, surging over 175% from the previous day. Call options account for 82% of overall option trades. Particularly high volume was seen for the $9.5 strike call option expiring December 29 $NIO 20231229 9.5 CALL$, with 60,306 contracts trading. Meanwhile, the option mentioned above surged 271.43% on Tuesday.

Unusual Options Activity

Intel rose 5.21% on Tuesday as Israel's government agreed to give it a $3.2 billion grant for new $25 billion chip plant it plans to build in southern Israel.

There were 483.2K Intel option contracts traded on Tuesday, doubling from the previous day. Call options account for 71% of overall option trades. Particularly high volume was seen for the $50 strike call option expiring December 29 $INTC 20231229 50.0 CALL$, with 34,451 contracts trading. Meanwhile, the $51 strike call option expiring December 29 $INTC 20231229 51.0 CALL$ surged 600% on Tuesday.

Tupperware soared 25% as it was extending the deadline to provide its turnaround plans as well as other financial documents. The deadline for the plan along with two financial statements is now Feb. 2, 2024.

There were 40.17K Tupperware option contracts traded on Tuesday, surging nearly 700% from the previous day. Call options account for 91% of overall option trades. Particularly high volume was seen for the $2.5 strike call option expiring December 29 $TUP 20231229 2.5 CALL$, with 13,226 contracts trading. Meanwhile, the $2.5 strike call option expiring January 12 $TUP 20240112 2.5 CALL$ surged 400% on Tuesday.

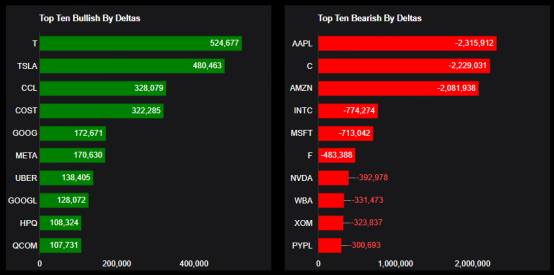

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: AT&T Inc, Tesla Motors, Carnival, Costco, Alphabet, Meta Platforms, Inc., Uber, Alphabet, HP Inc, Qualcomm

Top 10 bearish stocks: Apple, Citigroup, Amazon.com, Intel, Microsoft, Ford, NVIDIA Corp, Walgreens Boots Alliance, Exxon Mobil, PayPal

Based on option delta volume, traders sold a net equivalent of 2,315,912 shares of Apple stock. The largest bearish delta came from selling calls.

The largest delta volume came from the 29-Dec-23 195 Call $AAPL 20231229 195.0 CALL$, with traders getting short 2,162,872 deltas on the single option contract.

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments