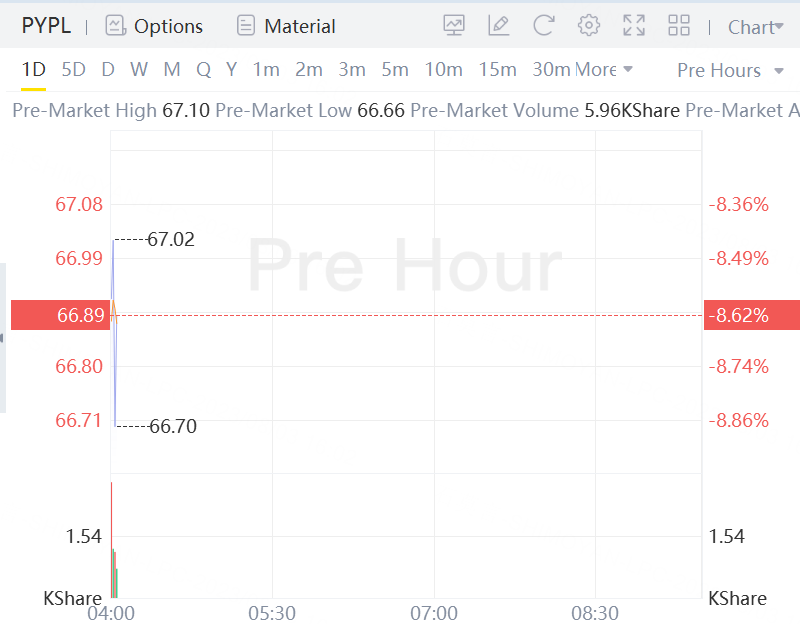

PayPal Holdings shares fell 8.62% in premarket trading as investors were disappointed by the payments firm's quarterly operating margin, even as executives said they expect improvement towards the end of the year.

Underwhelming margins at PayPal have been worrying analysts in recent quarters. The company's low-margin business products have grown strongly, while growth in its branded products has slowed due to increased pressure from competitors like Apple.

"When we think about the back half, in Q3, we'll still see some pressure on transaction margin performance. In Q4, we expect to see an improvement," acting CFO Gabrielle Rabinovitch said on a call with analysts.

PayPal's adjusted operating margin for the quarter came in at 21.4%, missing its forecast of 22%.

In a bright spot, PayPal CEO Dan Schulman said that as inflation cools the company expects discretionary spending to rebound and drive e-commerce growth.

"So one of the headwinds we faced was e-commerce growth slowing. Now it's accelerating again," he added.

PayPal's total payment volume surged 11% in the second quarter to $376.5 billion, benefiting from resilient consumer spending trends.

"TPV growth above consensus affirms the ongoing theme of resilient consumer spending in the face of broader macroeconomic uncertainty," said Kevin Kennedy, analyst at research firm Third Bridge.

Banking on the continued steady use of its platform, PayPal expects third-quarter revenue of about $7.4 billion, above analysts' estimates of $7.32 billion, according to Refinitiv data.

PayPal forecast adjusted profit per share for the current quarter to be in a range of $1.22 and $1.24, above analysts' estimates of $1.22.

PayPal posted revenue of $7.3 billion in the second quarter, compared with $6.8 billion last year. It earned $1.16 per share on an adjusted basis, in line with Wall Street expectations.

Comments