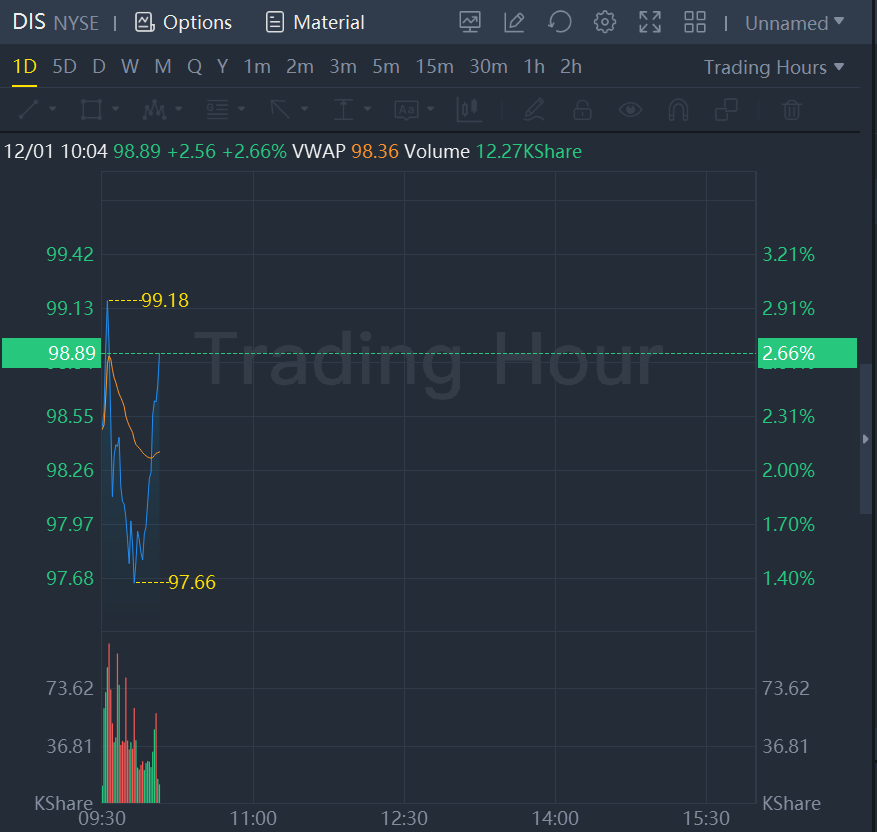

Disney stock jumped 2.66% as Nelson Peltz plans proxy fight against Disney.

Disney revealed the activist’s intentions Wednesday afternoon in a statement that said that it is opposed to having him join the board. It also said that current directorMark Parkerwould become chairman, succeedingSusan Arnold.

Mr. Peltz had planned to launch the battle Thursday, according to people familiar with the matter.Late Wednesday, his firm launched a website for its campaign, called Restore the Magic.

Disney said that while members of its senior leadership team have engaged with Mr. Peltz numerous times over the past few months, the board is asking shareholders to vote against him at the coming annual meeting.

Executives at Mr. Peltz’s Trian Fund Management met with Disney’s top leadership, including Mr. Iger and Chief Financial OfficerChristine McCarthy, in California on Tuesday in an attempt to come to an agreement with the company and avoid a proxy battle, but the talks were unfruitful, the people said.

Ms. Arnold phoned Mr. Peltz on Wednesday morning to offer him a role as a board observer and to ask him to sign a standstill agreement, which Mr. Peltz declined, according to the people with knowledge of the call.

Trian, an influential activist investor co-founded by Mr. Peltz, wants Disney to plan for a successor to Mr. Iger, the people said. Mr. Iger had been CEO since 2005 before passing the reins toBob Chapekin 2020. Last year, Mr. Chapek was fired by the board and Mr. Iger was brought back.

Disney said that its new chairman, Mr. Parker, will lead a newly created succession-planning committee that will advise the board on a new CEO and look at internal and external candidates. The company added that it continually refreshes its board, with a focus on directors with industry experience.

Disney said that Mr. Iger’s mandate is to serve out his full two-year term at the company.

Trian thinks Disney has excessive compensation practices and lacks cost discipline, the people said. The firm is also critical of Disney management’s judgment in recent deal-making efforts, including by overpaying, in its view, for the assets of 21st Century Fox Inc. and bidding aggressively for pay-TV giant Sky PLC, the people said. Fox’s corporate sibling,News Corp, owns The Wall Street Journal.

Ahead of Mr. Iger’s return, Trian in November accumulated more than $800 million of Disney stock in the days following the company’s lackluster fiscal fourth-quarter earnings report, the Journal previously reported.

The stake, which has now grown by about $100 million, isn’t as large as Trian would like it to be and will likely get bigger, subject to market conditions, the people said.

Disney has a market capitalization of over $175 billion. The shares have fallen sharply from a high of roughly $200 in early 2021, and hit a 52-week low of $84.07 on Dec. 28. The shares closed Wednesday at $96.33.

Mr. Iger loomed large over Mr. Chapek’s short tenure as CEO,the Journal previously reported. Mr. Chapek took over days before the Covid-19 pandemic would crimp the company’s bottom line. Losses ballooned in the company’s streaming division, with subscriber growth coming at a hefty cost, which overshadowed strength at its theme parks.

Trian, like other activists, is known for encouraging changes at the companies it targets, such as the breakup or sale of underperforming divisions or moves to improve efficiency and better use capital. It often seeks board representation and tries to avoid public spats, unlike some of its more pugnacious rivals.

Trian’s proxy battle at Disney will represent the fourth such clash in the investment firm’s history.

The firm is accustomed to hunting large prey, having targeted companies includingProcter & GambleCo.,DuPontCo. andGeneral ElectricCo.

Mr. Peltz has previously served on the board ofother consumer-facing companiesincluding Oreos makerMondelez InternationalInc.,Kraft HeinzCo. and, more recently,UnileverPLC, the maker of Dove soap and Hellmann’s mayonnaise.

Disney faced pressure from another activist investor before Trian’s arrival.

Dan Loeb’s Third Pointbought a new stake in Disney last yearand called on the company tobuy the rest of the Hulu streaming service, explore spinning off ESPN and refresh its board. Mr. Loeb praisedgains in Disney’s streaming-subscriber base, but also asked the company to more aggressively slash expenses.

Since then, Mr. Loebhas backed offhis request that Disney spin off its popular sports network. In September, Disney added Carolyn Everson, a veteran tech and media executive, as a director, andMr. Loeb agreed to a standstillover the makeup of the company’s board.

Comments