U.S. stock indexes climbed the most in roughly a month as bond yields eased, with investors shrugging off hawkish remarks made by Federal Reserve officials on Wednesday(Sep 7).

The Dow Jones Industrial Average rose 435.98 points, or 1.4%, to 31,581.28, the S&P 500 gained 71.68 points, or 1.83%, to 3,979.87 and the Nasdaq Composite added 246.99 points, or 2.14%, to 11,791.90.

Options Broad View

A total volume of 35,470,461 contracts were traded on Wednesday, up 5% from the previous day. Call options account for 50% of total options trades.

There are 7.98 million SPDR S&P500 ETF Trust options traded on Wednesday. Call options account for 41% of overall option trades. Particularly high volume was seen for the $390 strike put option expiring Sep 7, with 277,576 contracts trading on Wednesday.

Top 10 Option Volumes

Top 10: SPY, QQQ, TSLA, AAPL, IWM, AMZN, NVDA, HYG, META, AMD

Options related to equity index ETFs are still top choices for investors, with 2.73 million Invest QQQ Trust ETF(QQQ) options contracts trading on Wednesday. Total trading volume for SPY and QQQ decline 7.7% and 12.5% respectively from the previous day.

Apple stock gained 1% on Wednesday after iPhone 14 event. The biggest changes on Wednesday were in the higher-end iPhone Pro models that cost more and have helped drive more revenue for the company.

Wedbush raised price target to $220. iPhone launch may offer a catalyst to Apple's stock price. October offers a 4.3% average monthly return since the launch of the original iPhone in 2007.

There are 1.47M Apple option contracts traded on Wednesday, up 40% from the previous day. Call options account for 55% of overall option trades. Particularly high volume was seen for the $160 strike call option expiring Sep 9, with 141,810 contracts trading on Wednesday.

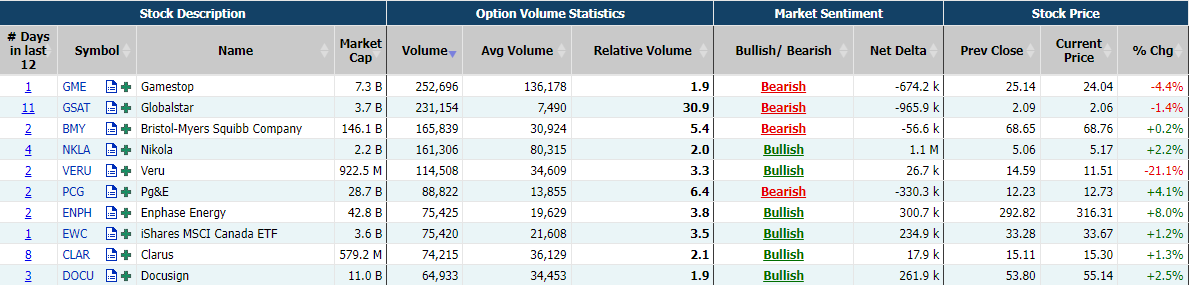

Unusual Options Activity

GameStop Corp on Wednesday reported a smaller-than-expected quarterly loss and a partnership with crypto marketplace FTX US, sending the video game retailer's shares up 11% after the bell.

GME's option trading also seen relatively large changes. There are 252,696 option contracts traded on Wednesday. Call options account for 48% of overall option trades. Particularly high volume was seen for the $20 strike put option expiring September 9, with 12,774 contracts trading on Wednesday.

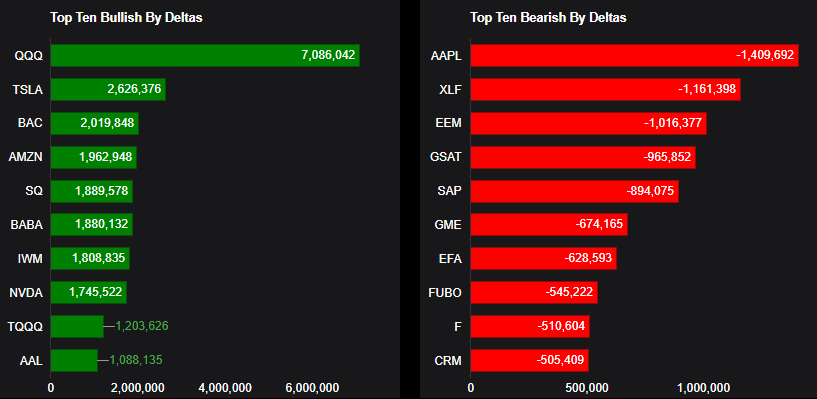

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: QQQ, TSLA, BAC, AMZN, SQ, BABA, IWM, NVDA, TQQQ, AAL

Top 10 bearish stocks: AAPL, XLF, EEM, GSAT, SAP, GME, EFA, FUBO, F, CRM

Comments