Market Overview

Wall Street indexes closed higher on Tuesday(Oct 10), to notch their third straight day of gains, after dovish comments from U.S. Federal Reserve officials pushed Treasury yields lower as investors cautiously monitored developments in the Middle East.

Regarding the options market, a total volume of 36,223,910 contracts was traded, up 23% from the previous trading day.

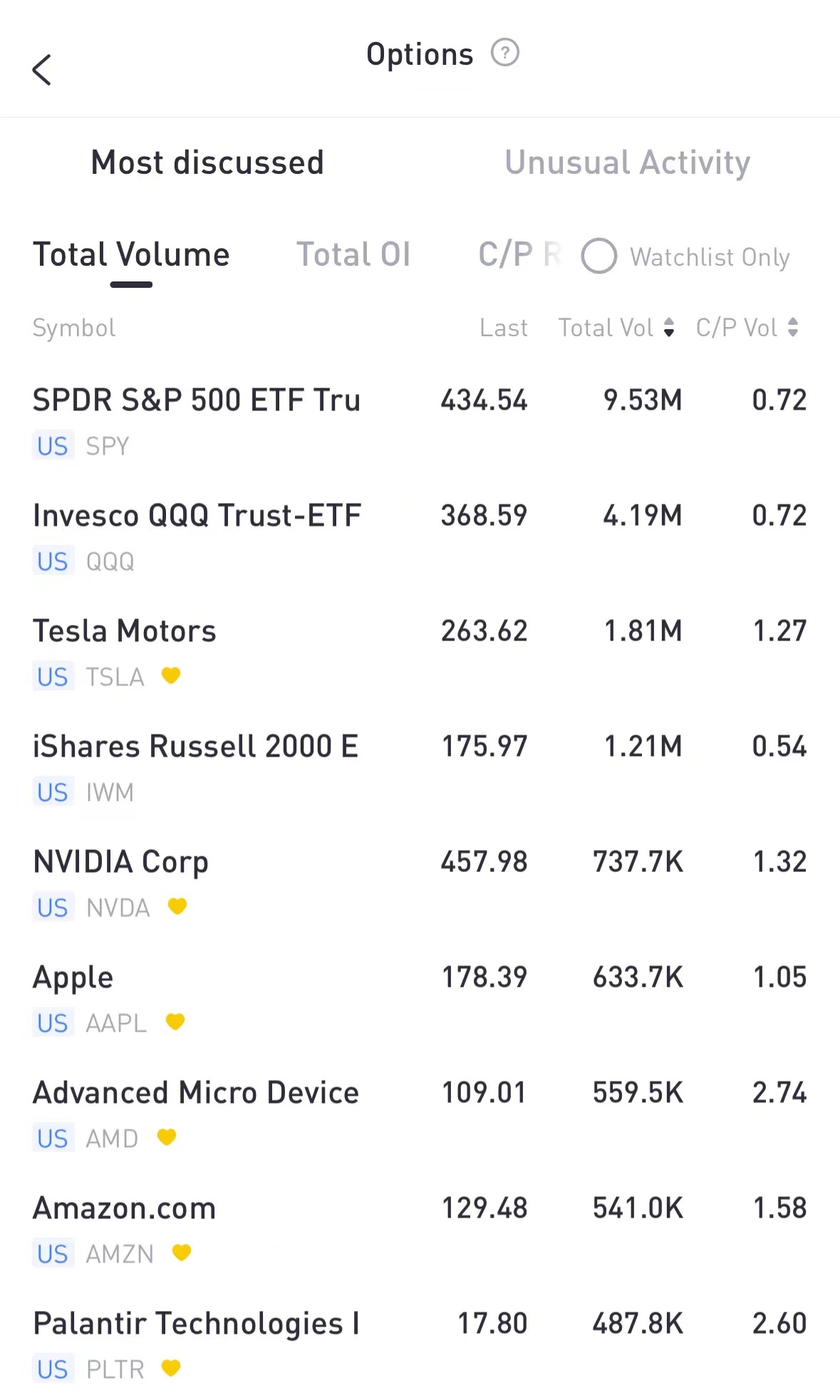

Top 10 Option Volumes

Top 10: SPY, QQQ, TSLA, IWM, NVDA, AAPL, Advanced Micro Devices , AMZN, Palantir Technologies Inc.

AMD said on Tuesday it plans to buy an artificial intelligence startup called Nod.ai as part of an effort to bolster its software capabilities. AMD gained 1.9%.

There are 559.5K AMD option contracts traded on Tuesday, up 118% from the previous trading day. Call options account for 73% of overall option trades. Particularly high volume was seen for the $120 strike call option expiring Nov 17, with 58,531 contracts trading.$AMD 20231117 120.0 CALL$

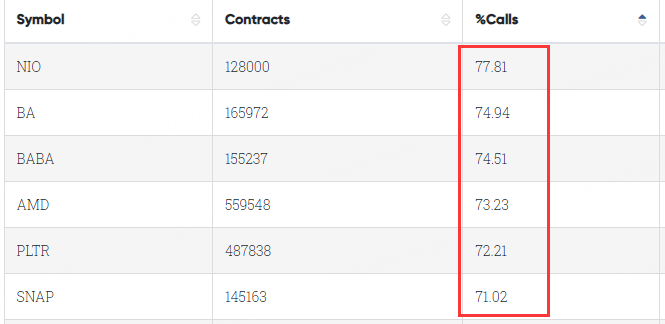

Most Active Equity Options

Special %Calls >70%: NIO Inc. , Boeing , Alibaba , Advanced Micro Devices , Palantir Technologies Inc. , Snap Inc

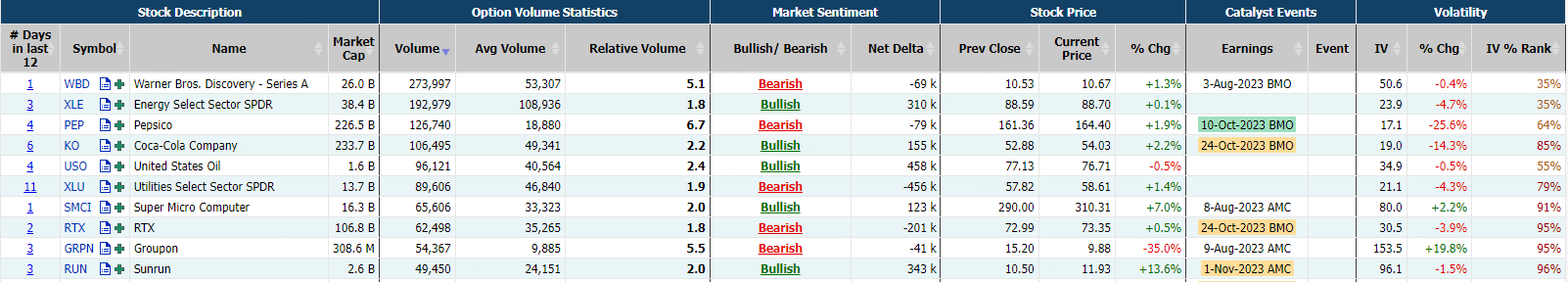

Unusual Options Activity

PepsiCo climbed 1.9% after the soft drinks company raised its annual profit forecast for a third time this year.

There are 126,740 Pepsi option contracts traded on Tuesday, up 72% from the previous trading day. Put options account for 51% of overall option trades. Particularly high volume was seen for the $155 strike put option expiring Dec 15, with 11,651 contracts trading.$PEP 20231215 155.0 PUT$

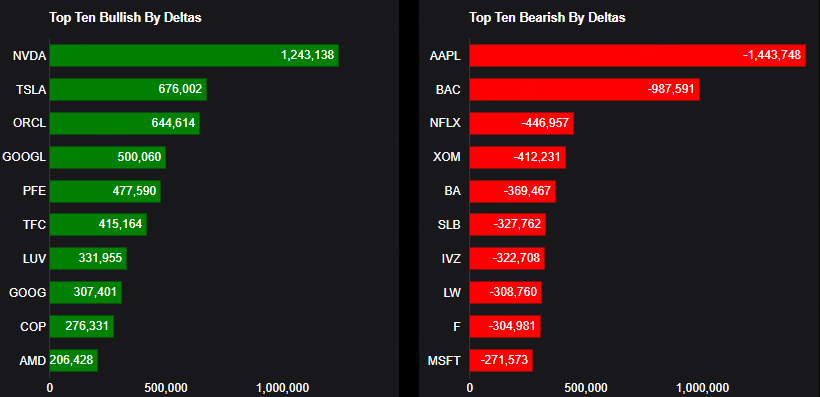

TOP 10 Bullish & Bearish S&P 500

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: NVDA, TSLA, ORCL, GOOGL, PFE, TFC, LUV, GOOG, COP, AMD

Top 10 bearish stocks: AAPL, BAC, NFLX, XOM, BA, SLB, IVZ, LW, F, MSFT

Based on option delta volume, traders bought a net equivalent of 1,243,138 shares of Nvidia stock. The largest bullish delta came from buying calls. The largest delta volume came from the 13-Oct-23 460 Call, with traders getting long 348,478 deltas on the single option contract.$NVDA 20231013 460.0 CALL$

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments