★70-80年代-滞胀时期的加息

70年代布雷顿森林体系瓦解后,美国陷入了凯恩斯主义的经济驱动方式,货币政策为财政政策服务,引起了通胀预期的明显上升,叠加能源危机,出现了滞胀的局面,美联储整体加息落后于曲线。

★80-90年代-先发制人的加息

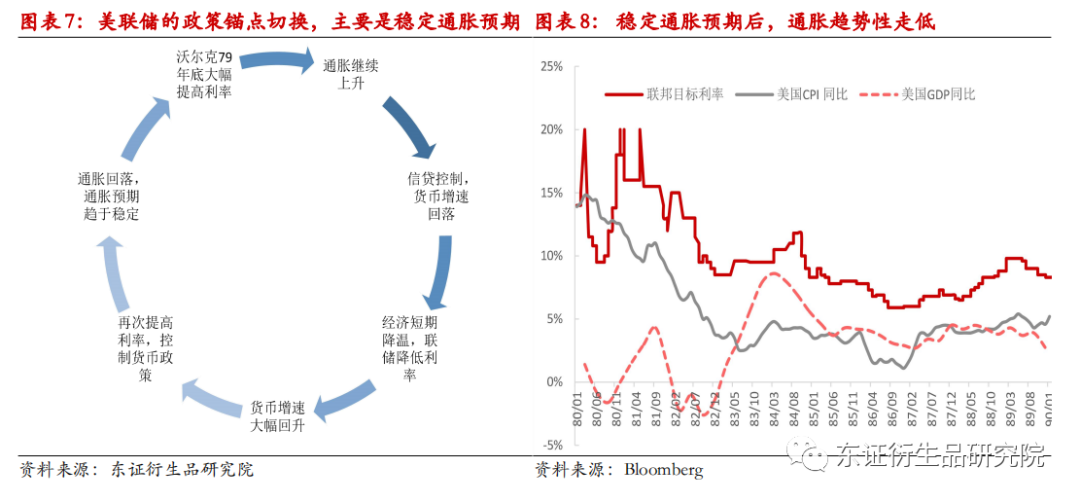

沃尔克开始了针对滞胀的先发制人的加息模式,大幅提高利率来控制通胀预期,经历了非常曲折的加息过程,终于美联储成功控制了通胀预期,并且把美联储的政策锚定变为了稳定通胀预期。

★90年代之后的加息-相机决策

2000年后,美联储在通胀预期非常稳定的状态下,加息变为了相机决策,加息在增长和通胀之间做权衡,08年金融危机后,低通胀和低增长的特点使得美联储加息幅度缓慢并且力度较低。

★加息要点分析-穿透表象的迷雾

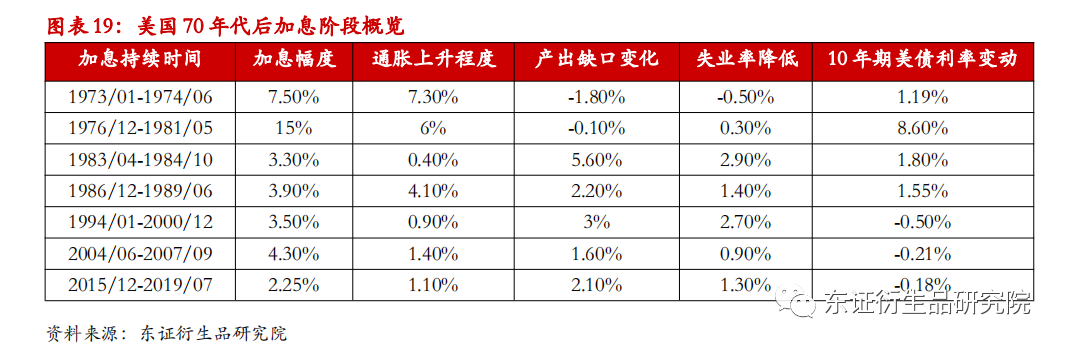

美联储加息主要是对于产出缺口的确认,大部分时间,加息后产出缺口上升,失业率走低,但是滞胀阶段往往加息后产出缺口走低,因此目前的状况接近于滞胀阶段的加息,美联储提出“前置加息” 的政策加息曲线左移,但是受制于债务和经济周期,本次加息周期将会较短。

★投资建议:

美元短期受到紧缩预期走强,中期滞涨局面不改对于美元施加走低压力。

★风险提示:

美国加息分析

在目前的环境下,市场对于美联储的加息节奏各执一词,尤其是当面临高通胀阶段,上一次美国经济滞胀时代已经是70-80年代,因此我们准备研究一下美国70年代后,美联储历次加息的主要原因,面临的问题和最终的结局,希望对于分析目前的政策上能有一些启迪。

1.1、滞胀年代下的加息,美国70-80年代的加息

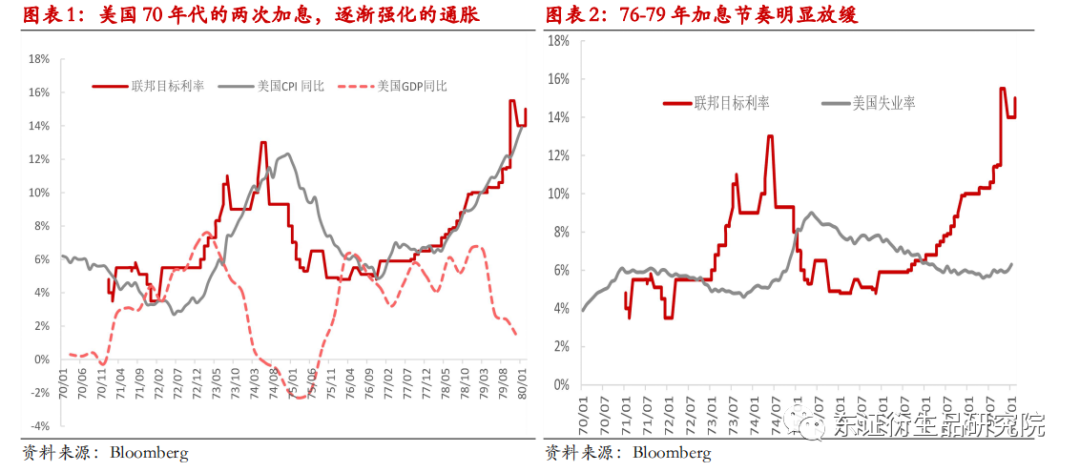

由于美国财政赤字上升叠加贸易赤字,使得70年代初布雷顿森林体系解体,美元进入到自由兑换阶段。布雷顿森林体系解体造成的影响直接就是美国的通胀水平出现了明显的上升,当时美联储的政策框架决策的核心因素偏重于就业,因此愿意高通胀来换取低失业率,这就为日后的持续高通胀埋下了种子。

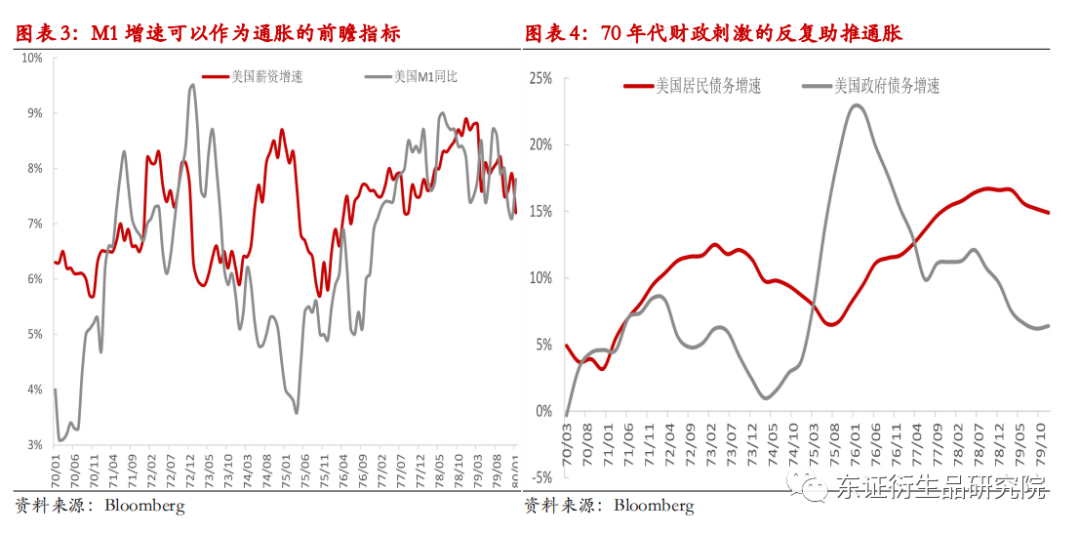

美联储73年开始的加息正是处于这样一种环境,美国当时正处于物价管制的影响下,由于担心通胀的进一步上升,因此美联储开始上调基准利率,那为何美联储在当时物价和工资管制的状况下开始担心通胀的上升?主要原因在于 71年到73年这个阶段的经济增长迅速主要得力于物价管制带来的低通胀和物价管制背景下,为了促进经济增长实行的扩张性货币政策。

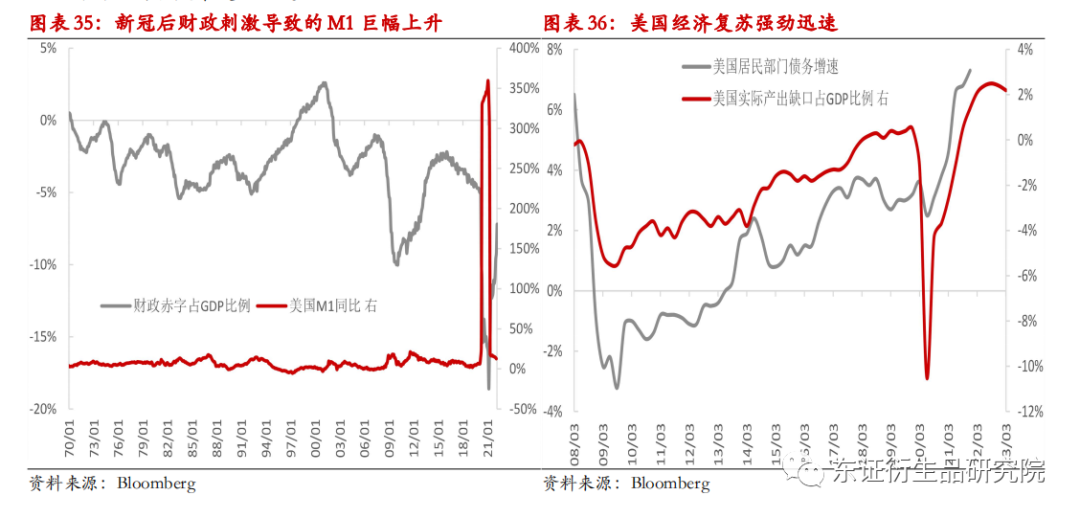

也就是说当时的美联储在73年开始加息的时候注意到了当时的美国M1持续的高增速,而作为高通胀的前瞻指标,我们可以把美国M1增速看做是实际上的通胀预期,因此在高M1的情况下,物价管制必然是失败的,随着通胀预期的走高,美联储不得不开始收紧流动性,与此同时,73年10月到74年6月的第一次原油战争爆发,原油价格从2.8美元涨到9.6美元。能源价格的大幅上涨加剧了美国通胀的形势,使得美联储不得不加强加息的力度。

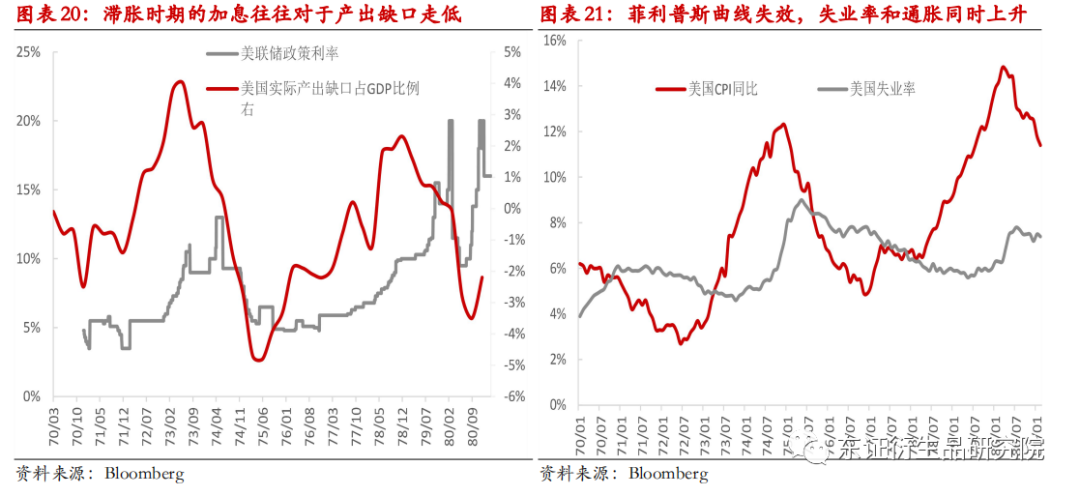

73年的加息明显是一次滞胀式加息的预演,经济在加息后不久就出现走弱,通胀在加息过程中上升,通胀预期得到了明显的抑制,因此滞胀的局面由于经济的下行和利率的上升并未出现长期的持续,随着经济的逐渐走弱,失业率的上升,需求的减少,最终通胀在本次加息结束后出现了走低。73年的加息过程中,经济增速,失业率,通胀传导并不是直接的过程,因此通胀是在加息结束后出现的回落,伴随着的是为了对冲经济下行出现的连续降息,这其中有能源价格的因素,但是我们需要注意的是本次加息环境中,通胀预期实际上并未被彻底扭转,74-75年的滞胀环境为以后更加激进的宽松政策埋下伏笔。

如果说73年的第一次加息是滞胀加息的预演,那76年到79年的加息明显就是滞胀加息的典型。我们看到在74年美国经济开始下行阶段,美国政府的财政支出就开始对冲经济下行压力,此时福特担任美国总统,民主党总统倾向于扩大财政支出,因此从74年开始,美国财政支出就明显开始了扩张,此后的高通胀环境限制了财政支出的扩张,但是在经济受困于滞胀的阶段,通胀预期并未被彻底解决。

在福特接替卡特担任总统后,最核心的任务就是提振经济,因为此前滞胀阶段失业率上明显,因此很快政策的重点就变为了维持就业,卡特上台后进行了减税计划刺激经济,而美联储则对于上调利率的节奏犹豫不决,因此76年开始的加息很明显不足以对于M1增速产生负面影响。而1978年美联储主席由伯恩斯换成了米勒,米勒的政策和福特的政策倾向高度一致,因此美联储在通胀预期上升的阶段,加息的幅度不足,目的是稳定经济增长。因此这时美联储的政策实际上形成了一个非常不利的预期导向,就是市场的通胀预期上升明显,在经历了74-75年的滞胀之后,通胀预期并未完全被解决,此时的政策造成的结果就是通胀预期的大幅强化,高企的M1增速和薪资增速形成了螺旋循环,叠加79年开始的第二次石油战争,美国通胀演变成了明显的大滞胀。

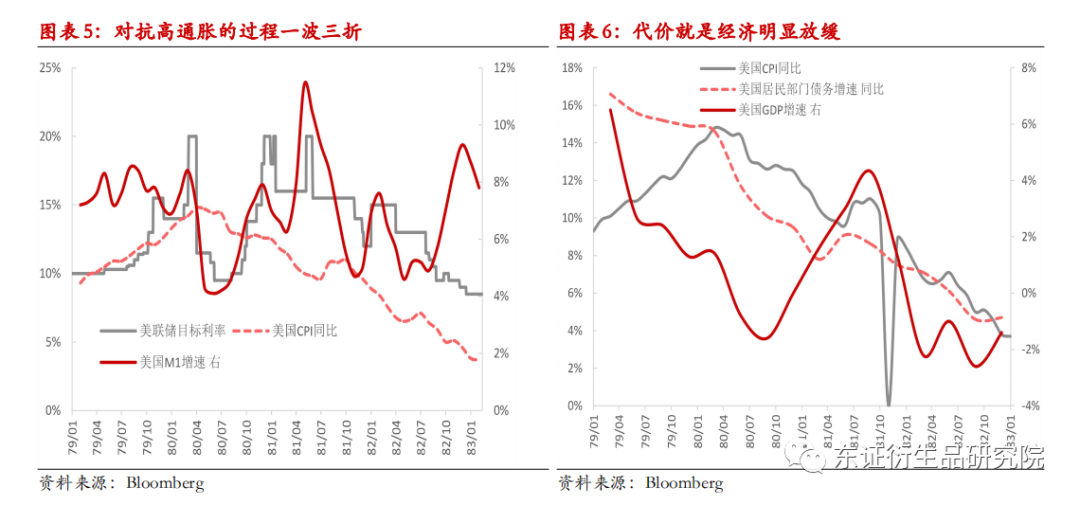

1.2、80年代开始的对抗通胀,先发制人政策的加息

持续的滞胀成为了沃尔克在79年底担任美联储主席之后面临的最大挑战。沃尔克采取的措施非常直接,就是完全无视菲利普斯曲线,用短期内大幅加息来稳定通胀预期。虽然在沃尔克上任初期,苏联入侵阿富汗导致美国预算平衡问题担忧加剧,对于通胀的担忧再起,即使如此沃尔克在美国经济趋势性面临衰退,还是选择了加息,即使在美联储内部也面临着巨大的阻力,不但如此,美联储还在1980年3月到7月采取了信贷控制政策,降低整体的信贷投放,81年经济指标波动较大,美联储坚持强硬的加息政策,持续的高利率终于使得通胀从高位回落,并且不再上升,通胀预期被稳定,因此从此时开始,稳定的通胀预期成为了美联储的政策目标。沃尔克在滞胀中的加息过程非常曲折,美联储在稳定通胀预期的目标上和经济平衡之间做出了反复。

从此之后,美联储的加息就带有了先发制人的特征,因为稳定通胀预期意味着一旦通胀有上升趋势,政策制定者就需要采取行动。1984年的加息就是很明显的案例,当1984年初债券利率大幅上升时,即时失业率依旧处于高位,美联储仍旧明显抬高利率水平,目的在于当通胀还未大幅上升但是通胀预期已经开始大幅上升的状况下,需要使用先发制人的政策来稳定通胀预期。

1987年的加息依旧是通胀恐慌的结果,由于广场协议导致的美元大幅贬值使得市场对于通胀上升的预期明显上升,因此美联储不得不上调利率来稳定通胀预期,这个过程中,格林斯潘开始担任美联储主席,87年的加息过程中,股市的大幅波动和经济走弱使得美联储不得不短期降息。

1.3、90年代之后的加息,通胀预期逐渐稳定下的相机决策

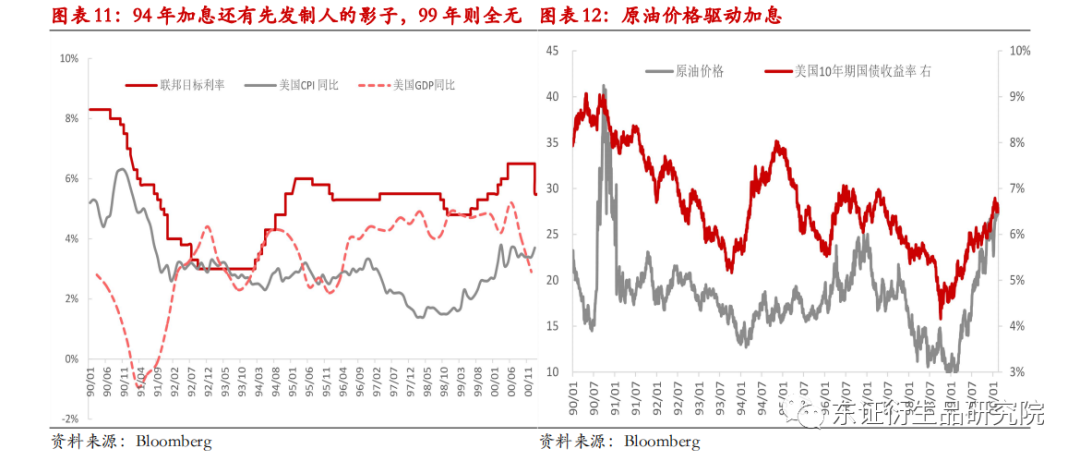

94年美国加息还带有一些80年代的影子,因为经济强力复苏,失业率非常低,对于通胀的担忧再起,因此美联储在通胀还未明显上升的阶段下就开始加息,并且一度转向大幅的加息。事后证明通胀并未出现大幅上升,美联储的先发制人的加息阻止了通胀的上升。94年加息之后,由于亚洲金融危机,美联储降低了利率水平。

99年开始的加息明显有落后于曲线的特征,在90年代信息科技革命后,劳动生产率的大幅上升使得通胀不存在持续上升的基础,格林斯潘的政策行动倾向于和市场节奏相一致,因此99年的加息是在失业率水平非常低的情况下,通胀开始出现上升,经济过热,美联储才开始加息,直到美股暴跌后,美联储停止加息。从这次加息开始,美联储的政策导向实际上已经完成了转变,“先发制人”的政策导向不复存在,美联储加息的决策倒向了相机行事,这也可以认为是长期低通胀中枢加息预期改变的开始。

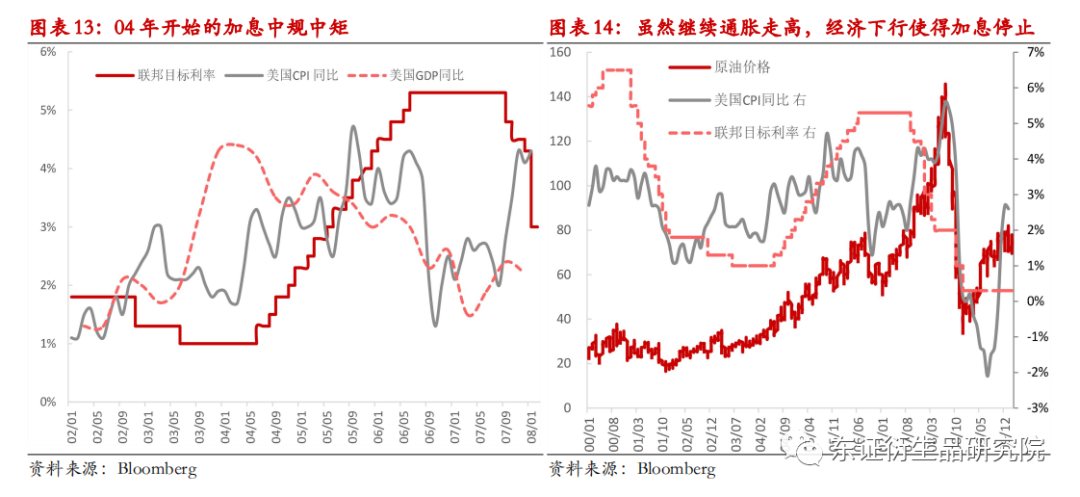

04年开始的加息是在失业率较低,经济增速处于高位开始,直接原因还是通胀持续上升引起的政策变动。04年开始的加息属于非常稳定的持续性加息,值得注意的是加息到07年9月就停止了,加息停止的时间节奏和通胀并非一致,原油价格在08年5月份达到高位,通胀并不是这次美联储加息停止的原因,而是经济形势在07年底出现了明显的走弱倾向,美联储不得不停止加息,那怕通胀实际上还是有上升的压力。实际上居民部门债务水平在加息结束前已经开始走弱,美联储在经济和通胀中选择了经济。

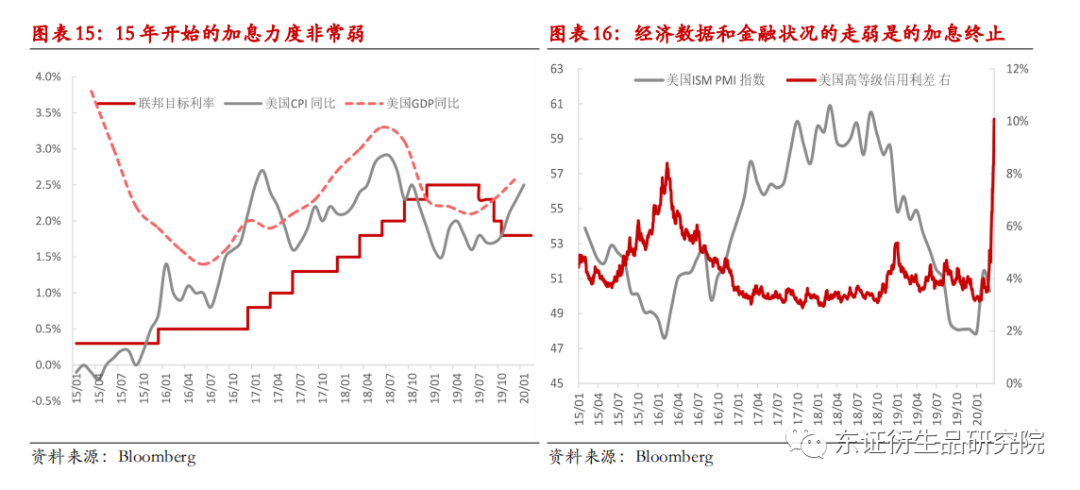

15年开始的加息是美联储在08年全球金融危机后的首次加息,在此之前,美联储向市场进行了足够的预期引导。随着失业率降至低位,通胀开始上升,美联储开始加息,值得注意的是本次加息在16年就遇到了新兴市场尤其是中国的经济大幅放缓,导致美联储不得不放缓加息节奏,直到17年才恢复正常的加息节奏,直到19年美国经济明显走弱之后,美联储不得不停止了加息。

1.4、美联储加息要点总结

我们在研究了从70年代开始的美联储历次加息后,发现美联储的加息实际上都是对于产出缺口的确认,这个结论非常重要,这意味着美联储的加息政策不可能独立于经济周期存在,美联储加息锚定的产物从货币增速到通胀预期,基本上是按照当时经济周期和推动经济增长的动力来选择。我们不能认为70-80年代在滞胀阶段的加息节奏较慢就认为当时的美联储一定决策失误,主要还是受制于当时的环境和经济形势,可能70-80年代的加息过程就是当时的最优解,虽说沃克尔力挽狂澜,但是美国经济80-90年代度过了黑暗阶段,所谓得失之间,各有不同而已。

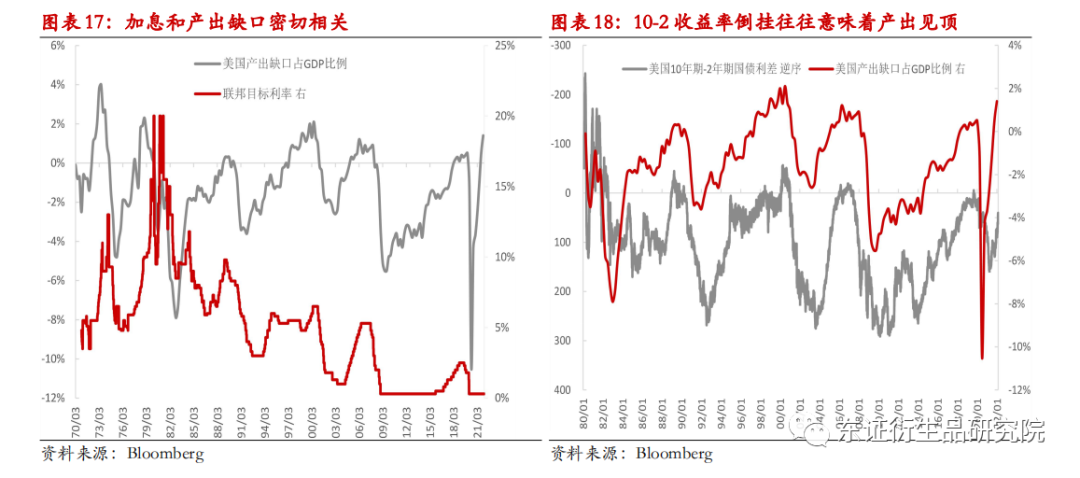

接着说产出缺口的问题,我们可以看到,每一次美联储加息加到顶点,往往就是产出缺口的顶部,因此加息顶点意味着经济潜在产出将出现走低,这也就是为什么我们看到美债10年期和2年期的利差可以预测政策变化,因为10年期和2年期的利差基本上和产出缺口的变化一致,当10年期和两年期利差倒挂往往就是产出缺口到达顶点,也往往就是美联储政策转折的附近。当未来增长潜力开始消退,短期利率上升乏力阶段,正好对应产出缺口高点,因此我们需要密切关注10年期和2年期国债的利差,因为产出缺口数据本身滞后而且频率较低,只能作为滞后指标来确认趋势。

根据我们的研究,历次美联储加息阶段,产出缺口大部分时间都是上升的,因此劳动力市场走强,失业率降低,同时通胀走高,因此一般来说美联储加息阶段利率中枢上升,风险资产价格走高。值得注意的是美联储两次产出缺口为负的加息都是在70年代滞涨阶段,因为滞胀阶段的产出和高通胀之间存在密切关系,因此面对高通胀,政策制定者对抗高通胀的行为将导致产出的降低,因此滞胀阶段的加息往往结果对于风险资产不利。滞胀时期的加息往往对应产出缺口的走低,菲利普斯曲线失效,失业率和通胀同时上升。

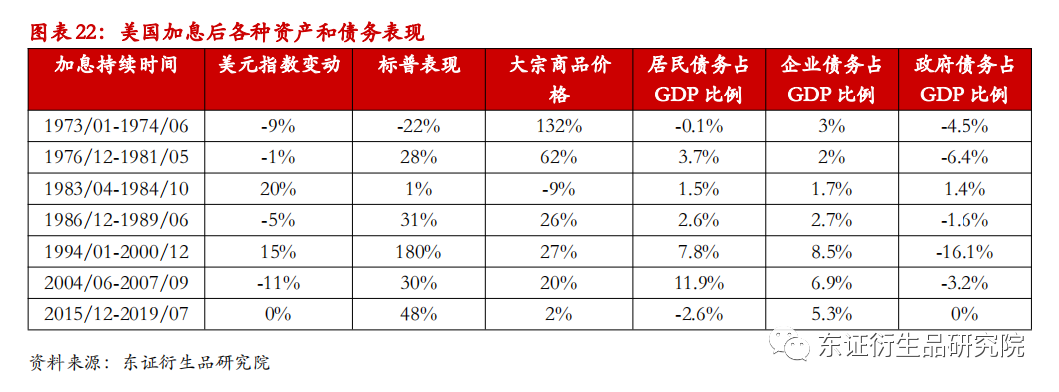

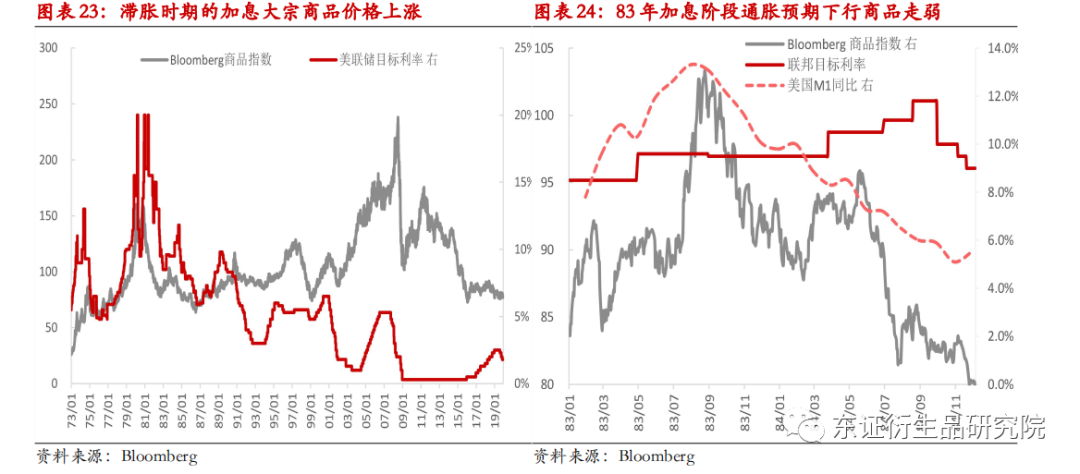

非常值得注意的是大宗商品的走势,我们可以看到,绝大部分阶段,大宗商品的价格在加息过程中都是上涨的,典型的就是70-80年代滞涨加息阶段,和04-07的新兴市场大繁荣导致的大宗商品牛市阶段,即使是在86-89,90-00阶段的加息,面临的并非明显的滞胀,大宗商品价格依旧出现了上涨。大宗商品价格走弱或者下跌的阶段时83-84年的加息和15-19年的加息。

这里特别需要指出83-84年阶段加息和90-00阶段加息实际上是有一些共通之处,在经历了里根的供给侧改革后,83年开始的美国经济出现了较为强势的增长,虽然失业率还在高位,但是市场对于经济增长预期上升,因此83年-84年的加息是强势美元下的加息,美元明显上升,经济走强,大宗商品走弱。94年-00年的加息也是强势美元下的经济增长加息,但是大宗商品在99年开始明显回升,这其中的差别在何处?我们注意到83年的加息阶段之后,美国以当时衡量的通胀预期指标M1增速持续性走低,而99年加息后,美国CPI明显见底回升并且持续上升,这表明通胀预期是大宗价格在强势美元和美国经济高增长状况下能否上涨的主要原因。这也可以解释为何15年之后的加息大宗表现平淡,因为15年之后美国的通胀持续处于低位,通胀预期稳定,因此大宗商品价格表现有限。

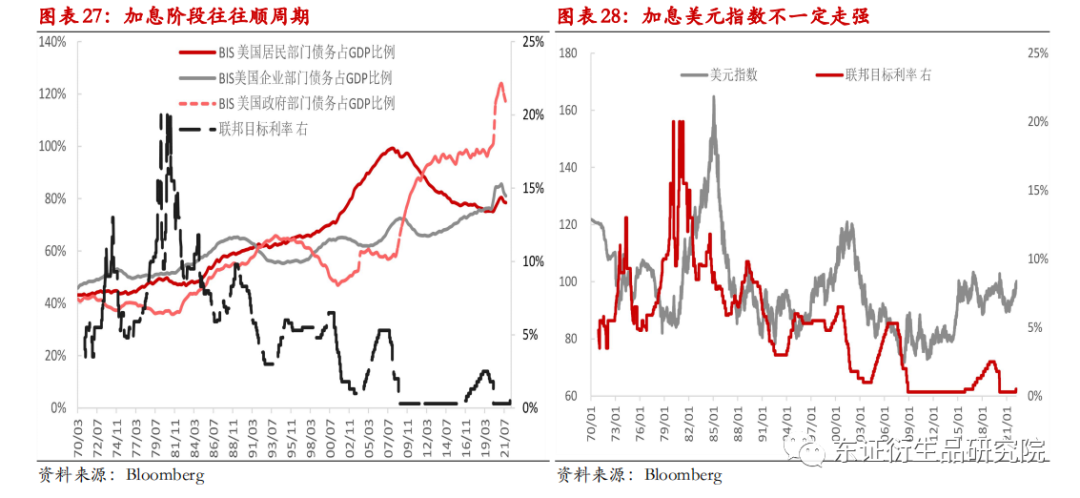

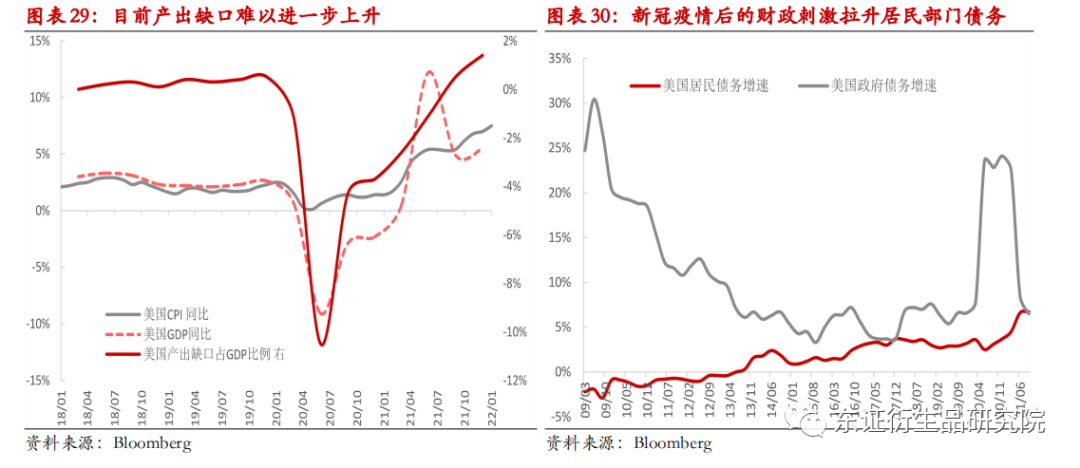

历次加息的过程中,居民和企业债务占GDP的比例大部分阶段都在上升,反倒是政府债务占GDP的比例在降低,因为加息阶段主要是对于增长的确认,因此是顺周期的阶段,居民和企业部门债务占GDP比例在上升,政府债务占GDP比例在降低,加息阶段往往是居民和企业部门债务增速上升,政府债务增速降低的阶段,即使是在滞胀加息阶段,政府部门债务增速相对来说也是降低的,因此不同的加息阶段债务呈现出来的往往具有一致性的特点,但是这并不能代表对于资产价格的影响也一致,美元指数在加息阶段中出现了既有走强也有走弱的状况。

1.5、目前局面判断

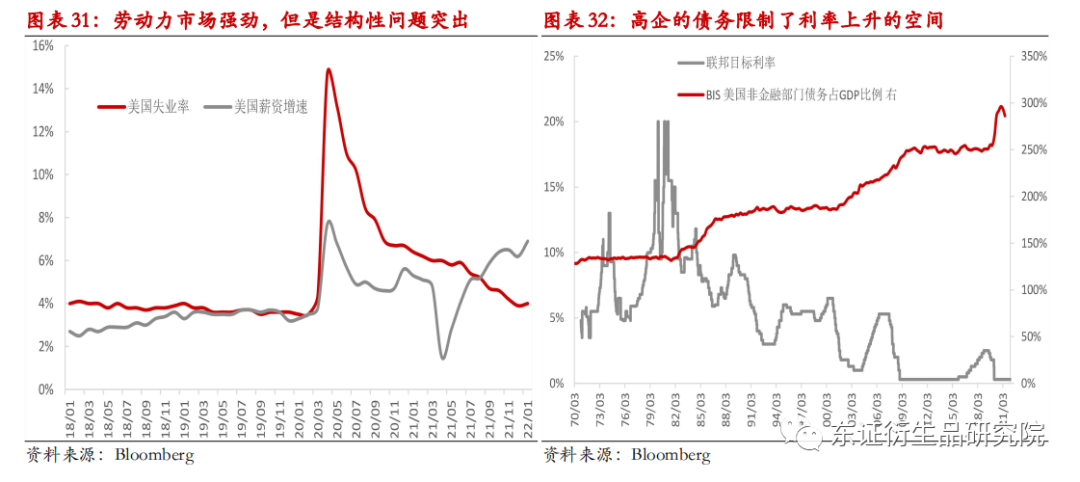

我们目前所处的形势是历史上没有出现过的局面,因为从经济基本面的角度来看,目前美国处于非常高的通胀水平,这个高通胀是由于新冠疫情后的财政刺激和疫情导致的供应链错配叠加形成,而目前的俄乌冲突则加剧了大宗商品供应缺口,因此美国目前很明显进入到了滞胀的阶段。

可以类比的就是美国70-80年代滞涨阶段的加息,我们从之前的分析可以看出滞胀阶段的加息基本上分成了两个阶段1)政策滞后于曲线,加息造成通胀预期进一步上升,经济受到负面影响2)通胀水平远高于目标,需要短时间内大幅提高利率来稳定通胀预期。

目前的状况非常复杂之处在于,由于长期央行的资产购买,导致负债水平远远高于70-80年代,因此即使通胀水平已经非常高,但是长端债券收益率水平相较而言非常低。同时由于疫情原因,美联储在通胀开始上升阶段,采取了“平均通胀目标”机制,对于通胀的容忍程度上升,使得加息时间点和通胀并非同步,节奏远远落后于曲线,导致一个问题在于,产出缺口在本次加息阶段继续上升的空间不足,这点也可以从收益率曲线接近倒挂来印证。因此我们判断,美联储这次加息面临的是通胀和增长的两难,由于目前对于通胀的预期变化,美联储初期的加息基本上不可能起到抑制通胀的作用,随着时间的推移,经济基本面下行的压力会持续上升,因此我们将看到收益曲线倒挂并且通胀依旧处于高位,因此本轮加息是明显的滞胀局面下的加息。

考虑到目前美联储进行了巨量的资产购买,因此整体美国的债务水平相较于上次滞胀阶段有明显的上升,我们并不认为在这种情况下,美联储可以做到加息和通胀的水平相接近。因为这次产出缺口本身的上升主要还是财政政策的结果,因此导致加息力度一旦过高,对于信用利差产生的负面影响将直接对于实体经济形成利空。

因此最终来看,本次美联储加息必然是一个非常纠结的过程,短期内的加息速度不太可能太强,这对于遏制通胀来说还是起不到太大的作用,因此我们认为通胀预期可能也不太会因为初期的加息出现走低,滞胀将持续较长时间。

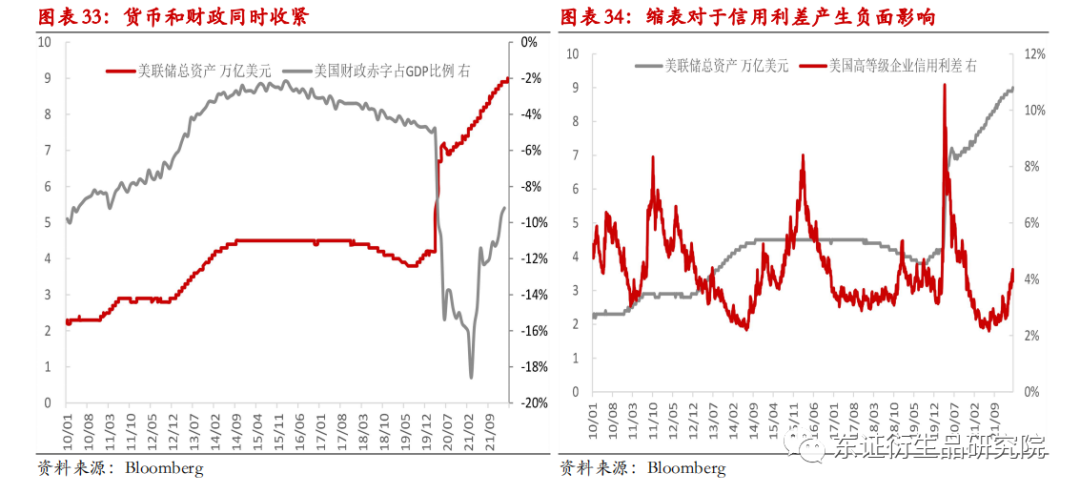

在进一步分析一下本次加息不同于其他滞胀阶段中最核心的点在何处?我们认为就是美国这一次的局面是长期以来货币政策转到财政政策的节奏过于突然,由于疫情导致大量的财政刺激在短期内发生,这个力度甚至比70年代滞涨阶段的财政刺激力度还要大,并且财政刺激的方式是直接给居民部门注入流动性,这个效果也比之前的以基建为主的财政刺激效果更加迅速。

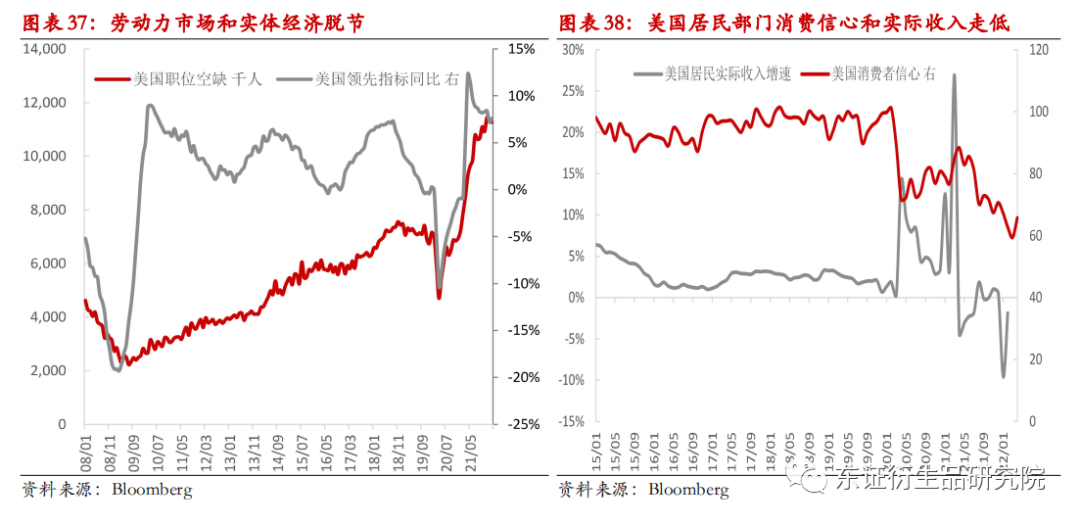

这就造成了一个非常不同于此前阶段的特点,由于本次财政刺激短期规模大,节奏快,因此20年以后美国经济复苏的力度非常高,同时劳动力市场由于疫情原因导致的职位空缺维持高位,这使得在本次加息开始阶段,更加趋向于是一次劳动力市场过热下的加息,但是其他的经济数据已经出现了明显的和劳动力市场不匹配的下行压力,这也就是说,财政刺激带来的经济推动边际递减的速度很快,但是劳动力市场由于疫情的结构因素,并没有直接对于实体经济下行做出有效的反应,而本次美国经济的通胀则作为财政刺激的直接结果,叠加疫情和地缘政治对于供应的影响,其降低的速度明显要弱于实体经济走低的速度。

这种错配导致的结果就是通胀体现出来的突然性和持续强度要求政策制定者拿出非常明确的态度,就是强力控制通胀预期,通胀预期目前的水平相较于以前之前出现了明显的上升,但是和通胀本身相比可能远远不足,这已经是长期低通胀带来的惯性还在导致的结果。

因此留给政策制定者的时间窗口比历史上其他的滞胀阶段加息窗口还要短,因为实体经济和通胀对于流动性收紧的边际效应不同,而且实际经济迅速复苏的21年美联储并未采取行动,本就滞后的政策行动叠加未来愈发明显的经济下行压力,必然要求政策制定者短期拿出明显的政策魄力去对抗通胀。

但是目前我们还没有看到通胀预期出现螺旋上升的状况,也就是说通胀预期还没有达到不可逆的阶段,因此政策制定者真的有足够的魄力来在实际的行动中彻底执行短期迅速的流动性收紧?我们还是表示出来怀疑的态度,我们在上文已经提到,和历史上滞胀阶段不一样的是,在长期的央行资产购买后,美国各部门债务的状况已经今非昔比,因此实体经济对于利率的敏感度要比上一次滞胀阶段要高,这也就意味着通过迅速的加息来消灭需求平衡通胀,但是由于目前的债务水平,这种行为会造成流动性的抽离导致高债务下信用利差的快速上升。信用利差的快速上升对于实体经济的负面反馈让政策制定者能撑多久?

尤其是目前美联储还要缩减自己的资产负债表,美联储上一次缩表的速度和节奏完全无法和本次缩表相提并论,这次缩表是每年1万亿美元甚至更高的速度,这对于信用利差的影响可能比上次缩表还要强。

所以我们看到这次加息市场一方面是很强的短期紧缩倾向,另一方面却是收益率曲线在开始加息的阶段就出现倒挂,这正是我们此前提到的本次加息的两个相互矛盾的局面冲突对立的结果。

目前的局面的复杂程度可能已经超出了我们此前加息面临的状况,政策制定者最优解并不是一成不变的,倒挂的收益率曲线表明了政策空间的紧迫,而且实际上的空间则很明显受到债务的压力。

所以单纯的货币政策来解决目前的局面可能是低效的,里根政府通过“供给侧改革”来解决滞胀的核心矛盾,如此沃尔克的大幅加息才不至于彻底摧毁美国经济。而目前的局面在于贫富差距的巨大导致核心矛盾要求财富的再分配,但是财政刺激作为美国目前最优解不可避免的推高通胀,所以解决的核心问题在于,目前的政策制定者做好了彻底改变财富分配,倾向于劳动者的准备了吗?目前的社会矛盾可能还没有剧烈到这个阶段,因此我们认为未来甚至不排除财政刺激再次登陆的可能。于此同时,疫情造成的供应链和劳动力错配,美国目前也并未做好供应链重塑的准备,全球供应链重塑是一个漫长的过程,远水难解近渴。

因此本次加息政策制定者的最优解是短期迅速提高利率,在美国经济走弱之前,通胀就回到正常水平,但是目前的环境想要达成这种效果,必然是造成美国经济出现明显的负面冲击,如果联储对于通胀可以容忍更长的时间,那意味着短期利率水平可能不得不被压制,造成通胀预期的反复。实际的政策操作必然是利用美国经济尚有韧性的阶段不断极限操作来测试短期利率水平上限,再遇到临界点修正政策的节奏,这种手段会造成美元短期非常强势,但是中期明显走弱。因此我们看到了美联储本次加息提出了“前置加息”的策略,前置加息是改变加息次数的分布,短期加息次数显著上升,加息分布明显偏向左侧。“前置加息”策略还是在走钢丝,因此平衡通胀和经济随着时间推移的难度也会逐渐上升。因此从目前的加息速度和周期来看,本次加息的时间一定是非常短暂,而短暂的加息能否压制住通胀预期我们持有怀疑态度。

这也可以解释为何目前的大宗商品价格走势背离美元指数,因为美元的强势在于短期政策收紧带来的流动性紧缩压力,但是大宗商品的走强是高通胀的伴随物,而对于本次财政政策而言,对于经济效用和对于通胀的传导节奏上是不同步的,这就是滞胀来源,因此短期的紧缩政策还无法解决目前高通胀的局面,大概率市场的通胀预期还要来回反复,这意味着对于股市和债市而言,中期面临下行压力,而大宗商品则面临走强的状况,尤其是目前地缘政治的风险加速了这一进程。

综合来看,本次加息不但面临滞胀阶段应对通胀和增长之间的平衡,还要处理债务水平大幅上升后流动性退出对于经济的冲击。因此短期美元指数受到紧缩压力出现明显上升,中期走弱的预期并不会改变。

2.1、美元短期强势,中期走弱

美元短期受到紧缩预期走强,中期滞涨局面不改对于美元施加走低压力。

2.2、强烈建议高配贵金属

面对美国经济的滞胀,我们认为贵金属在这种情况下会明显走强。因为复杂的局面最终对于通胀预期的影响不会太过于直接和迅速,因此实际利率持续处于低位利好贵金属。

Comments