U.S. stock futures fell Tuesday after the Nasdaq Composite closed at its lowest in two years during the regular session.

Market Snapshot

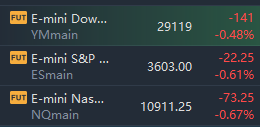

At 7:50 a.m. ET, Dow e-minis were down 141 points, or 0.48%, S&P 500 e-minis were down 22.25 points, or 0.61%, and Nasdaq 100 e-minis were down 73.25 points, or 0.67%.

Pre-Market Movers

Angi Inc – Angi shares added 2% in premarket trading after the online home services company named Joey Levin as CEO, replacing Oisin Hanrahan. Levin is currently the CEO of Angi parent company IAC and will continue in that role as well as running Angi.

Leggett & Platt – Leggett & Platt tumbled 8.6% in the premarket after the industrial manufacturer slashed its full-year sales and earnings guidance. The company points to inflation and economic conditions that have weighed on demand, but does expect fourth quarter results to improve from the third quarter.

KLA-Tencor – The semiconductor equipment and services company will reportedly halt some sales and services in China to comply with U.S. export controls, according to a source familiar with the situation who spoke to Reuters. KLA shares slid 2.4% in premarket trading.

Zscaler Inc. – Zscaler took a 4.9% premarket hit after the cloud security company announced the resignation of company president Amit Sinha, who will move to a CEO position at a privately held technology company. Sinha will remain on Zscaler’s board of directors.

Meta Platforms, Inc. – Meta was downgraded to “neutral” from “overweight” at Atlantic Equities, which also lowered its price target for the Facebook and Instagram parent’s stock to $160 per share. The firm said Meta faces an increasingly challenged growth outlook due to macroeconomic headwinds. Meta fell 1.3% in premarket action.

BlackRock – BlackRock was downgraded to “neutral” from “buy” at UBS, with the price target for the asset management firm’s stock cut to $585 per share from $700. UBS said BlackRock faces some risk from its position on ESG investing, as well as limited expense flexibility. BlackRock is set to report quarterly earnings on Thursday. BlackRock fell 2% in premarket trading.

Roblox Corporation – Roblox slumped 4.3% in the premarket after the stock was rated “underweight” in new coverage at Barclays. The firm said the gaming platform operator was a prime beneficiary of the pandemic, but that growth may be challenged going forward as its key markets already have high penetration rates.

Lululemon Athletica – The apparel maker’s stock added 1.4% in the premarket after Piper Sandler upgraded it to “overweight” from “neutral,” noting ongoing sales momentum and an opportunity for outperformance in outerwear during the fall/winter season.

Warner Music Group Corp. – The music publisher’s stock rallied 3.4% in premarket trading after Goldman Sachs began coverage with a “buy” rating. Goldman cites growth in subscription and ad-supported music streaming as well as new licensing opportunities.

Market News

Former Federal Reserve Chair Ben Bernanke, who won the Nobel Prize in Economics on Monday for his research on financial crises, urged policy makers to watch for any worsening of financial conditions around the world as pressures from war and currency fluctuations squeeze economies.

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said “serious” headwinds are likely to push the US and global economies into recession by the middle of next year.

PayPal said on Monday it will not fine users for misinformation and an earlier policy update that said customers could have to pay $2,500 in damages was sent in error.

Elon Musk alleges Twitter officials ordered a whistle-blower to destroy evidence of their missteps as part of a $7.8 million severance package at issue in a legal fight over the billionaire’s attempt to cancel a buyout of the social-media platform.

Exxon Mobil is considering a takeover of Denbury Inc., an oil and gas producer with the largest carbon dioxide pipeline network in the US, according to people familiar with the matter.

Attempts by Oxford University researchers and AstraZeneca PLC to create a nasal-spray version of their jointly developed COVID-19 shot suffered a setback on Tuesday as initial testing on humans did not yield the desired protection.

Digital World Acquisition Corp that agreed to merge with former U.S. President Donald Trump's social media company postponed on Monday its shareholder vote to Nov. 3 after failing to garner enough support to win a 12-month extension.

Bio-Rad Laboratories is in talks to combine with fellow life-sciences company Qiagen NV in a deal that would be worth more than $10 billion, according to people familiar with the matter. The talks have been going on for a while but any agreement isn’t likely for another few weeks or more—and there may not be one.

Comments