(Update: Sept 9, 2021 at 04:09 a.m. ET)

GameStop Report posted a wider-than-expected second quarter loss Wednesday, but topped Street sales forecasts as brick-and-mortar stores saw increased traffic as pandemic restrictions around the country eased.

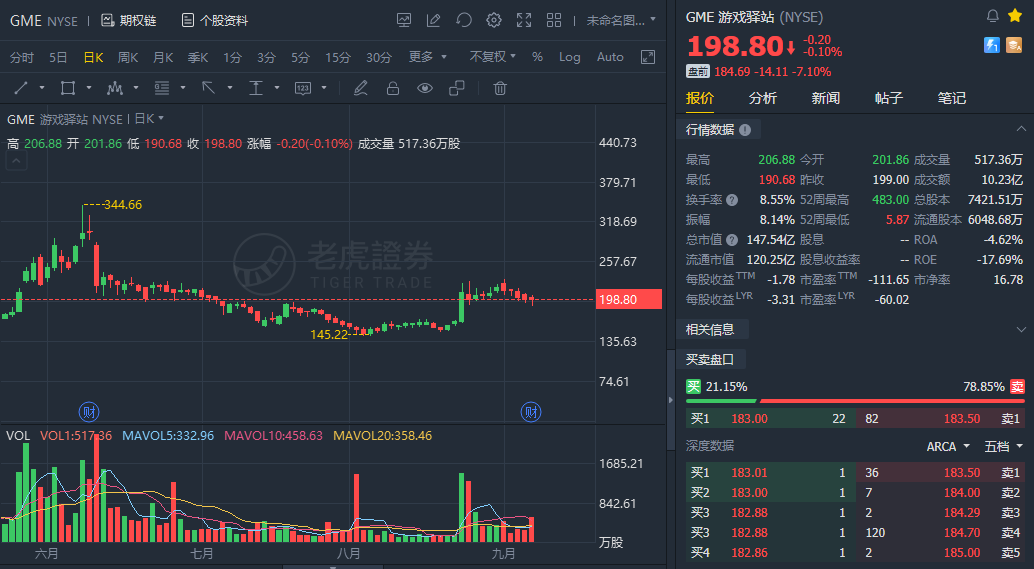

Shares of video game retailer GameStop fell about 7% in premarket trading Thursday.

GameStop said its adjusted loss for the three months ending on July 31 was pegged at 76 per share, narrowing from a loss of $1.42 per share over the same period last year but wider than the Street consensus forecast of -66 cents per share. GameStop's reported loss was 85 cents per share. Group revenues, GameStop said, rose 25.6% from last year to $1.183 billion, topping analysts estimates of $1.12 billion.

During the second quarter of 2021, most of our stores in all jurisdictions returned to normal operations," GameStop said in a Securities & Exchange Commission filing. "However, with the resurgence of COVID-19 cases due to variants, we experienced some temporary closures in our Australian segment prior to the end of the second quarter of 2021.

The retailer did not provide an outlook for the coming quarters or take questions during its earnings conference call. It was the first call since CEO Matthew Furlong and CFO Mike Recupero joined GameStop’s leadership.

The retailer also said the U.S. Securities and Exchange Commission has requested additional documents for a probe into GameStop and other companies’ trading activity, which the company had disclosed in May. GameStop said the inquiry is not expected to negatively impact the company.

GameStop has been trying to shift its business more toward e-commerce. In an effort to improve the delivery of online orders, the company announced it signed a lease for a 530,000-square-foot fulfillment center in Reno, Nevada. The site will help it to expand its fulfillment network across both U.S. coasts.

The retailer is also working to expand its customer care operations in the U.S. by leasing a center in Pembroke Pines, Florida.

Comments