U.S. stock index futures dipped on Friday at the end of a choppy week marked by the Federal Reserve hiking interest rates and no signs of an end to the war in Ukraine.

Market Snapshot

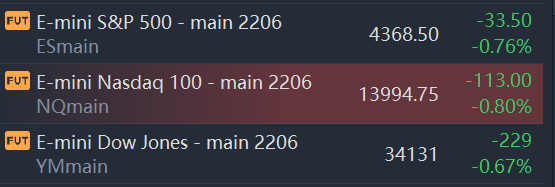

At 8:00 a.m. ET, Dow e-minis were down 229 points, or 0.67%, S&P 500 e-minis were down 33.5 points, or 0.76%, and Nasdaq 100 e-minis were down 113 points, or 0.8%.

Pre-Market Movers

FedEx (FDX) – FedEx earned an adjusted $4.59 per share for its latest quarter, missing estimates by 5 cents, though the delivery service’s revenue beat analyst forecasts. FedEx’s bottom line was impacted by worker shortages stemming from the Covid-19 omicron variant outbreak during the quarter. FedEx lost 3.1% in the premarket.

GameStop (GME) – GameStop reported an unexpected quarterly loss, even as the videogame retailer’s revenue topped estimates. GameStop CEO Matt Furlong said the omicron variant and supply chain issues had a significant impact on results during the holiday season. GameStop slid 8% in the premarket.

U.S. Steel (X) – U.S. Steel shares fell 3.6% in premarket trading after the company issued weaker-than-expected guidance for the current quarter. The company cited increasing raw materials costs, among other factors.

Moderna, Inc. (MRNA) – Moderna is seeking FDA approval for a second booster shot of its Covid-19 vaccine for adults aged 18 and older. The submission comes a day after Pfizer(PFE) and partner BioNTech(BNTX) asked the FDA to approve a second booster for people 65 years and older. Moderna gained 1% in premarket action.

Boeing (BA) – The jet maker is in talks with Delta Air Lines(DAL) for a 737 MAX 10 jet order of up to 100 aircraft, according to people familiar with the matter who spoke to Reuters.

JOANN Inc. (JOAN) – The crafts retailer’s shares tumbled 8.3% in the premarket after it missed quarterly sales expectations and noted a $60 million increase in ocean freight costs for 2021. Joann said the freight increase was among a number of significant supply chain headwinds and disruptions.

Wingstop (WING) – The restaurant chain’s stock slid 4.7% in premarket trading after a double downgrade by Piper Sandler to “underweight” from “overweight.” Piper said it will be more difficult for Wingstop to keep a premium valuation during a restaurant industry expansion cycle as higher expenses hit earnings.

Rent the Runway, Inc. (RENT) – The fashion rental company’s stock rallied 4.2% in premarket action after Jefferies began coverage with a “buy” rating. The firm said Rent The Runway’s extensive offerings and high barrier to entry are among the factors that will drive top-line growth of as much as 50%.

SolarEdge (SEDG) – The solar equipment and software producer’s 2 million shares offering was priced at $295 per share, compared with Thursday’s close of $314.60. SolarEdge slid 3.4% in the premarket.

Market News

Volkswagen (OTCPK:VWAGY) has issued a recall of over 246K SUVs in the U.S. and Canada due to faulty wiring harnesses that can make them brake unexpectedly.

Activist investor Pentwater Capital Management, the largest minority shareholder of Canada's Turquoise Hill with a 10% stake, has rejected a $2.7 billion bid for the copper producer by Rio Tinto as too low.

Managers at sportscar maker Porsche late last year travelled to the United States to discuss possible joint projects with iPhone maker Apple as well as with some other tech companies, Porsche's CEO said on Friday."We already have Apple CarPlay, we will expand on that," Chief Executive Oliver Blume said during a video conference on the carmaker's annual results on Friday.

St. Louis Federal Reserve president James Bullard on Friday called for a dramatic increase in the Fed's overnight lending rate to more than 3% this year, a step he feels is needed to catch up with inflation posing a "particularly heavy" burden on families.

Wall Street traders are bracing for fresh equity-market fireworks Friday after another week of global turbulence. In a quarterly event known as triple witching, roughly $3.5 trillion of single-stock and index-level options are set to expire, according to Goldman Sachs Group Inc. At the same time, more near-the-money options are maturing than at any time since 2019 -- suggesting a bevy of investors will actively trade around those positions.

Comments