Market Overview

U.S. stocks closed mostly lower last Friday(Oct.27), losing momentum as investors digested a hectic week of mixed earnings, and economic data that seemed to support the "higher for longer" interest rate scenario.

The Dow Jones Industrial Average fell 1.12%, the S&P 500 lost 0.48%, and the Nasdaq Composite added 0.38%.

Regarding the options market, a total volume of 43,461,437 contracts was traded, down 2.64% from the previous trading day.

Top 10 Option Volumes

Top 10: SPDR S&P 500 ETF Trust, Invesco QQQ Trust-ETF, Tesla Motors, Amazon.com, iShares Russell 2000 ETF, NVIDIA Corp, Cboe Volatility Index, Apple, Meta Platforms, Inc., Ford

Amazon.com rose 6.83% last Friday as it reported revenue and profit that topped analysts’ estimates, buoyed by rising sales in its retail unit and significant cost-cutting.

There were 2,321,143 Amazon.com option contracts traded last Friday, jumping over 50% from the previous day. Call options account for 62% of overall option trades. Particularly high volume was seen for the $130 strike call option expiring November 3 $AMZN 20231103 130.0 CALL$, with 46,937 contracts trading. Meanwhile, the $127 strike call option expiring November 3 $AMZN 20231103 127.0 CALL$ surged 69.44% last Friday.

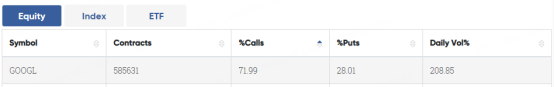

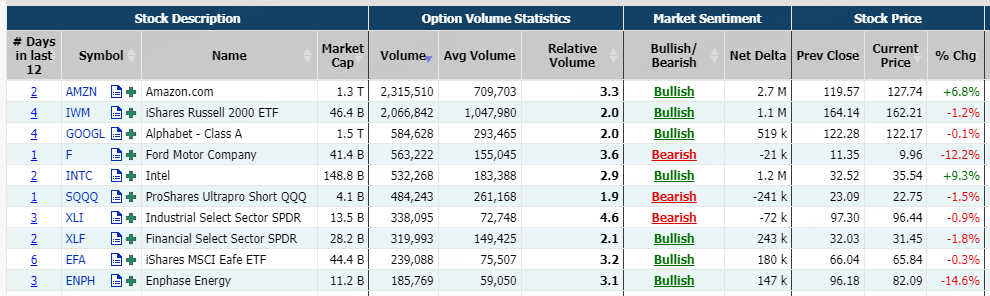

Most Active Trading Equities Options

Special %Calls >70%: Alphabet

Unusual Options Activity

Intel soared 9.29% last Friday as it reported Q3 adjusted earnings that were better than expected and issued upbeat profit guidance. It expects Q4 adjusted profit of 44 cents a share and revenue ranging from $14.6 billion to $15.6 billion.

There were 532,988 Intel option contracts traded last Friday, jumping over 30% from the previous day. Put options account for 53% of overall option trades. Particularly high volume was seen for the $35 strike put option expiring November 3 $INTC 20231103 35.0 PUT$, with 13,643 contracts trading. Meanwhile, the $34 strike call option expiring November 3 surged 183.87% last Friday $INTC 20231103 34.0 CALL$.

Ford crashed 12.25% last Friday after it reported wider losses from its EV business and pulled its 2023 forecast, citing "uncertainty" over the pending ratification of its new labor deal with the United Auto Workers (UAW) union.

There were 638,158 Ford option contracts traded last Friday, surging nearly 120% from the previous day. Call options account for 53% of overall option trades. Particularly high volume was seen for the $10.5 strike call option expiring November 3 $F 20231103 10.5 CALL$, with 21,882 contracts trading. Meanwhile, the $10.5 strike put option expiring November 3 $F 20231103 10.5 PUT$ surged 525% last Friday and gained over 730% in 2 days.

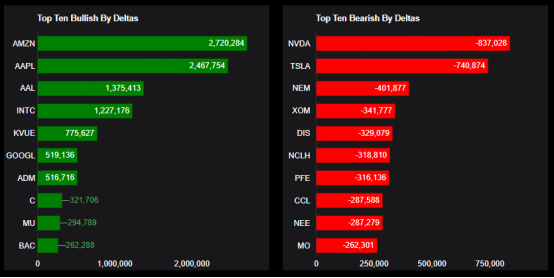

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: Amazon.com, Apple, American Airlines, Intel, Kenvue Inc, Alphabet, Archer-Daniels Midland, Citigroup, Micron Technology, Bank of America

Top 10 bearish stocks: NVIDIA Corp, Tesla Motors, Newmont Mining, Exxon Mobil, Walt Disney, Norwegian Cruise Line, Pfizer, Carnival, NextEra, Altria

Based on option delta volume, traders sold a net equivalent of 837,028 shares of NVIDIA Corp stock. The largest bullish delta came from selling puts. The largest delta volume came from the 27-Oct-23 410 Call, with traders getting short 2,342,275 deltas on the single option contract.

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments