Market Overview

U.S. stocks gyrated to a mixed close last Friday as investors headed into the Christmas holiday weekend.

The Dow Jones Industrial Average fell 0.05%, the S&P 500 gained 0.17% and the Nasdaq Composite added 0.19%.

Regarding the options market, a total volume of 38,615,877 contracts was traded, up 4.3% from the previous trading day.

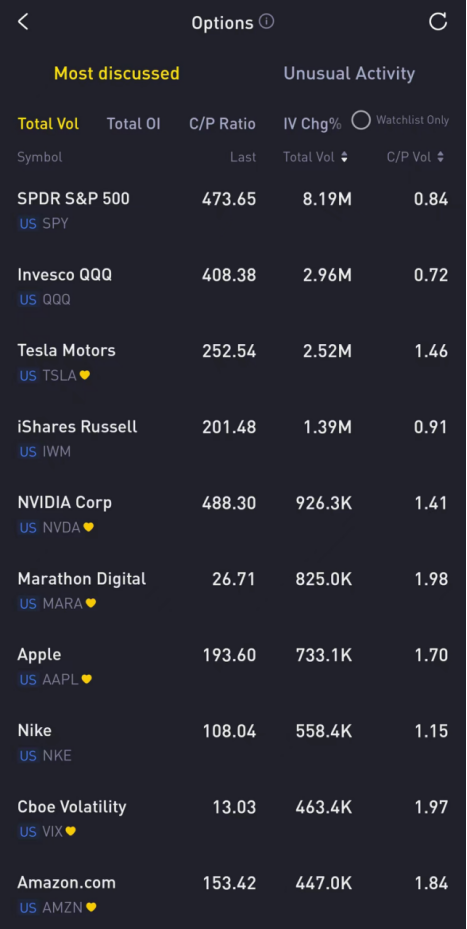

Top 10 Option Volumes

Top 10: SPDR S&P 500 ETF Trust, Invesco QQQ Trust, Tesla Motors, iShares Russell 2000 ETF, NVIDIA Corp, Marathon Digital Holdings Inc, Apple, Nike, Cboe Volatility Index, Amazon.com

Nike crashed 11.83% last Friday after it announced a $2 billion cost-cutting plan over the next three years as it expects sales to soften in the second half of fiscal 2024.

There were 558.4K Nike option contracts traded last Friday, doubling from the previous day. Call options account for 53% of overall option trades. Particularly high volume was seen for the $110 strike call option expiring December 29 $NKE 20231229 110.0 CALL$, with 15,564 contracts trading. Meanwhile, the $113 strike put option expiring December 29 $NKE 20231229 113.0 PUT$ gained 396.12% last Friday.

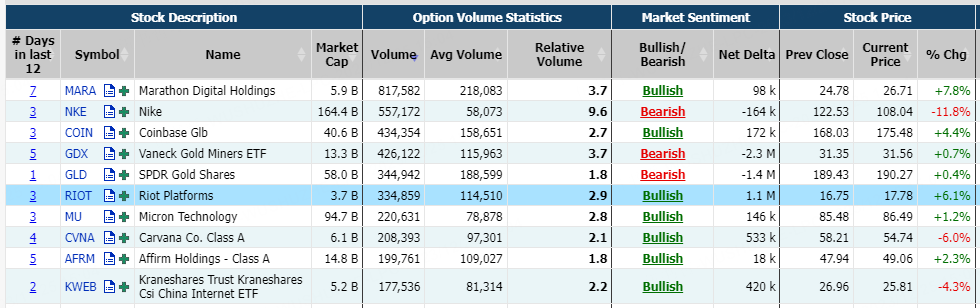

Unusual Options Activity

NIO Inc. rose 1.57% last Friday; the company on Saturday unveiled a flagship model featuring self-developed technologies including semiconductors, betting they would help prop up earnings.

There were 229.9K NIO Inc. option contracts traded last Friday. Call options account for 84% of overall option trades. Particularly high volume was seen for the $8.5 strike call option expiring December 29 $NIO 20231229 8.5 CALL$, with 15,238 contracts trading. Meanwhile, the $6.5 strike put option expiring December 29 $NIO 20231229 6.5 PUT$ crashed 66.67% last Friday.

FTSE China Bull 3X Shares fell 7.94% last Friday as the Chinese government announced new draft rules for online gaming industry aimed at curbing the amount of money and time players spend playing the games.

There were 37.81K FTSE China Bull 3X Shares option contracts traded last Friday, jumping nearly 70% from the previous day. Call options account for 85% of overall option trades. Particularly high volume was seen for the $19 strike call option $YINN 20231229 19.0 CALL$ expiring December 29, with 936 contracts trading. Meanwhile, the $18 strike put option expiring December 29 $YINN 20231229 18.0 PUT$ gained 125% last Friday.

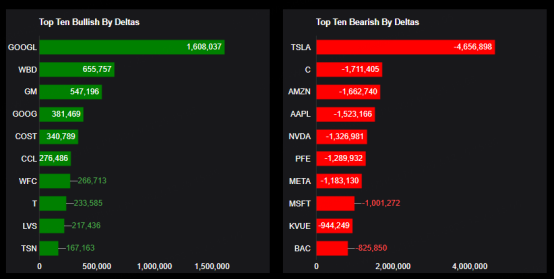

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: Alphabet, Warner Bros. Discovery, General Motors, Alphabet, Costco, Carnival, Wells Fargo, AT&T Inc, Las Vegas Sands, Tyson

Top 10 bearish stocks: Tesla Motors, Citigroup, Amazon.com, Apple, NVIDIA Corp, Pfizer, Meta Platforms, Inc., Microsoft, Kenvue Inc, Bank of America

Based on option delta volume, traders sold a net equivalent of 4,656,898 shares of Tesla Motors stock. The largest bearish delta came from selling calls. The largest delta volume came from the 22-Dec-23 255 Put, with traders getting long 4,813,458 deltas on the single option contract.

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments