Inflation cooled in March as the Federal Reserve’s interest rate increases showed more impact, the Labor Department reported Wednesday.

The consumer price index, a widely followed measure of the costs for goods and services in the U.S. economy, rose 0.1% for the month against a Dow Jones estimate for 0.2%, and 5% from a year ago vs. the estimate of 5.1%.

Excluding food and energy, core CPI increased 0.4% and 5.6% on an annual basis, both as expected.

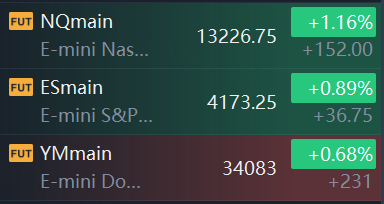

Market Snapshot

At 8:34 a.m. ET, Dow e-minis were up 231 points, or 0.68%, S&P 500 e-minis were up 36.75 points, or 0.89%, and Nasdaq 100 e-minis were up 152 points, or 1.16%.

Pre-Market Movers

Stock in Triton International TRTN soared nearly 30% after agreeing to be acquired by Brookfield Infrastructure Partners in a cash and stock deal worth around $4.7 billion.

Wireless product manufacturer Tessco Technologies Inc. TESS shares skyrocketed over 85% after signing an acquisition deal by two investment firms in a deal valued at $161.4 million.

National Instruments NATI was trading over 8% up premarket after reports emerged that Emerson Electric EMR, -0.01% is in advanced talks to buy the measuring equipment maker for about $60 a share, Bloomberg reported, citing people familiar with the matter.

Bed Bath & Beyond’s BBBY stock was up 3% in Wednesday premarket trading after disclosing in a filing last Tuesday that it had sold just over 100 million shares for roughly $48.5 million with B. Riley Securities. The retailer could sell up to $300 million under an “at the market offering” program.

National CineMedia Inc.’s NCMI stock rose 13% premarket after filing for Chapter 11 bankruptcy late Tuesday. The rise follows an earlier rally sparked by AMC Entertainment Holdings AMC disclosing that it owned a significant chunk of the U.S. movie-theater advertising company. AMC shares were up 3% premarket.

Tesla TSLA was down 0.32% premarket along with other electric vehicle competitors such as U.S.-listed shares in NIO which slid over 1% even after new and tighter tailpipe emission standards released by the Environmental Protection Agency. The new rules will make it harder and more expensive to sell cars that burn gasoline and emit carbon dioxide.

Shares in American Airlines Group AAL dropped over 1% premarket after reporting a first quarter loss that also missed estimates.

Market News

Alphabet’s Waymo and Aurora Hit Speed Bump As Union Opposes Safety Exemption for Driverless Trucks

Alphabet's (NASDAQ: GOOGL) self-driving unit Waymo hit a speed bump on Tuesday after major transport union, the Federal Motor Carrier Safety Administration (FMCSA), voiced its opposition to a petition put forward by the tech company.

Waymo, alongside autonomous driving company Aurora are seeking an exemption from rules on warning devices for large semi-trucks.

Buffett: Japan Investments Have Exceeded Expectations

Warren Buffett said Wednesday that his investments in Japan have beaten his expectations and he is open to investing more in the country. The CEO of Berkshire Hathaway (ticker: BRK.A) was talking on CNBC about his increased investment in five major Japanese trading houses.

“Their results have exceeded our expectations since we bought the group,” Buffett said. “We couldn’t feel better about the investment.”

Brookfield Infrastructure to Buy Triton in $4.7 Billion Deal

Brookfield Infrastructure Partners struck a deal to buy Triton International Ltd., the world’s largest owner of intermodal containers, for $4.7 billion.

The takeover bid is for $85 a share, including $68.50 in cash, the companies said early Wednesday, and is expected to close in the fourth quarter. It’s a 35% premium to Tuesday’s closing price.

Comments