Market Overview

The S&P 500 closed nominally higher on Thursday, retracing early gains just before the closing bell on the penultimate trading day of 2023.

The Dow Jones Industrial Average rose 0.14%, the S&P 500 gained 0.04%, and the Nasdaq Composite dropped 0.03%.

Regarding the options market, a total volume of 31,887,571 contracts was traded.

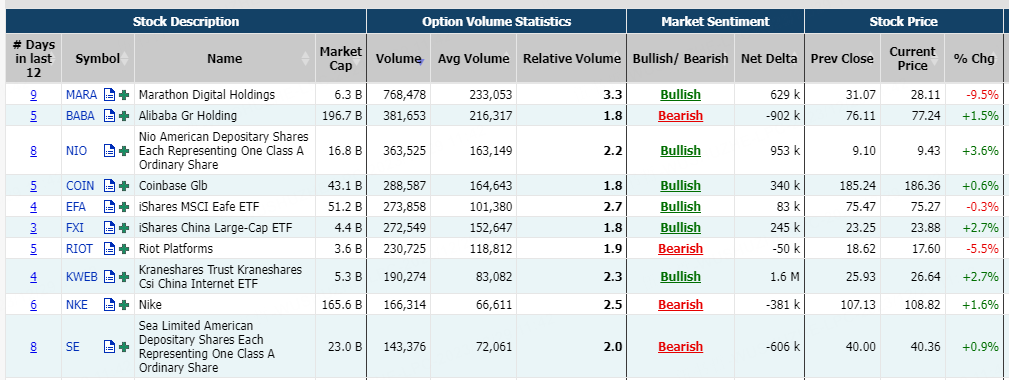

Top 10 Option Volumes

Top 10: SPDR S&P 500 ETF Trust, Invesco QQQ Trust, Tesla Motors, iShares Russell 2000 ETF, Advanced Micro Devices, Marathon Digital Holdings Inc, NVIDIA Corp, Amazon.com, Apple, Alibaba

Tesla Motors slid 3.16% on Thursday as analysts believe that the company delivered 1.82 million vehicles in 2023, but it will fall short of the company's 2 million target.

There were 2.57M Tesla Motors option contracts traded on Thursday. Call options account for 61% of overall option trades. Particularly high volume was seen for the $265 strike call option expiring December 29 $TSLA 20231229 265.0 CALL$, with 202,386 contracts trading. Meanwhile, the $252.5 strike put option expiring December 29 $TSLA 20231229 252.5 PUT$ surged 411.9% on Thursday.

Unusual Options Activity

ARM Holdings Ltd rose 4.34% and hit another record high on Thursday after Rosenblatt analyst Hans Mosesmann bumped his price target from $85 to $110.

There were 83.85K ARM Holdings Ltd option contracts traded on Thursday. Call options account for 70% of overall option trades. Particularly high volume was seen for the $80 strike call option expiring December 29 $ARM 20231229 80.0 CALL$, with 6,345 contracts trading. Meanwhile, the $77 strike call option expiring December 29 $ARM 20231229 77.0 CALL$ surged 323.08% on Thursday.

Upstart Holdings, Inc. fell 5.88% on Thursday as the Chief Legal Officer sold 7,328 shares according to a recent SEC Filing.

There were 93.77K Upstart Holdings, Inc. option contracts traded on Thursday. Call options account for 72% of overall option trades. Particularly high volume was seen for the $46 strike call option expiring December 29 $UPST 20231229 46.0 CALL$, with 7,050 contracts trading. Meanwhile, the $46.5 strike call option expiring December 29 $UPST 20231229 46.5 CALL$ crashed 83.64% on Thursday.

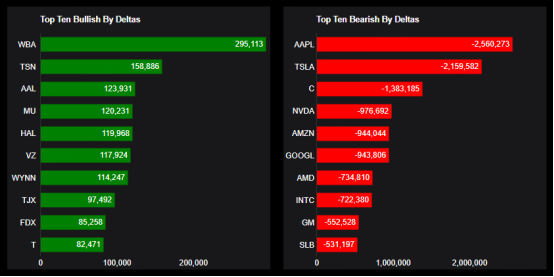

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: Walgreens Boots Alliance, Tyson, American Airlines, Micron Technology, Halliburton, Verizon, Wynn, TJX Companies, FedEx, AT&T Inc

Top 10 bearish stocks: Apple, Tesla Motors, Citigroup, NVIDIA Corp, Amazon.com, Alphabet, Advanced Micro Devices, Intel, General Motors, Schlumberger

Based on option delta volume, traders sold a net equivalent of 2,560,273 shares of Apple stock. The largest bearish delta came from selling calls.

The largest delta volume came from the 29-Dec-23 195 Call $AAPL 20231229 195.0 CALL$, with traders getting short 3,270,967 deltas on the single option contract.

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments