Ulta Beauty Inc reported first-quarter sales growth of 21% year-over-year to $2.35 billion, beating the consensus of $2.12 billion. Comparable sales increased 18%, driven by a 10% increase in transactions and a 7.3% increase in average ticket.

The gross margin expanded to 40.1% from 38.9% in 1Q21.

SG&A expenses increased to $501 million compared to $443.9 million in 1Q21. SG&A expenses decreased to 21.4% from 22.9% as a percentage of net sales due to lower marketing expenses and leverage in-store payroll and benefits due to higher sales.

The operating income increased by 43.4% Y/Y to $437.7 million, and the margin expanded to 18.7% from 15.8% a year ago.

EPS improved to $6.30 from $4.10 in 1Q21, above the consensus of $4.46.

ULTA generated cash from operating activities in Q1 of $426.3 million, compared to $330.07 million in a year-ago quarter. It held cash and cash equivalents of $654.5 million, at the end of Q1.

View more earnings on ULTA

Merchandise inventories increased to $1.57 billion at the end of Q1, compared to $1.35 billion in 1Q21.

ULTA repurchased 331,834 shares of its common stock at $132.8 million during the quarter.

Ulta Beauty operated 1,318 stores totaling 13.9 million square feet at the end of the quarter; It added 10 new stores during the quarter.

FY22 Outlook:ULTA expects net sales of $9.35 billion to $9.55 billion (prior expectations were of $9.05 billion to $9.15 billion) vs. consensus of $9.18 billion, Comparable sales of 6% to 8% (up from prior 3% to 4%).

It expects Operating margin of 14.1% to 14.4% (prior 13.7% to 14.0%); and EPS of $19.20 to $20.10 (prior $18.20 to $18.70).

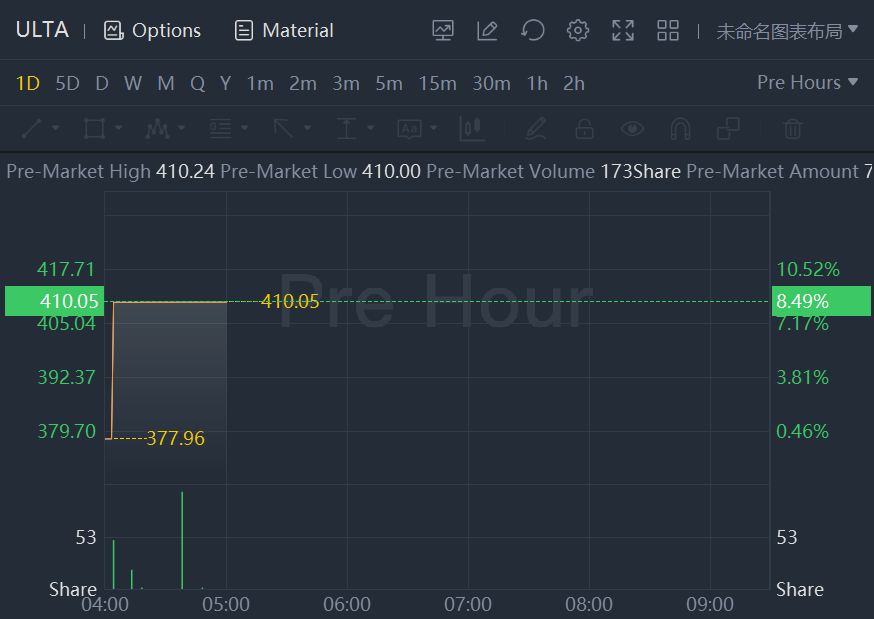

Price Action: ULTA shares are trading higher by 8.5% in premarket trading Friday.

Comments