U.S. Stock futures fell on Monday, as traders tried to find their footing after a dramatic week of trading.

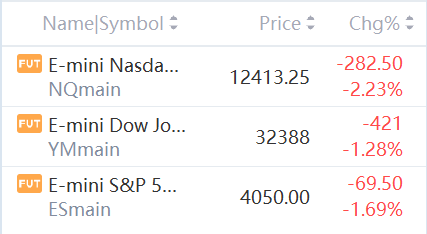

Market Snapshot

At 8:00 a.m. ET, Dow e-minis were down 421 points, or 1.28%, S&P 500 e-minis were down 69.5 points, or 1.69%, and Nasdaq 100 e-minis were down 282.5 points, or 2.23%.

Pre-Market Movers

Palantir Technologies – The data analytics software company’s shares plunged 15% in premarket trading after posting a mixed quarter. Palantir reported profit of 2 cents per share, compared to a 4 cents a share consensus estimate. Revenue was higher than expected, however, despite slowing growth in its government business. Palantir also issued a softer-than-expected current-quarter revenue forecast.

Rivian –Ford Motor(F) is selling 8 million of its 102 million share stakein the electric vehicle maker, according to sources who spoke to CNBC’s David Faber. The move comes as the insider lockup period for selling the stock expires. Rivian shares plummeted 17% in the premarket.

Uber Technologies – Uber plans to slash spendingon marketing and incentives and be deliberate about adding workers, according to a staff email obtained by CNBC. CEO Dara Khosrowshahi said the ride-hailing and food delivery company said Uber needs to become a leaner business to address a “seismic shift” in investor sentiment. Uber fell 3% in the premarket.

Coty – Coty reported quarterly earnings of 3 cents per share, beating the penny a share consensus estimate. Revenue topped forecasts as well and the cosmetics company raised its full-year outlook on strong demand for its products. The stock rose 1.7% in the premarket.

Energizer – The battery maker beat estimates by 9 cents a share, with quarterly profit of 47 cents per share. Revenue topped Street forecasts as Energizer raised prices. Its shares gained 2.3% in the premarket.

Elanco Animal Health – Elanco fell 4.3% in premarket action after the animal health products company lowered its full-year outlook, reflecting the impact of a stronger U.S. dollar. Elanco reported slightly better-than-expected profit and revenue for its most recent quarter.

Tyson Foods – The stock rose 1% in the premarket after the beef and poultry producer beat profit and revenue estimates for its latest quarter. Tyson earned $2.29 per share, compared to a $1.91 a share consensus estimate.

BioNTech – BioNTech trounced Wall Street estimates for profit and revenue in its latest quarter, and also backed its prior outlook for 2022 including projections for Covid-19 vaccine sales.

Twitter – Elon Musk detailed his financial goals for Twitter in an investor presentation obtained by the New York Times. Among those goals: quintuple revenue by 2028, cut Twitter’s reliance on advertising and reach 931 million users by 2028 compared to 217 million at the end of 2021. Twitter fell 1.3% in premarket trading.

Shell – Third Point’s Daniel Loeb told investors he has added to his stake in energy giant Shell, according to a letter seen by Reuters. Loeb said in the letter that he had held “constructive” talks with management, the board and shareholders about his call for the company to split itself up. Shell shares fell 2.6% in premarket action.

Southwest Gas – Southwest Gas reached a settlement with investor Carl Icahn that will see the utility company replace its CEO and give Icahn as many as four board seats. Southwest Gas rose 1% in the premarket.

Market News

Palantir’s Earnings and Outlook Fall Shy of Estimates

For the March quarter, Palantir posted revenue of $446.4 million, up 31% from a year ago,a smidge shy of the company’s guidance of $447 million, but above the Wall Street consensus at $443 million.

On an adjusted basis, the data analytics company earned 2 cents a share in the quarter, 2 cents short of the Wall Street consensus. Under generally accepted accounting principles, the company lost 5 cents a share. Adjusted Ebitda, or earnings before interest, taxes, depreciation and amortization, was $121.7 million, up 27%. Adjusted operating margin was 26%, three points better than the company had forecast.

BioNTech Earnings and Sales Top Wall Street Forecasts

BioNTech, the German biotech company, reported first-quarter earnings and sales that topped Wall Street expectations.

The company, which partnered with Pfizer to develop the first Covid-19 vaccine approved for use in the U.S., earned €14.24 a share in the quarter on revenue of €6.37 billion.

Analysts surveyed by FactSet were expecting earnings of €9.16 a share on revenue of €4.34 billion. A year earlier, the company earned €4.39 a share on sales of €2.05 billion.

Uber to Cut Costs, Slow Down Hiring, CEO Tells Staff

Uber Technologies Inc will scale back hiring and reduce expenditure on its marketing and incentive activities, CNBC reported on Monday, citing a letter from Chief Executive Officer Dara Khosrowshahi.

The ride-hailing company becomes the latest to rein in costs to have a lean investment model, after Facebook-owner Meta Platforms Inc said last week it would slow down the growth of its workforce.

Khosrowshahi said Uber's change in strategy was a necessary response to the "seismic shift" in investor sentiment, according to the CNBC report.

Tyson Foods Reported Quarterly Earnings of $2.29 Per Share

Tyson Foods reported quarterly earnings of $2.29 per share which beat the analyst consensus estimate of $1.88 by 21.81 percent. This is a 70.9 percent increase over earnings of $1.34 per share from the same period last year.

The company reported quarterly sales of $13.12 billion which beat the analyst consensus estimate of $12.84 billion by 2.16 percent. This is a 16.08 percent increase over sales of $11.30 billion the same period last year.

Comments