U.S. stocks are wrapping up a good November that saw equities to bounce off their 2022 lows set in October, with optimism building that the momentum will cement a year-end rally.

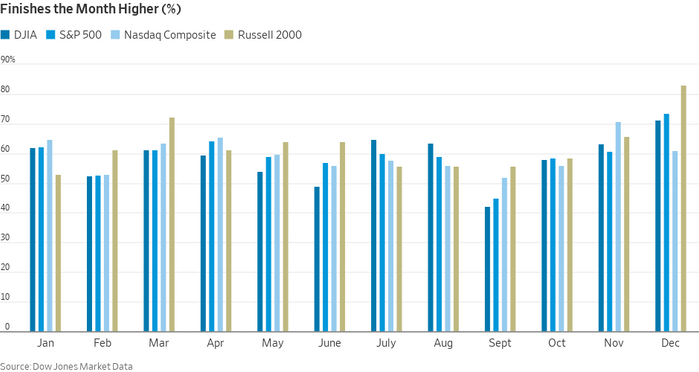

Indeed, there’s been a lot of talk about seasonal tailwinds and how they might — or might not — work to the advantage of stock-market bulls next month. While historical data is only a rough guide, December’s track record is an impressive one when it comes to the “winning percentage” for the Dow Jones Industrial Average, the S&P 500 and the small-cap Russell 2000. The Nasdaq Composite’s December performance isn’t too shabby either, as the chart below from Dow Jones Market Data illustrates.

Of course, averages and other historical data are a rough guide at best. Some investors, no doubt, have bad memories of the market’s 9.2% December 2018 plunge.

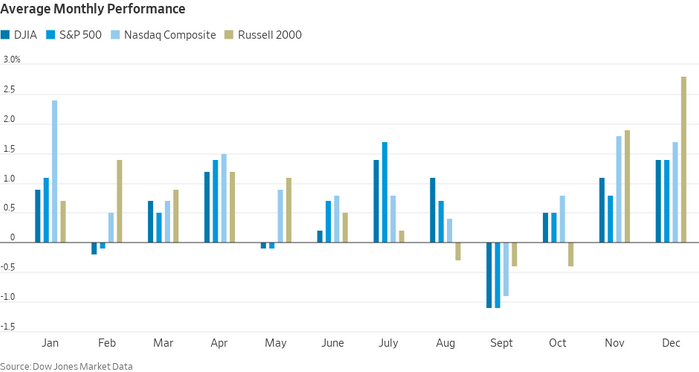

With that caveat in mind, here’s a broader breakdown on how major indexes tend to perform in the final month of the year.

- The Dow Jones Industrial Average is up 71% of the time; it’s highest winning percentage of any month

- The average December return for the Dow is 1.4%, second only to July

- The S&P 500 is up 73% of the time; it’s highest winning percentage of any month

- The average December return for the S&P 500 is 1.4%, 3rd best month on average

- The Nasdaq Composite is up 61% of the time

- The average December return for the Nasdaq Composite is 1.7%, 3rd best month on average

- The Russell 2000 is up 83% of the time; it’s highest winning percentage of any month

- The average December return for the Russell 2000 is 2.8%; the best average return for any month

The chart below illustrates how December returns stack up historically:

The Dow was on track for a 5.2% monthly rise in November, with the S&P 500 up 4.9% and the Nasdaq Composite gaining 3.8%.

Comments