The tech-heavy Nasdaq lost ground on Tuesday (Jan. 30th) and The S&P 500 closed nominally lower after touching a new intraday high, while the blue-chip Dow finished higher.

Regarding the options market, a total volume of 34,118,257 contracts was traded on Tuesday.

Top 10 Option Volumes

Top 10: SPY; QQQ; SPX; TSLA; AMD; IWM; NVDA; AAPL; MSFT; SOFI

Chipmaker Advanced Micro Devices forecast first-quarter revenue below market estimates on Tuesday, as it grapples with uncertain demand for its AI server chips and a cyclical slump in sales of its programmable processors. Shares of the Santa Clara, California-based company fell over 6.88% in premarket trading to $160.22 on Wednesday.

A total number of 1.07 million options related to AMD was traded on Tuesday, 3.16 times higher than the 90-day average volume. Among bulk orders, selling the $185 strike call options expiring February 9th is worth attention as it helps protect the downside for existing shareholders in AMD stock.

However, it's not so lucky for those who sold the short-term $165 strike put options as they had the obligations to buy AMD stock as it may fall below $165 on Wednesday's trading session.

Alphabet disappointed Wall Street on Tuesday as holiday season advertising sales came in below expectations and overshadowed the company's efforts in artificial intelligence and the cloud. Shares fell 5.33% to $143.39 in premarket trading on Wednesday.

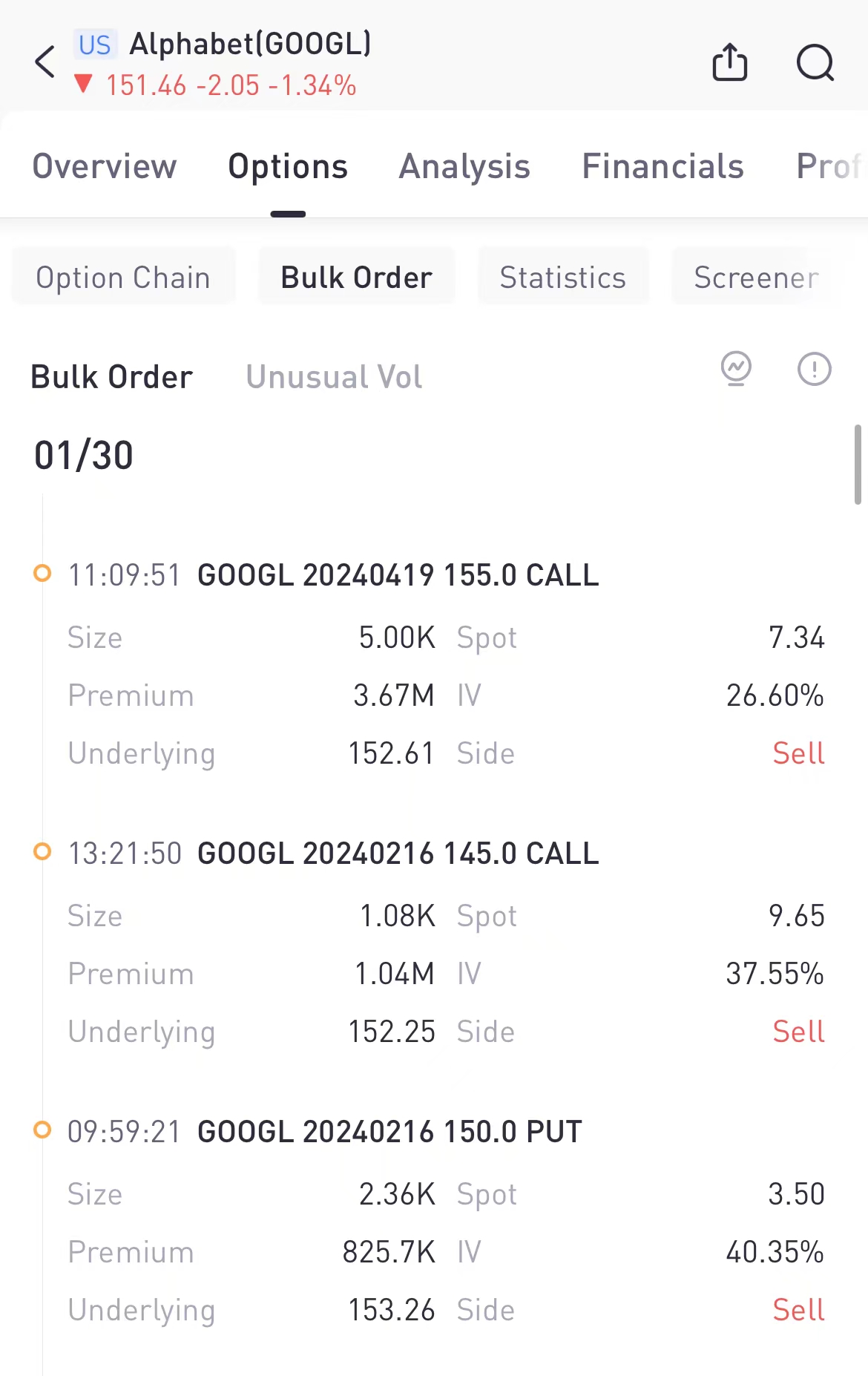

A total number of 438.9K options related to Google was traded on Tuesday, 2.17 times higher than the 90-day average volume. Among bulk orders, selling the $155 strike call options expiring April 19th is worth attention as this is a good example for providing protections for stock holders. The gain from selling calls could generate some gains that offset the downside of the stock.

For those who sold the short-term strike put options, it's still reasonable for them to sell covered calls if they are forced to buy Google shares. They still have the chance to lessen unrealized losses as early as possible even if misjudged the direction before earnings report.

Unusual Options Activity

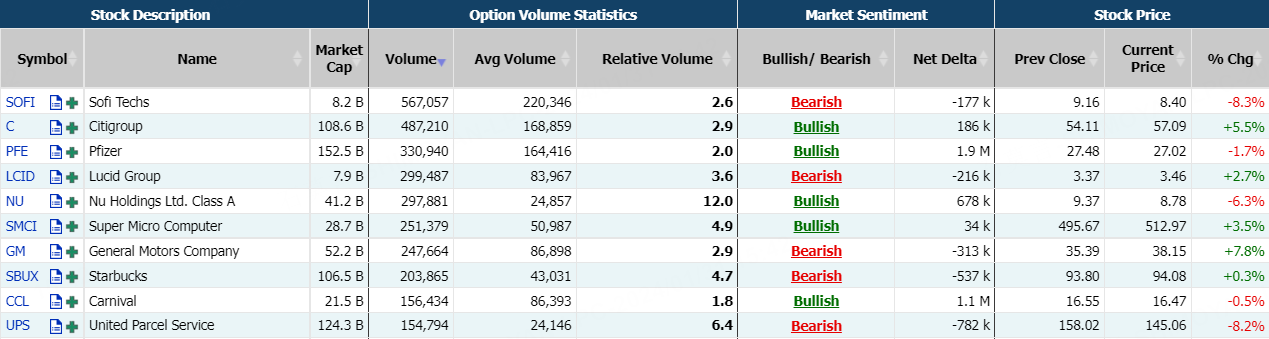

United Parcel Service Inc. shares fell as much as 8.2% on Tuesday. After registering a 9.3% drop in annual sales, UPS forecast a 2024 upswing of as little as 1.1%. Soft demand in Europe and the US led to an overall decline of 7.5% in fourth-quarter delivery volumes.

A total number of 154,794 options related to UPS was traded on Tuesday, 6.4 times higher than the 90-day average volume. Among the total options trading volume, 69% were call options. A particularly high trading volume was seen for the $145 strike put option expiring this Friday, with a total number of 10,689 options trading on Monday.

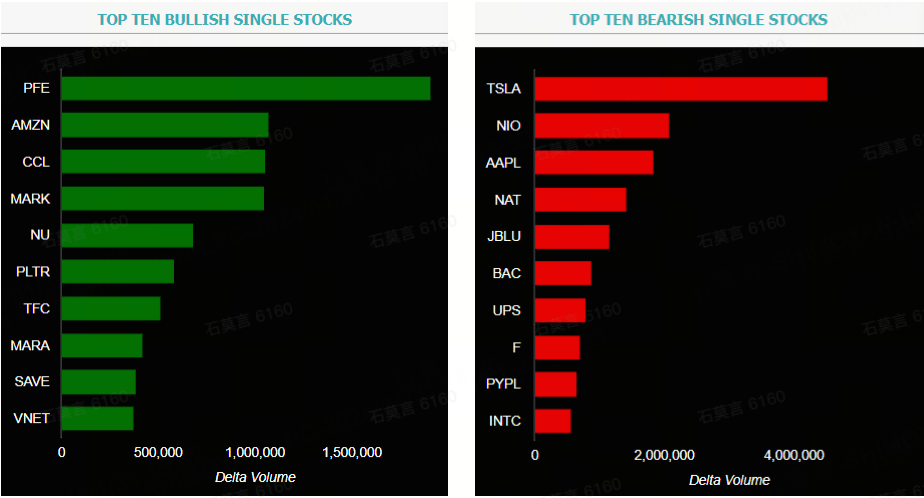

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: PFE; AMZN; CCL; MARK; NU; PLTR; TFC; MARA; SAVE; VNET

Top 10 bearish stocks: TSLA; NIO; AAPL; NAT; JBLU; BAC; UPS; F; PYPL; INTC

Based on option delta volume, traders sold a net equivalent of -4,515,380 shares of Tesla stock. The largest delta volume came from the 02-Feb-24 195 Call, with traders getting short 3,012,391 deltas on the single option contract.

Elon Musk's $55 billion pack package at electric vehicle maker Tesla was voided by a Delaware judge after a shareholder lawsuit claimed his hefty pay package was unduly approved. Tesla fell 2.94% to $184.96 in premarket trading.

This first big test of 2024 for Amazon comes this week. The company will publish its fourth-quarter earnings on Feb. 1, after trading closes. Analysts expect Amazon's revenue to be $166.177 billion, adjusted net income to be $11.203 billion, and adjusted EPS to be $1.04, according to Bloomberg's unanimous expectations.

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments