U.S. stock index futures were largely subdued on Wednesday ahead of minutes from the Federal Reserve's May meeting, which will likely offer clues on the path of future rate hikes.

The minutes are due at 1400 ET (1800 GMT). U.S. Federal Reserve Chair Jerome Powell has promised to keep pushing on rate hikes until there is clear and convincing evidence that inflation is dropping.

Money markets are pricing in 50 basis point hikes in June and July at a time when there have been fears about waning U.S. economic momentum, with data released on Tuesday showing new home sales plunging and business activity decelerating.

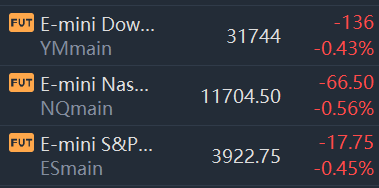

Market Snapshot

At 8:25 a.m. ET, Dow e-minis were down 136 points, or 0.43%, S&P 500 e-minis were down 17.75 point, or 0.45%, and Nasdaq 100 e-minis were down 66.5 points, or 0.56%.

Pre-Market Movers

Dick's Sporting Goods(DKS) – The sporting goods retailer's shares slid 13% in the premarket after it issued a weaker-than-expected outlook for the full year as it adjusts for what it calls challenging macroeconomic conditions. Dick's reported better-than-expected profit and revenue for its latest quarter, and comparable-store sales that fell less than expected.

Express(EXPR) – The apparel retailer's shares jumped 10.9% in premarket trading after reporting quarterly results that were better than expected. Express lost an adjusted 10 cents per share, narrower than the 15-cent loss anticipated by analysts, and revenue topped forecasts as well. Express also raised its full-year outlook for comparable-store sales.

Wendy's(WEN) – Wendy's rallied 9.1% in premarket action after long-time shareholder Trian Fund Management said it was exploring an acquisition or other potential deal for the restaurant chain. Trian is the company's largest shareholder, with a 19.4% stake.

Dell Technologies(DELL) – Dell added 1% in premarket trading after Evercore added the information technology company to its "Tactical Outperform" list. Evercore believes IT demand trends remain strong enough to lead to an earnings beat and a raised outlook when Dell reports quarterly earnings Thursday.

Lyft(LYFT) – Lyft plans to cut budgets and slow hiring, moves similar to those recently announced by ride-sharing rival Uber Technologies(UBER). Lyft shares are down more than 60% this year, including a more than 17% tumble Tuesday.

Nordstrom(JWN) – Nordstrom rose 4.8% in the premarket after the retailer raised its annual sales and profit forecast, a contrast to other big box retailers. Nordstrom posted a slightly wider-than-expected loss for the first quarter, while sales surged 23.5% to exceed pre-pandemic levels.

Intuit(INTU) – Intuit shares rose 1.7% in premarket trading after reporting better-than-expected quarterly profit and revenue. The financial software company also raised its current-quarter outlook on improvement in its QuickBooks business and the addition of recently acquired email marketing firm Mailchimp.

Toll Brothers(TOL) – Toll Brothers stock rallied 1.6% in premarket action after the luxury home builder beat top and bottom-line estimates for its latest quarter. Toll Brothers said that while demand was still solid, it has moderated amid higher mortgage rates and changing macroeconomic conditions.

Urban Outfitters(URBN) – Urban Outfitters rose 2.5% in premarket trading after first-quarter results that fell shy of analyst forecasts on both the top and bottom lines. Like other retailers, Urban Outfitters highlighted the negative impact of inflation on its operations including higher costs for raw materials and transportation.

Comments