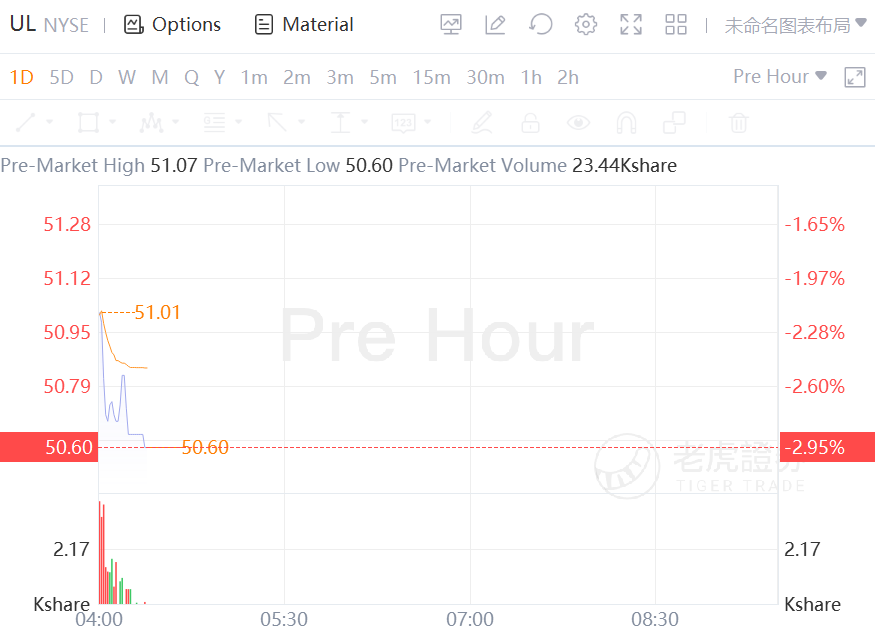

Unilever Shares Fell Nearly 3% in Premarket Trading. Unilever Plc warned it will take two years to return to the profitability level of 2021 as the worst inflation since the financial crisis erodes the benefits of faster growth.

The stock fell as much as 3.2% in London Thursday morning.

The maker of Dove soap also ruled out making major acquisitions in the foreseeable future after Chief Executive Officer Alan Jope was rebuffed for his attempt to buy GlaxoSmithKline Plc’s consumer healthcare division.

It’s Unilever’s first results since news of its unsuccessful attempt to buy the Glaxo unit, which investors met with criticism, provoking a stock sell-off. Pressure has been rising on Jope after billionaire activist investor Nelson Peltz’s Trian Fund Management LP built a stake in the company. The CEO is being forced to pass on higher costs to consumers, with fourth-quarter pricing at the highest level in a decade.

Commodity costs are rising by more than 20% in aggregate across the consumer goods industry, Chief Financial Officer Graeme Pitkethly said on a call with reporters. Unilever’s expenses are rising by slightly less as its scale allows the company to negotiate more favorable contracts with suppliers, although it’s particularly exposed to to increases in the price of crude oil, which has recently risen 60%, palm oil, which has risen 130%, and soybean oil, which has risen 100%.

“This hasn’t happened in well over a decade, if ever,” Pitkethly said.

The company announced a 3 billion-euro buyback program as it reported a 4.5% gain in underlying sales growth for 2021, the fastest rate in nine years and ahead of analysts’ estimates.

Last month, Unilever said it would cut 1,500 jobs and restructure its divisions to accelerate growth and improve accountability. The company is making ice cream, beauty and personal care independent units, which could facilitate mergers and acquisitions.

In July, Unilever abandoned a forecast for an improvement in its profit margin, saying it would be near 2020’s level. The company has been increasing prices by the most in almost a decade to compensate for higher raw material costs.

The stock is trading below the level of Kraft Heinz Co.’s failed bid for Unilever in 2017. After that approach, Unilever set the target of an underlying 20% margin by 2020, which it missed.

The company’s forecast is for a margin of 16% to 17% in 2022.

Comments