U.S. stocks ended sharply higher on Wednesday (August 23rd). The S&P 500 gained 48.46 points, or 1.10%, to 4,436.01 and the Nasdaq Composite added 215.16 points, or 1.59%, to 13,721.03.

Regarding the options market, a total volume of 36,984,550contracts was traded, up 10.6% from the previous trading day.

Top 10 Option Volumes

Top 10: SPY; QQQ; TSLA; NVDA; JNJ; AAPL; IWM; KVUE; EEM; AMD

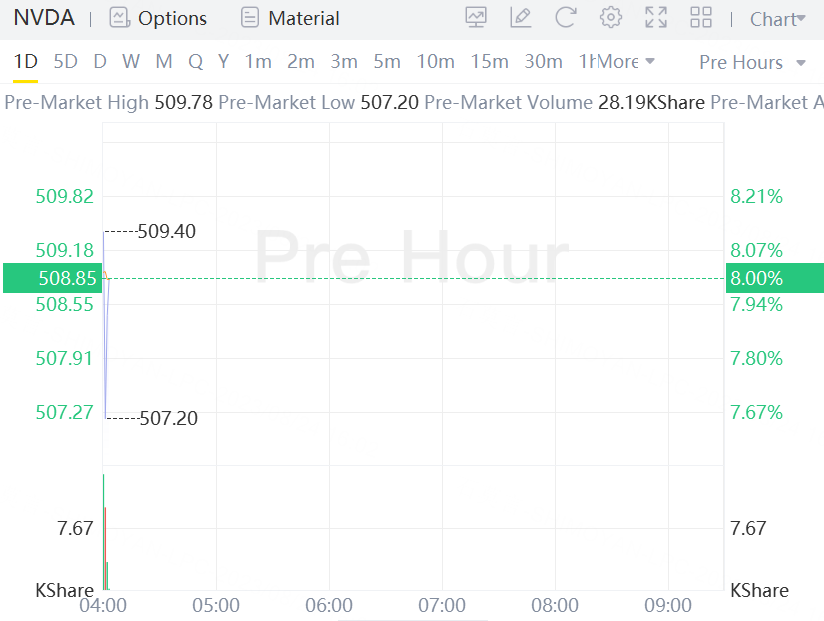

Nvidia Corp. shares rallied 8% to $508.85 in premarket trading on Thursday, following a 3.2% rise in the regular session to close at $471.16, less than 1% below the stock's record closing high of $474.94, set on July 18. A close at such levels on Thursday would mean a new record high for the stock.

In the fiscal second quarter, which ended July 30, revenue doubled to $13.5 billion, the company said. Profit was $2.70 a share, minus certain items. Analysts had predicted sales of about $11 billion and profit of $2.07.

Nvidia said sales will be about $16 billion in the three months ending in October. Analysts had estimated just $12.5 billion, according to data compiled by Bloomberg. Nvidia’s results last quarter also blew past projections, and it approved an additional $25 billion in stock buybacks.

Nvidia’s division that supplies chips to data centers — once a sideline business — has become its biggest moneymaker. The unit had sales of $10.3 billion last quarter, versus an estimate of $7.98 billion. Gaming revenue was $2.49 billion, compared with an average analyst prediction of $2.38 billion. Automotive-related chips brought in $253 million.

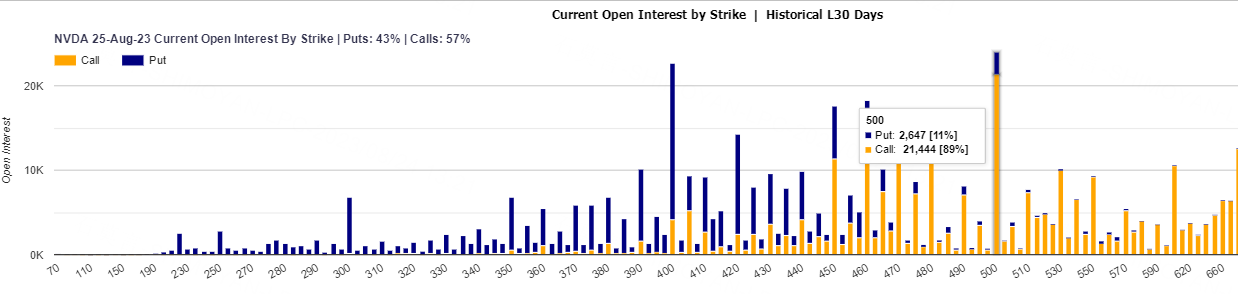

A total number of 1.33 million options related to Nvidia was traded. Among Nvidia's contracts expiring this week, the largest open interest comes from $500 strike call options with a total amount of 21,444 as of Wednesday. The robust activity suggests some traders are fearful of missing out on further gains in Nvidia.

Most Active Options

Most Active Trading Equities Options:

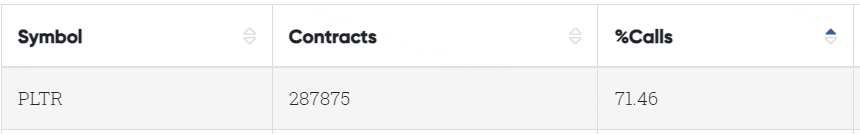

Special %Calls>70%: Palantir

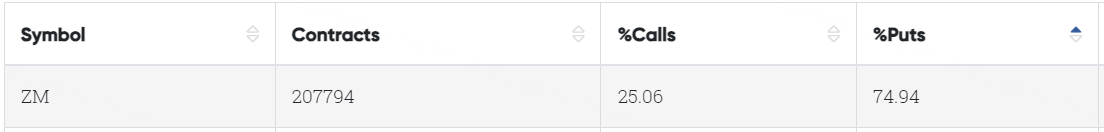

Special %Puts>70%: Zoom

Unusual Options Activity

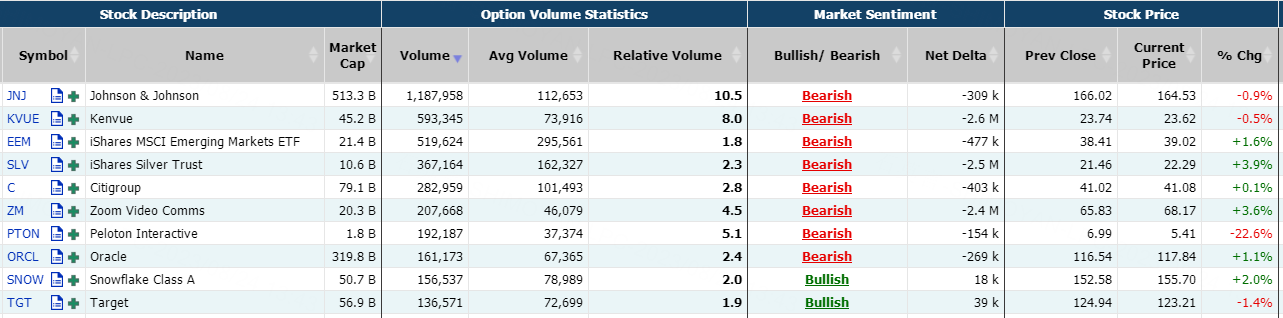

Johnson & Johnson completed the separation of Kenvue, making its consumer health spinoff a fully independent business, the companies announced Wednesday.

Kenvue, which houses brands such as Band-Aid and Tylenol, was spun out of the healthcare giant in May 2023, making it the largest initial public offering in the U.S. since 2021.

"This is a historic moment for Kenvue and with a singular focus on delivering innovative care solutions to customers and consumers around the world, we're excited to write the next chapter of consumer health," Kenvue (KVUE) CEO Thibaut Mongon said.

A total number of 1,187,958 options related to Johnson & Johnson was traded. A particularly high trading volume was seen for the $210 strike call options expiring September 15, with a total number of 465,107 option contracts trading on Wednesday.

Shares of Zoom rose 3.55% on Wednesday following a thorough thumping of Wall Street analyst profit estimates. The videoconferencing company came into this earnings cycle looking to capitalize on artificial intelligence hype among investors. It managed to feed the AI beast, but analysts were quick to call out a more mixed quarter than first thought and tepid guidance.

"Zoom's Q2 results initially appeared quite solid, with a healthy top/bottom line beat with revenue upside coming from the Enterprise segment with ZM Phone strength. That said, the upside was partially one-time driven with PSO revenue pull-forward, a softer Q3 billings and weaker 2H revenue outlooks," Citi analyst Tyler Radke said in a client note.

A total number of 207,668 options related to Zoom was traded. A particularly high trading volume was seen for the $80 strike put options expiring October 20, with a total number of 54,010 option contracts trading on Wednesday.

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: AMC; LUMN; NVDA; MULN; GPS; NKE; MSFT; HSY; PLTR; WE

Top 10 bearish stocks: KVUE; ZM; F; $DKS(DKS$; NKLA; PBR; PFE; C; MPW

Based on option delta volume, traders sold a net equivalent of -2,438,431 shares of Zoom stock. The largest bearish delta came from the 17-Nov-23 80 Put, with traders getting short 2,973,860 deltas on the single option contract.

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments