- Nasdaq futures lead stock drop.

- Pfizer, CVS boost outlooks.

- Oil continues its upward climb touching the $65 per barrel level.

- Gold was modestly lower trading at $1,782 an ounce.

(May 4) U.S. stock futuresslipped in early trading as investors digested a fresh batch ofcorporate earnings.

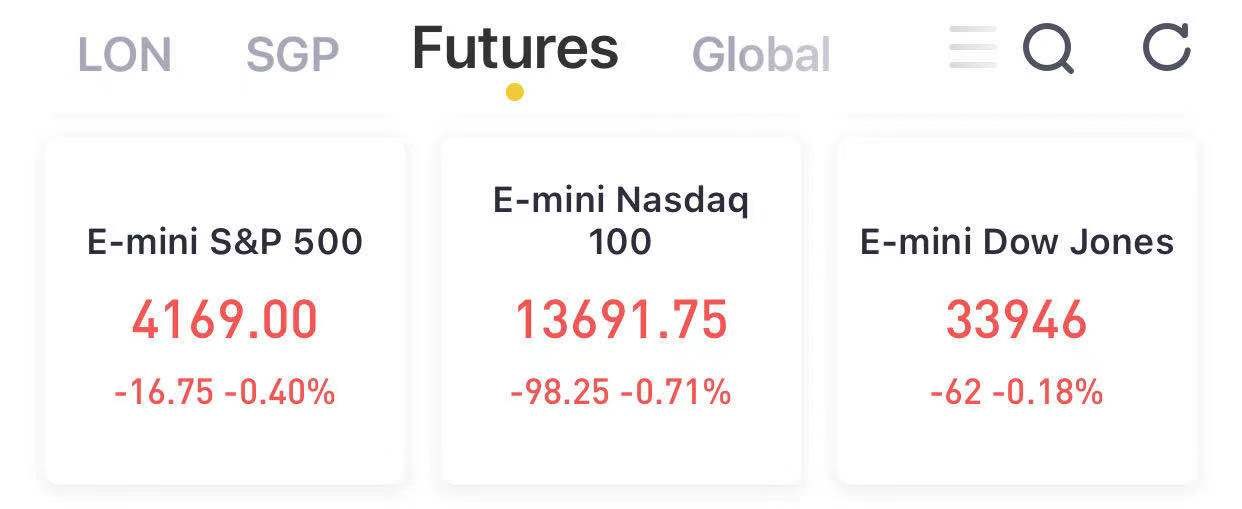

At 8:14 a.m. ET, Dow E-minis were fell 62 points, or 0.18%, S&P 500 E-minis were down 16.75 points, or 0.40% and Nasdaq 100 E-minis were down 98.25 points, or 0.71%.

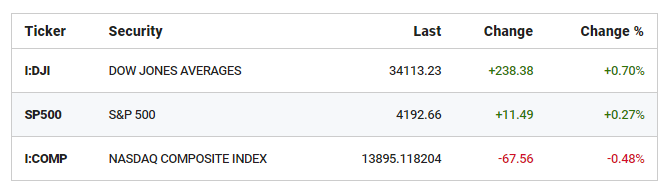

For tech, Tuesday may mark the second day of selling, even as the Dow and S&P posted gains, as investors piled into cyclical stocks and out of higher growth names.

FAANMG stocks fell; EV stocks retreated.

Stocks making the biggest moves in the premarket: CVS Health, iRobot, Vaxart & more

1) CVS Health(CVS) – The drug store and pharmacy benefits management companyearned $2.04 per share in the first quarter, above the consensus estimate of $1.72 a share. Revenue also came in above Wall Street forecasts. CVS saw higher sales at its stores, with customer traffic spurred by Covid-19 vaccination visits. CVS also raised its full-year forecast, and its shares rose 3% in the premarket.

2) iRobot(IRBT) – iRobot earned 41 cents per share during the first quarter, compared to a consensus estimate of 9 cents a share. The maker of the Roomba robotic vacuum’s revenue exceeded estimates as well, however the stock tumbled 8.6% in the premarket on concerns about shipping and component costs.

3) Pfizer(PFE) – The drugmakerbeat estimates by 16 cents a share, with quarterly profit of 93 cents per share. Revenue also came in above forecasts and the company raised its full-year guidance as sales of its Covid-19 vaccine continue to be stronger than expected. Additionally, the Food and Drug Administration is set to authorize the vaccine for use in adolescents aged 12-15, according to federal officials familiar with the plan who spoke to The New York Times. Pfizer shares added 1.3% in premarket trading.

4) Vaxart(VXRT) – Vaxart surged 18.6% in premarket trading after it reported positive results in a phase 1 trial of its oral Covid-19 vaccine. Vaxart said the vaccine could be just as effective as the injected vaccines developed by Pfizer andModerna(MRNA).

5) Under Armour(UAA) – The athletic apparel maker’s stock climbed 2.8% in premarket action after itreported first-quarter profit of 16 cents per share, well above the 3 cents a share consensus estimate. Revenue also topped analysts’ forecasts and Under Armour raised its full-year outlook as reopening markets spur demand for shoes and apparel. Separately, the companyagreed to pay $9 millionto settle a Securities and Exchange Commission probe into its accounting.

6) DuPont(DD) – The industrial materials maker reported quarterly profit of 91 cents per share, 15 cents a share above estimates. Revenue also topped analysts’ forecasts. DuPont is seeing strong demand for its products from semiconductor makers as well as automobile markets, and the company raised its full-year profit and revenue forecast.

7) XPO Logistics(XPO) – XPO reported quarterly earnings of $1.46 per share, well above the consensus estimate of 97 cents a share. The transportation company’s revenue was also above Wall Street forecasts, reaching record levels in sharp contrast to usual seasonal trends. XPO also raised its full-year forecast, but its shares lost 1.2% in premarket action.

8) Avis Budget(CAR) – Avis Budget lost 46 cents per share for the first quarter, smaller than the loss of $2.16 a share predicted by analysts. The car rental company’s revenue beat Wall Street forecasts as well amid a jump in demand and more solid pricing for car rentals. The stock fell 1.4% in premarket action despite the upbeat results.

9) Qiagen(QGEN) – Qiagen reported better-than-expected earnings and sales for its latest quarter, as the genetic testing company saw increasing demand for non-coronavirus products as well as strength in its Covid-19 testing business.

10) SmileDirectClub(SDC) – SmileDirectClub said its current-quarter sales will be hurt by an April cyberattack, costing it between $10 million and $15 million. The maker of teeth-straightening systems said it successfully blocked the attack and restored its systems to normal. The stock lost 9.2% in the premarket. (Disclosure: NBC Nightly News investigated SmileDirectClub’s customer complaints in February. The company accused NBCUniversal of publishing false information about the company and is seeking $2.85 billion for defamation.)

11) Domtar(UFS) – Domtar shares soared 16.1% in premarket action following a Bloomberg report that said Canada’s Paper Excellence is exploring a deal to buy its U.S.-based paper and packaging rival. A deal could value Domtar in the mid-$50 per share range, compared to Monday’s close of $40.52 a share.

In commodities, oil continues its upward climb touching the $65 per barrel level, while gold was modestly lower trading at $1,782 an ounce.

Comments