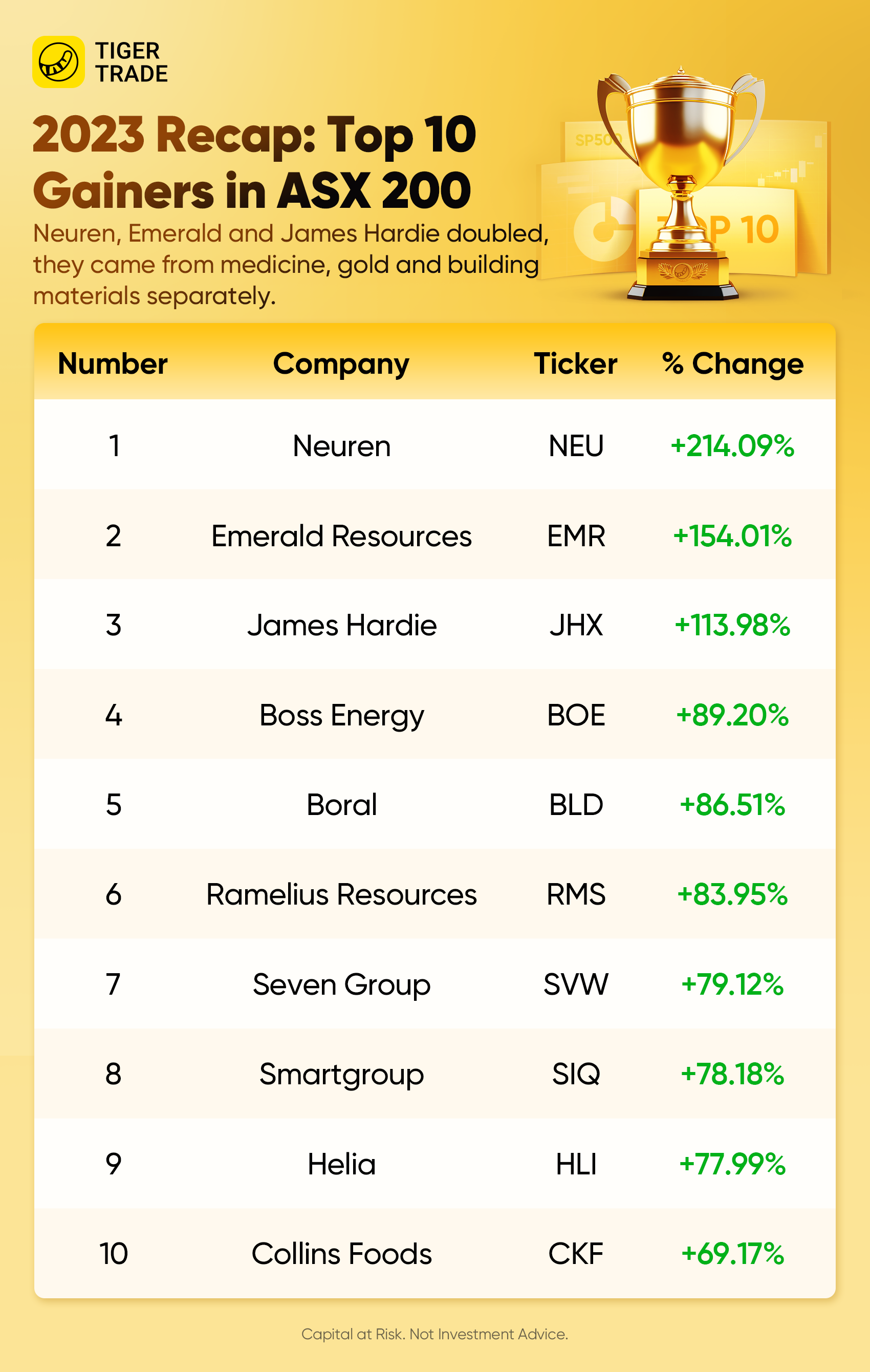

The S&P/ASX 200 ended the year at 7590.8 and rose 7.83% in 2023, its best return since 2021. Neuren Pharma, Emerald Resources NL and JAMES HARDIE INDUSTRIES-CDI doubled in 2023, and they came from medicine, gold and building materials separately.

Here’s a look at the top 10 ASX 200 gainers in 2023:

1. Neuren Pharma Yearly Performance: 214.09%

The latest news is that it reported significant improvement in children with PMS and said NNZ-2591 will now be the focus of a Phase 3 trial, and it pushed the stock price to hit an all-time high at $25.95 this year.

Jefferies analyst David Stanton says NNZ-2591 is Neuren's largest opportunity, representing about five times the size of the potential market from treating Retts Syndrome, the focus of its trofinetide drug. The analyst thought that its risk-weighted valuation for NNZ-2591 moves to A$9.77 per share (from A$3.42).

2. Emerald Resources NL Yearly Performance: 154.01%

It is an explorer and developer of gold projects with its head office in Perth, Western Australia.

The company surged 154.01% this year because of the rising gold price and its potential acquisition. On 13 October, Emerald revealed that it had upped its stake in Bullseye to a 76.5% ownership stake, which puts Emerald one step closer to acquiring Bullseye in full. Since then, it already gained %.

3. JAMES HARDIE INDUSTRIES-CDI Yearly Performance: 113.98%

The latest financial result is that it reported a 2% rise in net profits to $178.9 million for the three months to the end of September, and expects Q3 net profit of $165 million-$185 million. The company managed to increase the prices of building materials sold in Australia up by 15%, which helped its stock gain 113.98% this year.

Macquarie analysts kept an outperform rating and offered their price target to $58.4, they thought that the company is really setting itself up well for a market recovery.

4. Boss Resources Ltd Yearly Performance: 89.2%

The latest news is that it will buy a 30% stake in enCore Energy's Alta Mesa project in south Texas for $60 million while investing another $10 million in the company. Meanwhile, the doubling nuclear fuel price and the news that the COP28 summit supported a tripling in nuclear power generation by 2050 helped it soar 89.2% in 2023.

Macquarie analysts maintain an outperform stock rating and a price target of $5 per share. The brokerage says any additional contracts remain key catalysts over the near and medium term.

5. BORAL LIMITED Yearly Performance: 86.51%

The company now anticipates underlying earnings before interest and tax (EBIT) to be in the range of $300 million to $330 million, up from the previous August estimate of $270 million to $300 million. This represents a substantial rise of over 42% from the 2022-23 EBIT of $231.5 million, assuming the estimate holds through to next June.

Jefferies analyst Simon Thackray rated it at hold and thought that favorable weather and strong pricing outcomes are also supporting earnings. Long-term EBIT margin target that is over 10% will be achieved and A$500 million mid-cycle EBIT is possible, albeit some time away yet.

6. RAMELIUS RESOURCES LTD Yearly Performance: 83.95%

The company had a similar situation of the rising gold price and its acquisition to Emerald Resources NL, and its stock price gained 83.95%.

It intends to increase exploration spending by 20% in 2023-24 as it strives to transform resources into reserves. Meanwhile, it exercised its right to compulsorily acquire the remaining Musgrave shares it didn’t hold as part of its off-market takeover offer.

7. SEVEN GROUP HOLDINGS LTD Yearly Performance: 79.12%

The latest news is that the company increased group level guidance to "high single to low teen" EBIT growth in FY24, upgraded industrial services guidance to "low to mid-teen" EBIT growth in FY24, identified A$60 mln in cost-out initiatives to FY25 and targeted A$25 mln cost reduction in FY24.

Jefferies analysts raised its price target to $31.2 per share from$30.08 per share and retained a "hold" rating.

8. Smartgroup Corporation Ltd Yearly Performance: 78.18%

It gained a new contract from the South Australian government. The contract starts on 1 July 2024 and services will be made available to approximately 110,000 South Australian government employees. The company will also exclusively manage a panel of third-party novated leasing providers or financiers.

Meanwhile, it expects its 2023 underlying net profit is approximately $63 million. Its current revenue expectation for 2023 is approximately $249 million, largely driven by bigger novated leasing volumes. The company gained 78.18% this year.

9. Helia Group Limited Yearly Performance: 77.99%

Its H1 2023 underlying net profit after tax of A$137 million increased 7% on H2 2022 and 32% on H1 2022, and the board approved a further on-market share buy-back for shares up to a maximum aggregate value of $100 million. Both of them helped it gain 77.99%.

But Jefferies analyst Simon Fitzgerald downgraded it to underperform from hold and cut its price target to $3.08/share with claims costs expected to grow and a more difficult environment for high LVR loan originations going forward.

10. Collins Foods Yearly Performance: 69.17%

Its half-year results helped its stock price gain 69.17% in 2023. It reported a 14.3% increase in revenue from continuing operations to $696.5 million, and its underlying EBITDA from continuing operations rose 16.7% to $109.9 million.

Citi analyst Sam Teeger has a neutral rating and offered the $11.10 target price. He thought that the company had grown more positive on its Taco Bell operations. Crucially, Collins will be reviewing its prior pause on developing the franchise in H2.

Comments