The consumer price index rose less than expected in October, an indication that while inflation is still a threat to the U.S. economy, pressures could be starting to cool.

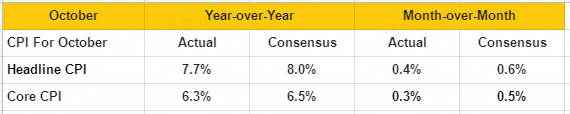

The consumer price index, a broad-based measure of goods and services costs, increased 0.4% for the month and 7.7% from a year ago. Respective estimates from Dow Jones were for increases of 0.6% and 7.9%.

Excluding volatile food and energy costs, so-called core CPI increased 0.3% for the month and 6.3% on an annual basis, compared to respective estimates of 0.5% and 6.5%.

Markets reacted sharply to the report, with futures tied to the Dow Jones Industrial Average up more than 800 points. Treasury yields fell sharply, with the policy-sensitive two-year note tumbling 0.22 percentage points to 4.41%.

“The trend in inflation is a welcome development, so that’s great news in terms of the report,” said Michael Arone, chief investment strategist at State Street Global Advisors. “However, investors are still gullible and they are still impatiently waiting for the Powell pivot, and I’m not sure it’s coming anytime soon. So I think this morning’s enthusiasm is a bit of an overreaction.”

The “Powell pivot” comment refers to market expectations that Federal Reserve Chairman Jerome Powell and his central bank colleagues soon will slow or stop the aggressive pace of interest rate increases they’ve been deploying to try to bring down inflation.

Even with the slowdown in the inflation rate, it still remains well above the Fed’s 2% target, and several areas of the report show that the cost of living remains high.

Comments