U.S. stock index futures started the week lower after quarterly results from Goldman Sachs and Morgan Stanley, with downbeat economic data from China denting investor sentiment globally on Tuesday.

U.S.-listed China stocks such NIO , JD.com Inc and Baidu fell more than 2.5% after China reported slower fourth-quarter economic growth compared with the previous quarter.

Crypto stocks soared in premarket trading. Bit Digital and BIT Mining rose 15%, Marathon Digita rose 9%, Coinbase rose 5%. Bitcoin is on the charge in 2023, dragging the crypto market off the floor.

Investors await data on retail sales, existing home sales for December and jobless claims later in the week, besides comments from several Fed officials for cues on the central bank's monetary tightening plans.

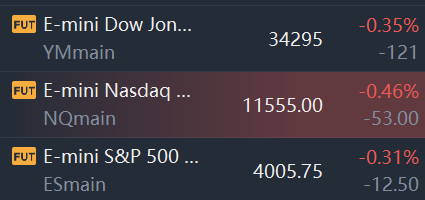

Market Snapshot

At 7:50 a.m. ET, Dow e-minis were down 121 points, or 0.35%, S&P 500 e-minis were down 12.5 points, or 0.31%, and Nasdaq 100 e-minis were down 53 points, or 0.46%.

Pre-Market Movers

Goldman Sachs (GS) — The bank slid more than 2% after reporting earnings-per-share and revenue that missed Wall Street estimates Tuesday.

Morgan Stanley (MS) — Morgan Stanley's earnings topped Wall Street expectations Tuesday, thanks, in part to record wealth management revenue. Shares were 1.46% higher in the premarket.

Roku (ROKU) — Roku shares dipped 2% after Truist downgraded the company to a hold from a buy rating, saying that the streaming stock is hypersensitive to a tough macro environment given that a large chunk of revenues are tied to advertising.

Snap (SNAP) — JMP Securities downgraded the company to market perform from market outperform, citing declining time spent on Snap and increased competition from Reels and YouTube shorts. Snap slid 1.73% in the premarket.

Alibaba (BABA) — Activist investor Ryan Cohen built a stake in the Chinese e-commerce giant, according to the Wall Street Journal. Cohen is pushing the company to increase its stock buyback program, the report said. Shares were higher by 0.3% in the premarket.

Pfizer (PFE) — Wells Fargo downgraded the pharmaceutical giant to equal weight from overweight on Monday, saying the company needed a reset from the pandemic for shares to work again. Pfizer was down 1.38% in the premarket.

Grab (GRAB) — Grab was upgraded to Buy on Tuesday as Bank of America sees a more favorable risk/reward dynamic into 2023. Grab shares rose 2.2% in premarket trading on Tuesday.

Whirlpool (WHR) — Shares dropped 3% after Whirlpool said it will divest a majority of its EMEA business, and form a new business focused on Europe with Turkish household appliances maker Arcelik. Whirlpool will own 25% of the new entity, while Arcelik will own 75%.

iQIYI (IQ) — iQIYI today announced an underwritten public offering of 76,500,000 American Depositary Shares, each representing seven Class A ordinary shares, par value $0.00001 per share, of the Company (the "ADSs"). The shares dropped more than 8% in premarket trading.

Emerson Electric Co. (EMR) has submitted a bid to acquire National Instruments Corp. (NATI) for $53 a share at an implied enterprise value of $7.6 billion. National Instruments shares jumped 17% in premarket trading while Emerson Electric fell 3.7%.

Vodafone (VOD) — The U.K. telecommunications company rose nearly 2% in the premarket. On Monday, Ghana approved Vodafone's sale of 70% of its stake in Vodafone Ghana to Telecel Group. On Thursday, Vodafone was upgraded to buy by Bank of America, which said it was optimistic about the company's prospects amid CEO Nick Read's departure.

Global Payments (GPN) — Morgan Stanley upgraded Global Payments to overweight from equal weight on Tuesday, citing a more favorable competitive backdrop and attractive valuation, among other things. The company gained 2% in the premarket.

Church & Dwight (CHD) — Morgan Stanley upgraded the consumer goods maker to overweight from equal weight and boosted its price target to $91 from $82. Church & Dwight gained more than 1% in the premarket.

Cheesecake Factory (CAKE) — The restaurant chain slid more than 3% after being downgraded by Citi to neutral from buy, which said shares are near its price target. Cheesecake was also downgraded to hold by Gordon Haskett.

Bloomin' Brands (BLMN) — The Outback Steakhouse parent slid nearly 2% after being downgraded to hold by Gordon Haskett, which cited the company's increasing balanced risk/reward profile.

Reynolds Consumer Products (REYN) — Shares fell about 1.3% after Credit Suisse downgraded the household goods maker to neutral from outperform, saying share gains are now baked into the stock price.

Market News

China 2022 GDP Slows, Population Shrinks

China saw gross domestic product growth of 3% in 2022, the second slowest pace since the 1970s, while fourth quarter and December data came in better than economists had expected. Meanwhile, the nation’s population started shrinking last year for the first time in six decades as births decline despite efforts to encourage bigger families.

Investors Most Underweight on US Stocks Since 2005, BofA Poll Shows

Investors are the most underweight on US equities since 2005 as improving market sentiment sends them flocking toward cheaper regions, according to Bank of America Corp.’s global fund manager survey.

Participants in the January poll were “a lot less bearish” than in the fourth quarter, sparking a rotation to emerging markets, Europe and cyclical stocks, and away from pharmaceuticals, technology and the US, strategists led by Michael Hartnett wrote in a note. Allocation to US equities “collapsed” during the first month of 2023, with investors a net 39% underweight the asset class, they said, exceeding even the UK’s 15%.

Activist Investor Ryan Cohen Takes Stake in Alibaba and Pushes for More Stock Buybacks

Activist investor Ryan Cohen takes stake in Alibaba and pushes for more stock buybacks. While the stake is small in comparison to Alibaba’s market capitalization of nearly $300 billion, Mr. Cohen has a wide following among individual investors who often follow his lead.

Cohen first contacted the Chinese e-commerce giant’s board in August to say he saw the company’s shares as undervalued.

Mr. Cohen has communicated to Alibaba’s board that the share-repurchase plan could be boosted by another $20 billion, to roughly $60 billion, the people said.

Comments