(Reuters) - GSK raised its full-year profit and sales forecasts on Wednesday for the second time this year, buoyed by the strong launch of its respiratory syncytial virus (RSV) vaccine and steady demand for its shingles shot.

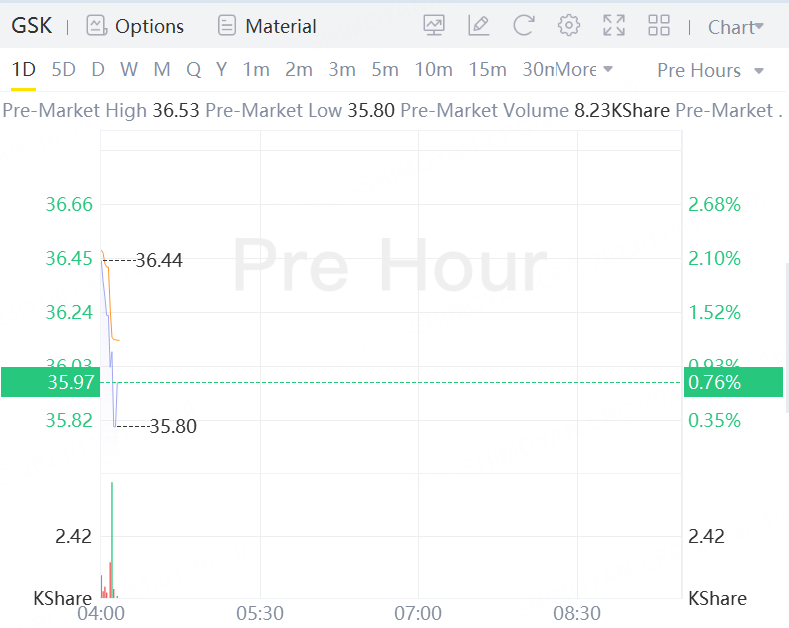

GSK Stock Jumps 0.76% in premarket trading.

Analysts expect the British drugmaker's RSV vaccine Arexvy to power future growth, amid worries about the strength of its pipeline of drugs in development and costly U.S. litigation over discontinued heartburn drug Zantac.

The drugmaker is betting on Arexvy to be its next blockbuster medicine as it faces a combination of patent expiries and declining revenue from its current bestsellers by the end of this decade.

Arexvy, launched in the United States recently, is expected to garner full-year sales of between 900 million pounds to 1 billion pounds ($1.22 billion), GSK said.

For the third quarter, the shot recorded sales of 709 million pounds, trouncing analysts' expectations of 358 million pounds, according to a company-compiled consensus.

GSK now expects a rise of 17% to 20% in annual adjusted earnings per share, excluding the effect of currency swings, up from 14% to 17% growth previously forecast.

Meanwhile, sales are seen to rise by 12% to 13% in 2023 compared with earlier expectations of 8% to 10%.

For the reported quarter, sales of Shingrix, the company's top-selling drug to treat shingles, generated 825 million pounds, below market estimates of 868 million pounds.

However, total sales and adjusted profit per share figures comfortably beat expectations.

($1 = 0.8229 pounds)

Comments