AMC dropped over 10% in morning trading. Is AMC Stock A Buy Or Sell Now? Here's What Fundamentals, Stock Chart Action, Mutual Fund Ownership Metrics Say.

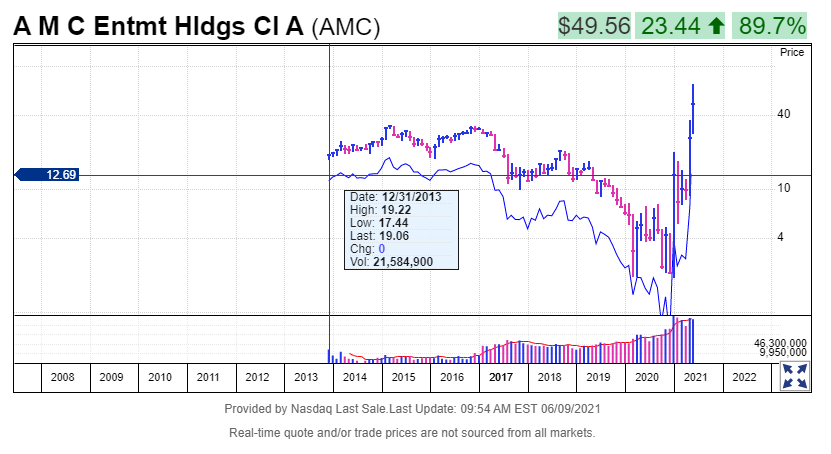

Going to the movies is exciting. But can it match the action byAMC Entertainment(AMC)? Starting the year at just 2 a share,AMC stock has skyrocketed more than 36-foldto new all-time highs this past week.

Shares at one point fell more than 30% on Thursday on news the company plans to sell up to 11.55 million shares — or roughly 2.6% of the total common shares outstanding. AMC later announced completion of the offering, raising $587 million. But in recent days, the stock is holding firm, and it's showing bullish inside action relative to some big daily moves over the past week.

Given extraordinary gains since late May, is it perhaps time to take some profits off the table? After all, the May rally carries theelements of a climax run. Or is it a buy now?

This story examines the fundamental, technical and fund ownership factors to determine if the Leawood, Kan., company scores a good probability of making money for stock traders.

Consider this stat: Prior to Wednesday's giant gain, over just five sessions of trade (May 24 to 28), AMC obliterated the short sellers by rising as much as 203% to Friday's intraday peak of 36.72. AMC stock almost finished up 100% or more for a second straight week. Incredible.

Following the long Memorial Day holiday weekend, AMC jammed nearly 23% higher Tuesday after the company announced an agreement to sell 8.5 million shares at $27.15 per share to Mudrick Capital. AMC said the proceeds would go toward strategic acquisitions of "additional theatre leases, as well as investments to enhance the consumer appeal of AMC's existing theatres."

Some of that money could also go toward paying down debt.

AMC Stock: Do You Have An Exit Strategy?

Some observers have expressed concern over the company's huge debt load ($5.4 billion in borrowings due one year from now or longer, as of March 31) vs. total assets ($10.5 billion) on the balance sheet.

On May 24, shares rallied more than 13% despite news that its heretofore largest shareholder, China's Wanda Group, has sold most of its remaining shares in AMC.

Earlier this year, WallStreetBets chat-room traders on Reddit joined in unison in buying shares and bullish call options in AMC stock. They did the same in a band of other companies that had been heavily sold short and struggling. If you were watching or tradingGameStop(GME), you likely were also keeping close tabs on AMC Entertainment.

Are The Shorts Covering AMC Stock?

When a stock shows ahigh level of short interestand is getting bid up, you can almost count on a chain reaction of buying to occur. Why? Short sellers, betting on a decline in the stock, often have to do an about-face. They cover their short position by buying back shares.

According to the latest data analyzed byMarketSmith, theshort interest— or shares sold short by individual and professional investors — is currently 0.7 times AMC stock's daily average volume of 132 million shares, or roughly 92 million shares. That's equivalent to 20% of the stock's entire float — huge. However, that amount may be skewed by the dramatic rise in daily share turnover.

Still, short sellers had clearly been betting big on a future decline.

TheInvestor's Business Daily teamwill keep close watch for any signs that short interest has dropped lately.

Since late January, AMC stock has followed an extreme zigzag path. Just two weeks after that 20.36 peak, AMC crashed. Shares fell to as low as 5.26. Then came a huge second wave of buying, sending shares back in the low teens.

Week to week, the stock (pumping its market value back up to $25 billion, 450.3 million shares outstanding and a float of 441.3 million) has lately seen its overall price range narrow. That's good as thenew base formed.

Will AMC Stock Keep Rallying In The Long Term?

In 2020, AMC lost $16.15 a share. Over the past five quarters, the company's sales have shrunk 22% to as much as 99% vs. year-ago levels. Such results would normally devastate most companies.

But as movie theaters open across the country and boost seating capacity, Wall Street is banking on a tremendous rebound in the top line.

Analysts polled by FactSet offer a consensus estimate of $375 million in second-quarter sales, up 1,884% from a minuscule $18.9 million in the year-ago quarter. Then they see sales rising an additional 561% in Q3 to $790 million and 575% in Q4 to $1.1 billion.

Wall Street expects net losses of $3.33 a share for 2021, a far cry from the unadjusted $39.15 it lost last year. And the Street sees net losses shrinking further in 2022, to 96 cents a share. Both estimates have gotten revised slightly upward, a bullish sign.

With big sales expected to arrive, you can expect cash flows to greatly improve.

Key IBD Ratings

The last time AMC paid a dividend came on March 23, 2020, at 3 cents per common share. If the company were to resume this cash payout, shareholders could attain an annualized 0.9% yield at the current price near 14 a share.

For now, AMC scores poorly in many of IBD's proprietary ratings. Headed into Monday's trading, they include a 22Earnings Per Share Ratingon a scale of 1 to 99; an E for Sales + Profit Margins + Return on Equity (SMR) Rating; and a 56Composite Ratingon a scale of 1 (wizened) to 99 (wizardly).

Meanwhile, AMC's movies industry group ranks in the top half of IBD's197 industry groupsin terms of six-month relative performance. Decent, but not outstanding. Mutual funds owning a stake in AMC rose to 203 at the end of March vs. 186 in Q4 of 2020. Some portfolio managers are eager to accumulate shares.

AMC Stock Forecast

When choosing growth stocks for the biggest potential gains based on theCAN SLIM investment paradigm, your chances of finding a true market leader improve when you focus on those with aComposite Ratingof 90 or higher. Shooting for a 95 or higher, particularly at the start of a new bull market, is even better.

However, given that AMC stock is a turnaround play, it makes sense to place more emphasis on relative strength. AMC has that in spades.

A 99Relative Strength Ratingon a scale of 1 to 99 means that the company has outperformed 99% of all stocks in the IBD database. Strong long-term performance? Indeed.The Accumulation/Distribution Rating, meanwhile, has jumped to a best-possible A+ grade on a scale of A to E.

Plus, notice on the weekly chart and inMarketSmith, how therelative strength linehas been vaulting.

The RS line, drawn in blue, compares a stock or ETF's moves vs. the S&P 500.

When a stock breaks out of anew base, prefer to see the RS line also running to new high ground. This means that a stock is now outperforming the general market.

In essence, AMC created a boxy cup-like base over the past two months. That's plenty of time for asolid cup patternto form. This pattern produces aproper buy pointof 10 cents above the cup's left-side peak of 14.54 on March 18. So in AMC stock's case, thecorrect entrystood at 14.64. You want to see heavy volume on the breakout.

Conclusion: Is It A Buy Now? Or A Sell?

In effect,AMC stockhas staged astrong breakouttwice last week.

First, AMC had to surpass 14.64 before becoming a new buy. The May 18 attempt was short-lived. However, a 20% gain on May 25 sent shares zooming past theproper buy point.

The5% buy zonegoes up to 15.37, so the stock quickly got extended.

As always, control your risk. Not all breakouts work, especially when thestock market uptrend is under pressure. The best time to buy? When IBD notes the stock market in aconfirmed uptrend, it signifies that buying demand is healthy among institutional investors.

In stock investing, you want the wind at your back, not in your face.

Last month, this story suggested keeping a close eye on how AMC stock handles potential upside resistance near 20. In fact, the action since that incredible week ended Jan. 29 could also be viewed as adeep cup pattern. From that vantage point, AMC delivered a second breakout, surpassing a new 20.46buy pointwith fury.

To get this additional entry in acup without handle, simply add 10 cents to the cup's left-side high — in this case, 20.36. On May 27, shares rifled past this entry and has not looked back. Still, with gains of as much as 501% in just two weeks, it makes sense to lock in at least partial profits.

And after you buy any stock with solid prospects,don't forget the golden rule of investing. Keeping your losses small keeps you in the investing game for the long haul.

Yet at this point, AMC is sharply extended from anIBD-style entry point. Keep watching to see if a new base will form; this could set up a new breakout opportunity.

Comments