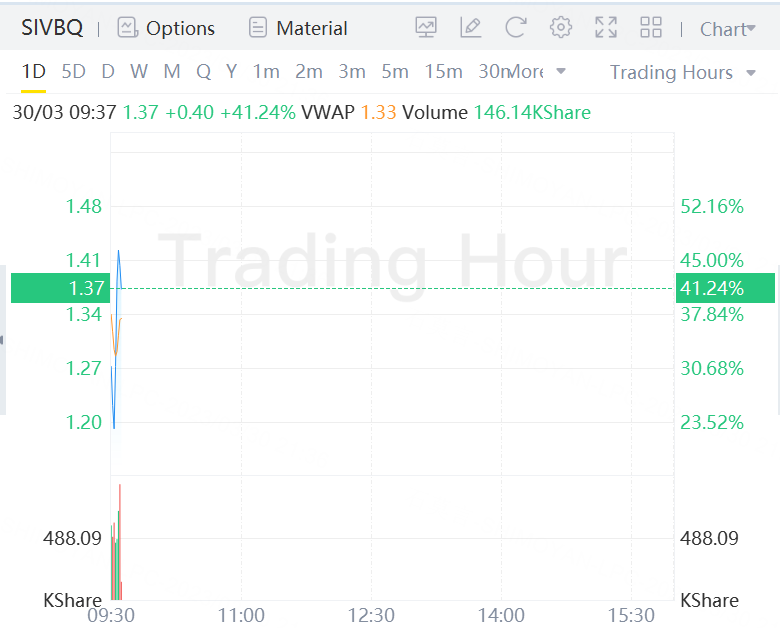

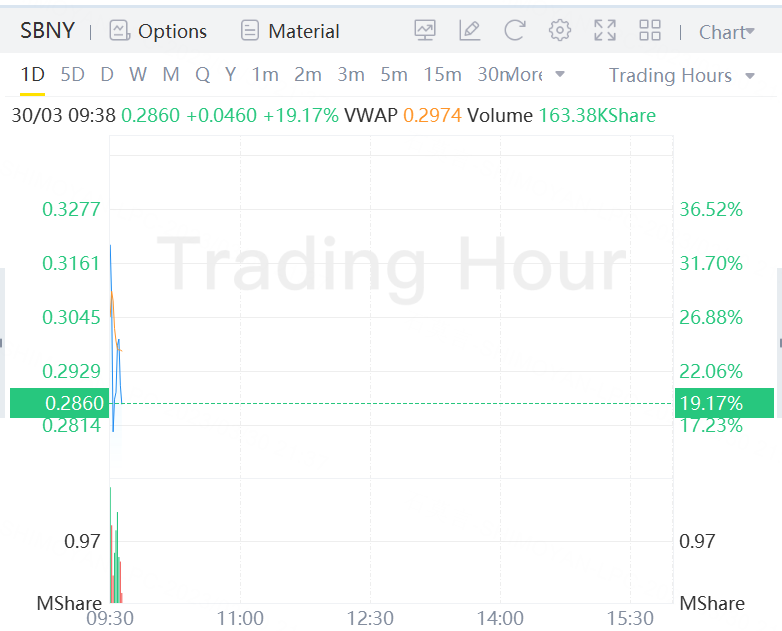

SVB Financial Group surges 42% in morning trading, while Signature Bank soars 19%.

As you can see, Silicon Valley Bank is now trading with a slightly different symbol that its previous SIVB. That’s probably a wise move when we consider the negative stigma that the company will forever carry with it. However, Signature Bank still uses the ticker that it traded under on the New York Stock Exchange.

Moving from the Nasdaq or NYSE to OTC will be viewed as a downgrade by many investors. But consider everything that has happened to Silicon Valley Bank. It is astounding that the company is allowed to trade at all.

That said, trading over the counter seems the best-case scenario for these delisted bank stocks. Companies typically move to an OTC exchange when they are unable to satisfy the cash and regulatory requirements to list on a major exchange. When a company indicates that it may be in danger of delisting from the NYSE or Nasdaq, it tends to spook investors. However, for a company like Silicon Valley Bank, being allowed to trade anywhere seems like progress.

Given the low levels at which both OTC stocks are trading, it will likely be a long time before either one is even close to their pre-crash prices. It is possible that SIVBQ may never, as the company may not be able to restore investor confidence.

Silicon Valley Bank is tradable again, but that doesn’t mean the company will succeed again. As of now, this news really just means that investors have the opportunity to finally offload their SIVB shares, should they choose to.

Comments