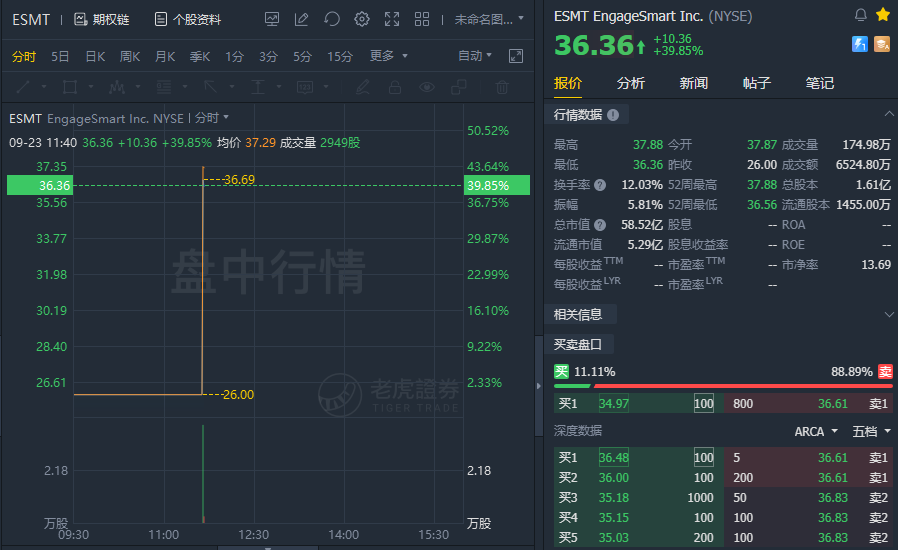

(Sept 23) EngageSmart Inc. opens for trading at $37, up about 43.6% from IPO price.

Company

Braintree, Massachusetts-based EngageSmart was founded to develop a platform that improves customer engagement tailored for certain industry verticals.

Management is headed by founder and CEO Robert P. Bennett, who has been with the firm since inception and was previously president of Sage Payment Solutions.

The company's primary offerings include:

- SimplePractice - Wellness

- InvoiceCloud - Government, Utilities and Financial Services

- HealthPay24 - Healthcare

- DonorDrive - Non-profit and Corporate Fundraising

EngageSmart has received at least $451 million in equity investment from investors including General Atlantic and Summit Partners.

Customer Acquisition

The firm pursues both large enterprise customers and SMB customers via its direct sales force and online service.

As of June 30, 2021, the firm had served over 68,000 clients in the SMB market and more than 3,000 customers in its Enterprise Solutions segment.

Selling and Marketing expenses as a percentage of total revenue have dropped as revenues have increased, as the figures below indicate:

Selling and Marketing |

Expenses vs. Revenue |

Period |

Percentage |

Six Mos. Ended June 30, 2021 |

32.4% |

2020 |

33.1% |

2019 |

43.1% |

Source: SEC

The Selling and Marketing efficiency rate, defined as how many dollars of additional new revenue are generated by each dollar of Selling and Marketing spend, dropped slightly to 1.1x in the most recent reporting period, as shown in the table below:

Selling and Marketing |

Efficiency Rate |

Period |

Multiple |

Six Mos. Ended June 30, 2021 |

1.1 |

2020 |

1.3 |

Source: SEC

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

ESMT's most recent calculation was 64% as of June 30, 2021, so the firm is performing well in this regard, per the table below:

Rule of 40 |

Calculation |

Recent Rev. Growth % |

59% |

EBITDA % |

5% |

Total |

64% |

Source: SEC

The firm's dollar-based net revenue retention rate for the year ended December 31, 2020, was 124%, a strong result.

The dollar-based net revenue retention rate metric measures how much additional revenue is generated over time from each cohort of customers, so that a figure over 100% means that the company is generating more revenue from the same customer cohort over time, indicating good product/market fit and efficient sales and marketing efforts.

Market & Competition

According to a 2021 marketresearch reportby Mordor Intelligence, the global market for customer engagement solutions was an estimated $15.5 billion in 2020 and is forecast to reach $30.9 billion by 2026.

This represents a forecast CAGR of 12.65% from 2021 to 2026.

The main drivers for this expected growth are a growth in technology solutions to improve the customer journey via any device they use to connect with businesses.

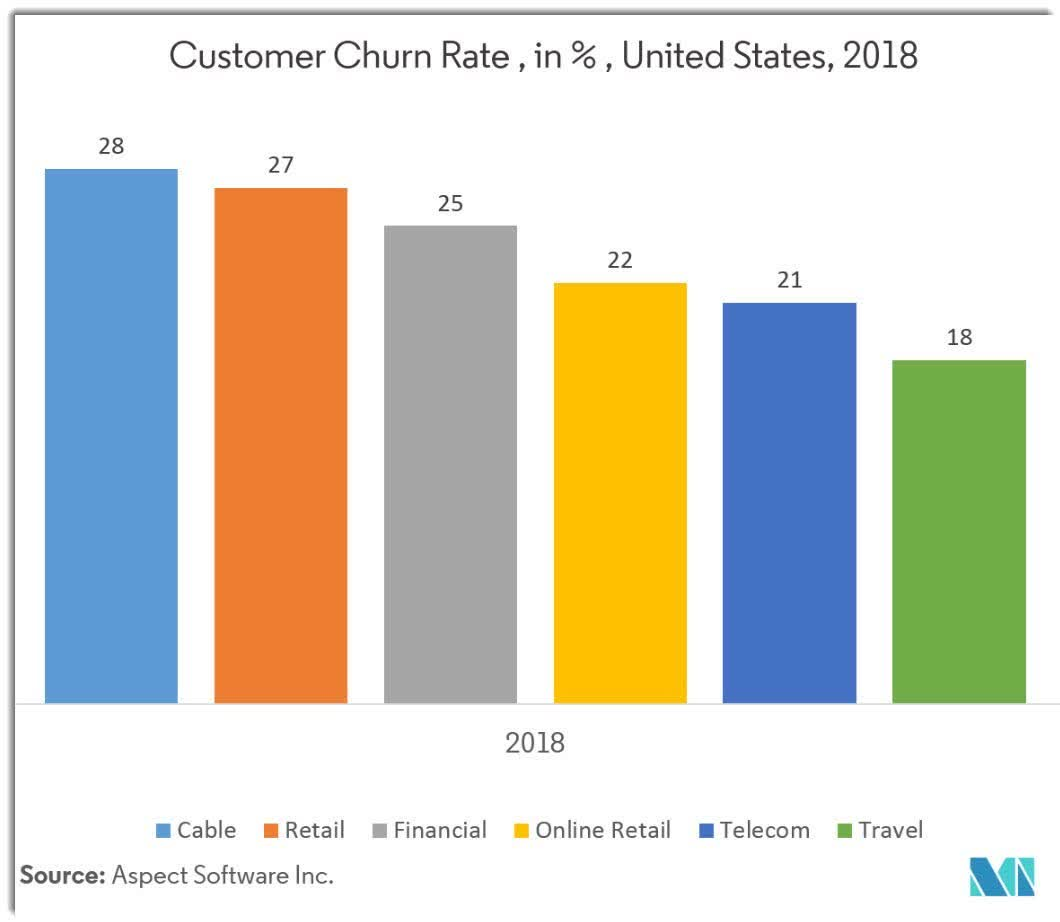

Also, a desire to reduce customer churn rate results in improved business financials and growing valuation.

Below is a chart showing the variation in customer churn rates in different industries in the U.S. in 2018:

IBM(NYSE:IBM)

Microsoft(NASDAQ:MSFT)

Nuance(NASDAQ:NUAN)

Oracle(NYSE:ORCL)

Salesforce(NYSE:CRM)

Avaya(NYSE:AVYA)

Calabrio

Aspect Software

Genesys

Verint Systems(NASDAQ:VRNT)

NICE Ltd.(NASDAQ:NICE)

OpenText

Pegasystems(NASDAQ:PEGA)

Others

Financial Performance

EngageSmart's recent financial results can be summarized as follows:

Growing topline revenue

Increasing gross profit and high gross margin

Growing operating profit and net income

Increasing cash flow from operations

Below are relevant financial results derived from the firm's registration statement:

Total Revenue |

||

Period |

Total Revenue |

% Variance vs. Prior |

Six Mos. Ended June 30, 2021 |

$ 99,171,000 |

58.6% |

2020 |

$ 146,557,000 |

77.8% |

2019 |

$ 82,432,000 |

|

Gross Profit (Loss) |

||

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

Six Mos. Ended June 30, 2021 |

$ 73,673,000 |

61.4% |

2020 |

$ 108,964,000 |

89.2% |

2019 |

$ 57,591,000 |

|

Gross Margin |

||

Period |

Gross Margin |

|

Six Mos. Ended June 30, 2021 |

74.29% |

|

2020 |

74.35% |

|

2019 |

69.86% |

|

Operating Profit (Loss) |

||

Period |

Operating Profit (Loss) |

Operating Margin |

Six Mos. Ended June 30, 2021 |

$ 5,001,000 |

5.0% |

2020 |

$ 648,000 |

0.4% |

2019 |

$ (50,398,000) |

-61.1% |

Net Income (Loss) |

||

Period |

Net Income (Loss) |

|

Six Mos. Ended June 30, 2021 |

$ 274,000 |

|

2020 |

$ (6,678,000) |

|

2019 |

$ (53,598,000) |

|

Cash Flow From Operations |

||

Period |

Cash Flow From Operations |

|

Six Mos. Ended June 30, 2021 |

$ 12,044,000 |

|

2020 |

$ 19,645,000 |

|

2019 |

$ (1,427,000) |

|

(Glossary Of Terms) |

Source: SEC

As of June 30, 2021, EngageSmart had $31.8 million in cash and $151.8 million in total liabilities.

Free cash flow during the twelve months ended June 30, 2021, was $25.2 million.

IPO Details

ESMT intends to sell 13 million shares and selling shareholders will offer 1.55 million shares of common stock at a proposed midpoint price of $24.00 per share for gross proceeds of approximately $349 million, not including the sale of customary underwriter options.

New potential investor Dragoneer Investment Group has indicated an interest to purchase 2.1 million shares of the offering or about $50.4 million at the proposed midpoint price.

Assuming a successful IPO at the midpoint of the proposed price range, the company's enterprise value at IPO (ex- underwriter options) would approximate $3.7 billion.

Excluding effects of underwriter options and private placement shares or restricted stock, if any, the float to outstanding shares ratio will be approximately 9.04%. A figure under 10% is generally considered a 'low float' stock which can be subject to significant price volatility.

Per the firm's most recent regulatory filing, it plans to use the net proceeds as follows:

We expect to use the net proceeds of this offering to repay in full the outstanding borrowings of approximately $114.2 million under our Credit Facilities. We currently intend to use the remaining net proceeds from this offering for general corporate purposes, including to fund our growth, acquire complementary businesses, products, services, or technologies, working capital, operating expenses, and capital expenditures.

Source: SEC

Management's presentation of the company roadshow isavailable here.

Regarding outstanding legal proceedings, management did not disclose any legal claims against the firm as of the regulatory filing date.

Listed underwriters of the IPO are JPMorgan, Goldman Sachs, BofA Securities, and other investment banks.

Valuation Metrics

Below is a table of the firm's relevant capitalization and valuation metrics at IPO, excluding the effects of underwriter options:

Measure [TTM] |

Amount |

Market Capitalization at IPO |

$3,862,956,720 |

Enterprise Value |

$3,656,695,720 |

Price / Sales |

21.09 |

EV / Revenue |

19.96 |

EV / EBITDA |

377.37 |

Earnings Per Share |

$0.00 |

Float To Outstanding Shares Ratio |

9.04% |

Proposed IPO Midpoint Price per Share |

$24.00 |

Net Free Cash Flow |

$25,236,000 |

Free Cash Flow Yield Per Share |

0.65% |

Revenue Growth Rate |

58.59% |

Source: SEC

As a reference, a potential public comparable would be NICE Ltd.; shown below is a comparison of their primary valuation metrics:

Metric |

Nice Ltd. |

EngageSmart |

Variance |

Price / Sales |

11.01 |

21.09 |

91.5% |

EV / Revenue |

10.67 |

19.96 |

87.1% |

EV / EBITDA |

41.73 |

377.37 |

804.3% |

Earnings Per Share |

$3.05 |

$0.00 |

-100.0% |

Revenue Growth Rate |

5.3% |

58.59% |

1003.34% |

(S-1/A andSeeking Alpha)

Commentary

ESMT is seeking public investment to pay down debt and for its general unspecified corporate growth plans.

The firm's financials show strong topline revenue growth and gross profit growth, operating profit and a swing to slight net profit along with growing cash flow from operations.

Free cash flow for the twelve months ended June 30, 2021, was a solid $25.2 million.

Selling and Marketing expenses as a percentage of total revenue have dropped as revenue has increased and its Selling and Marketing efficiency rate dropped to 1.1x in the most recent six-month reporting period.

The company's Rule of 40 performance was excellent and its dollar-based net revenue retention rate for the year ended December 31, 2020, was 124%, a strong result.

The market opportunity for providing customer engagement software to businesses is large and expected to double in size by the end of 2026, so the company will be helped by strong industry growth dynamics.

JPMorgan is the lead left underwriter and IPOs led by the firm over the last 12-month period have generated an average return of 20.4% since their IPO. This is a mid-tier performance for all major underwriters during the period.

The primary risk to the company's outlook is the ability for larger firms to bundle some of their services into their existing offerings, resulting in downward pricing pressure and greater competition.

As for valuation, compared to partial competitor NICE, ESMT is growing revenue much faster and so its much higher revenue multiples would appear to be justified.

Also, the company is growing much faster than competitor Pegasystems, so seems to be taking market share from these and other companies in the customer engagement market.

Given the firm's strong growth and operating metrics versus its competitors, while the IPO isn't cheap, it is worth consideration.

Comments