Stock futures fell on Thursday after the latest GDP reading showed a slight decrease while investors continued to digest the Federal Reserve’s latest monetary policy decision.

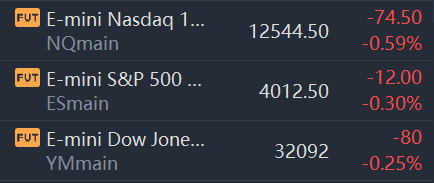

Futures tied to the Dow Jones Industrial Average slipped 80 points, or 0.2%. S&P 500 futures lost 0.3%, and Nasdaq 100 futures dropped 0.59%. All of the major averages are still on pace for a winning week and their best month of 2022.

The moves come on the heels of abroad-based rallyWednesday after the Fed’s latest monetary policy decision, as investors continued to bet on whether the central bank can halt surging prices without pushing the economy into a recession.

Following the rate hike from the Fed, DoubleLine Capital’s CEO Jeffrey Gundlach told CNBC’s “Closing Bell Overtime” he believes the central bank isno longer behind the curve on inflationand Powell has regained credibility.

“This market reaction seems less of a sugar high than the prior two in June and May,” Gundlach said.

The Dow jumped more than 400 points in the previous session, while the S&P 500 and Nasdaq Composite added 2.6% and 4.06%, respectively.

All S&P 500 sectors ended the day higher, with communications services posting its best daily performance since April 2020.

“For the most part, what’s really driving this move is that the economy is still performing okay and it looks like the Fed is probably going to slow the pace of tightening down by the next policy meeting,” said Ed Moya, Oanda’s senior market analyst.

Investors have grown increasingly concerned in recent months that the central bank’s attempts to tame surging prices would move the economy closer to a recession, if it hasn’t already entered one.

Fed Chair Jerome Powell on Wednesday said during a press conference hedoes not believe the economy has entered a recession.

“I do not think the U.S. is currently in a recession and the reason is there are too many areas of the economy that are performing too well,” he said.

Investors looking for further clues into the state of the economy are awaiting a reading on second-quarter GDP slated for Thursday. While two back-to-back negative quarters of growth is viewed by many as a recession, the official definition ismore nuanced, taking into account additional factors, according to the National Bureau of Economic Research.

Economists surveyed by Dow Jones expect the economyto have barely expanded last quarterafter contracting 1.6% in the first.

On the earnings front, investors are looking ahead to results from Apple, Amazon, Intel and Roku slated for after the bell.

Comments