The U.S. stock market should be given the benefit of the doubt over the next 12 months, according to an analysis of short sellers’ recent transactions.

This upbeat message may incline you to view short sellers more positively. They’ve never had a particularly good reputation, since many believe — I think wrongly — that there’s something untoward about betting that a stock’s price will go down.

For this column, I’m not interested in short-sellers’ integrity and virtue (or lack thereof). My focus instead is on whether their behavior can be used to time the market.

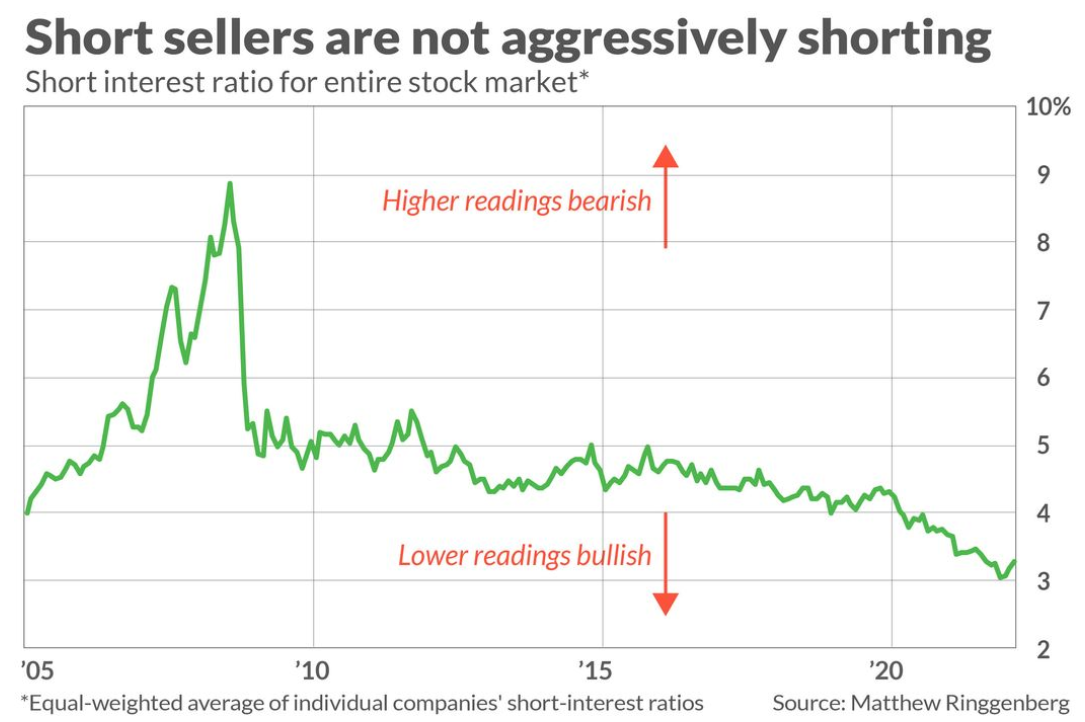

The answer is a resounding yes, according to research conducted by Matthew Ringgenberg, a finance professor at the University of Utah and one of academia’s leading experts on short selling. In research published in the Journal of Financial Economics in 2016, he reported that “short interest is arguably the strongest known predictor of aggregate stock returns.”

In an interview earlier this week, Ringgenberg added that short interest for the most part has continued to do an admirable job in the six years since his research was published. A year ago I reported that Ringgenberg’s data was bullish for the subsequent 12 months: “Short-selling may be helping to keep the bull market alive,” I wrote.

What’s more noteworthy is the contrast with how short sellers behaved leading up to and during 2008’s Great Financial Crisis (GFC). As you can see from the chart, they became increasingly bearish over a couple of years prior to the GFC, and became even more bearish in the first months of 2008, just as the bear market was beginning. It’s a relief that the short sellers are not reacting in the same way now. The “short seller data do not support an expectation of a bear market,” Ringgenberg said.

At the same time, it should be noted that short sellers haven’t reacted to the market’s recent selloff by becoming significantly more bullish. So the market outlook hasn’t gotten any better either.

Ringgenberg summed up the current message of the short sellers: “The market over the next 12 months is likely to behave much as it has in recent years.”

Comments