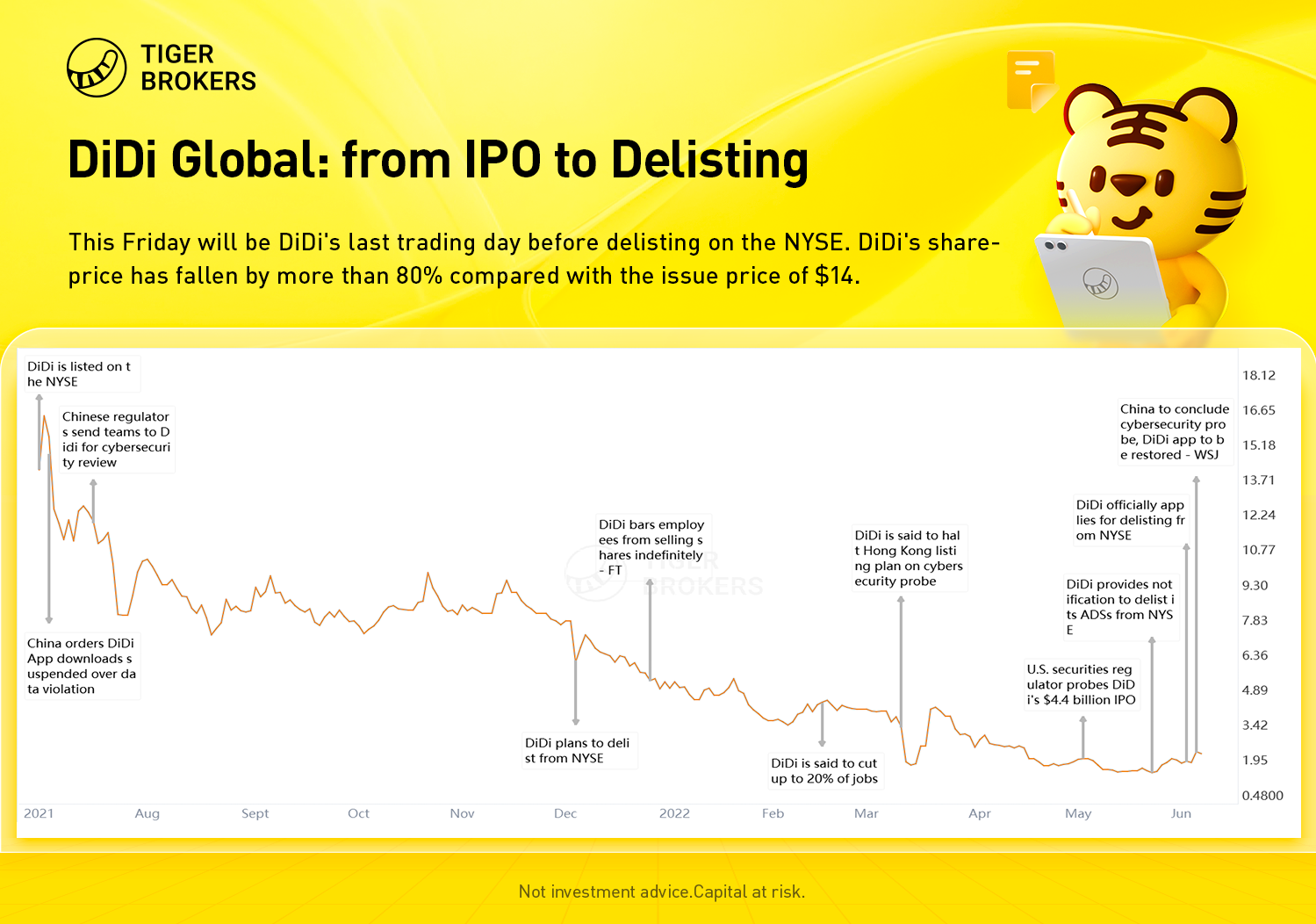

This Friday will be DiDi's last trading day before delisting on the NYSE. DiDi's share price has fallen by more than 80% compared with the issue price of $14.

Timeline:

June 30, 2021: DiDi is listed on the NYSE;

July 4, 2021: China orders DiDi app downloads suspended over data violation;

July 16, 2021: Chinese regulators send teams to DiDi for cybersecurity review;

December 3, 2021: DiDi announced that the company would immediately start delisting on the New York Stock Exchange and start preparations for listing in Hong Kong;

December 10, 2021: China's DiDi plans to hire Goldman for Hong Kong listing, U.S. delisting -sources;

December 28, 2021: DiDi bars employees from selling shares indefinitely - FT;

December 30, 2021: DiDi revenue fallsas China's regulation hits business;

February 10, 2022: Tencent owned 78.85 million of DiDi’s Class A shares as of Dec. 31, up from 77.07 million shares disclosed at the time of the IPO, the filing showed. Tencent’s Class A shareholding stood at 7.4% as of the end of December.

February 14, 2022: DiDi is said to cut up to 20% of jobs before Hong Kong listing;

March 10, 2022: DiDi is said to halt Hong Kong listing plan on cybersecurity probe;

April 18, 2022: DiDi revenue declines 12.7% in Q4;

May 3, 2022: U.S. securities regulator probes DiDi Global's $4.4 billion IPO;

May 23, 2022: DiDi investors to vote on NY delisting;

May 27 and 29, 2022: DiDi is said to draw China FAW’s interest in buying stake, FAW response: false information;

June 2, 2022: DiDi officially applies for delisting from NYSE;

June 6, 2022: China to conclude cybersecurity probe, DiDi app to be restored - WSJ.

Comments