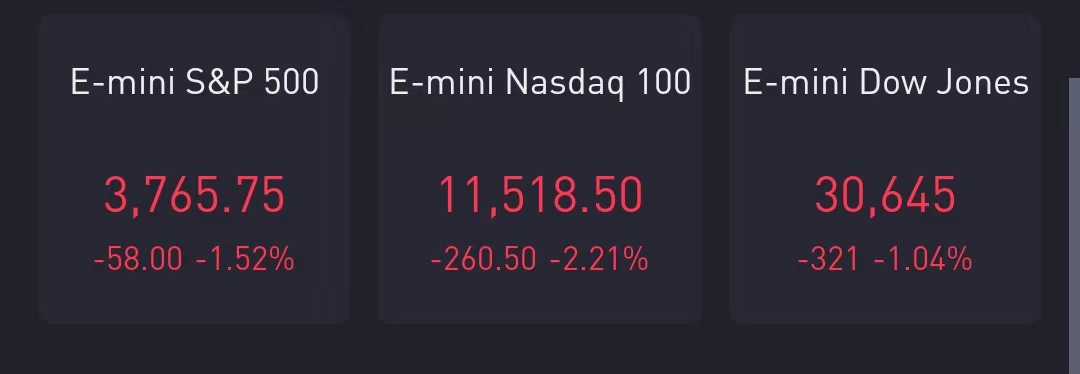

U.S. Stock futures crashed sharply Wednesday after showing inflation datas.

Market Snapshot

At 8:35 a.m. ET, Dow e-minis were down 321 points, or 1.04%, S&P 500 e-minis were down 58 points, or 1.52%, and Nasdaq 100 e-minis were down 260.5 points, or 2.21%.

Pre-Market Movers

Delta Air Lines – Delta shares slid 2.9% in the premarket after reporting a mixed quarter. The airline earned an adjusted $1.44 per share for the second quarter, shy of the $1.73 consensus estimate. Revenue exceeded estimates on strong travel demand, but margins took a hit from higher fuel prices and higher operational costs.

Twitter – Twitter added 2% in premarket trading after the company sued Elon Musk to force him to adhere to the terms of their $44 billion takeover. Musk said earlier this week he was backing out of the deal, alleging that Twitter had violated the terms of their agreement.

Snap Inc – The social media company is set to introduce a feature that would allow NFT artists to showcase their designs on Snapchat, according to people familiar with the situation who spoke to the Financial Times. Snap initially rose 1.7% in premarket action before paring those gains.

Stitch Fix Inc. – The clothing styler’s shares rallied 9.5% in the premarket following news that Benchmark Capital’s Bill Gurley bought one million shares. Gurley paid an average of $5.43 per share, according to an SEC filing. Gurley, who serves on the Stitch Fix board, already owned 1.22 million shares prior to the latest purchase.

Unity Software Inc. – The provider of interactive software technology announced an all-stock merger agreement with ironSource(IS), an Israel-based software publisher. The transaction values ironSource at approximately $4.4 billion. Unity also announced it was cutting its full-year revenue guidance. Unity slumped 8.2% in premarket trading, while ironSource soared 57%.

Novavax – The drug maker’s stock added 2.4% in premarket action after Politico reported the company’s Covid-19 vaccine could receive FDA approval as soon as today.

DigitalOcean Holdings, Inc. – The cloud computing company’s stock received a double-downgrade at Goldman Sachs, which cut its rating to “sell” from “buy.” Goldman’s move is based on expectations of softening demand, especially in international markets, as well as fading tailwinds in segments that have done well over the past 12 to 18 months. DigitalOcean fell 3.5% in the premarket.

Gap – The apparel retailer’s stock fell 1.3% in the premarket as Deutsche Bank downgrades the stock to “hold” from “buy.” Deutsche Bank said there is little visibility about a sales recovery at Old Navy, as well as concern about an elevated level of promotions at both Gap and Old Navy. The stock fell 5% Tuesday following news that CEO Sonia Syngal was stepping down.

Fastenal – The maker of industrial fasteners saw its stock slide 7% in premarket trading after it said it saw signs of softening demand in May and June. Fastenal’s comments came as it reported quarterly numbers that were generally in line with analyst forecasts.

Market News

Ive and Apple have agreed to stop working together, putting an end to a three decade run for Ive. Ive, whose work at Apple (AAPL) resulted in him being knighted for his design work and patents, signed a deal in 2019 to start his own design firm LoveFrom, with Apple (AAPL) as its primary client.

Twitter wants a lightning-quick trial to resolve its claim that billionaire Elon Musk wrongfully canceled his proposed $44 billion buyout of the social-media platform.

Unity Software Inc. and ironSource (IS) on Wednesday agreed to merge in all-stock transaction that values the Israeli systems software company at about $4.4 billion.

Delta Air Lines missed estimated earnings by 12.2%, reporting an EPS of $1.44 versus an estimate of $1.64.Revenue was up $6.70 billion from the same period last year.

UBS Group AG on Tuesday named Iqbal Khan the sole head of the Swiss bank's global wealth management division in an executive board reshuffle.Khan, who joined Switzerland's biggest bank in 2019 to co-head its flagship division, will take over when co-president Tom Naratil steps down in October after decades with the bank.

OPEC expects global oil demand to rise in 2023 but at a slower pace than 2022, the producer group said in its first forecast for next year, citing still robust economic growth and progress in containing COVID-19 in China.

The U.S. Treasury on Tuesday said it was seeking comment on the on the risks and opportunities posed by digital assets as it seeks to prepare a report for President Joe Biden on the implications of developments such as cryptocurrencies.

The Federal Reserve is ignoring signs of deflation as it continues its aggressive interest rate-hike plan to combat inflation and will soon be forced to make a dovish pivot, star stock picker Cathie Wood of Ark Invest said in a webinar on Tuesday.

Comments