U.S. Stock futures continued to rise in pre-market trading Friday after an up day on Wall Street that saw all three major indexes close sharply higher as investors further mulled the path forward for interest rates and a host of new sanctions against Russia.

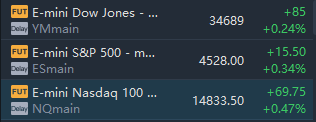

Market Snapshot

At 7:50 a.m. ET, Dow e-minis were up 85 points, or 0.24%, S&P 500 e-minis were up 15.5 points, or 0.34%, and Nasdaq 100 e-minis were up 69.75 points, or 0.47%.

Pre-Market Movers

Cannabis stocks – Shares of marijuana producers are extending a Thursday rally in the premarket, following an industry publication’s report that the House will vote for a second time next week to legalize cannabis at the federal level. The House passed such a bill in 2020, but the Senate did not follow suit.Tilray(TLRY) surged 14.1% in the premarket,Aurora Cannabis(ACB) jumped 10.2%,Sundial Growers(SNDL) soared 12% and Canopy Growth(CGC) rallied 9.6%.

Bed Bath & Beyond – Bed Bath & Beyond is close to reaching a settlement with investor Ryan Cohen, according to people familiar with the matter who spoke to Bloomberg. The agreement would see three new directors appointed to the housewares and personal care products retailer’s board. Cohen’s RC Ventures holds a 9.8% stake in Bed Bath & Beyond. The stock added 1.4% in premarket trading.

NIO Inc. - Nio shares fell 5.1% in premarket action after the China-based electric car maker reported better-than-expected quarterly sales but saw deliveries fall below analyst estimates.

The Honest Company, Inc. – Honest Company posted a wider-than-expected quarterly loss as sales of masks and sanitizing products dropped significantly. It also issued guidance for the current quarter that was weaker than expected. Shares slumped 19.5% in the premarket.

Shaw – Shaw’s shares added 2% in premarket trading after Canadian regulators gave conditional approval to a $16 billion takeover of Shaw’s broadcasting services by Canadian telecom giant Rogers Communications(RCI).

U.S-listed China stocks – These stocks continue to be volatile amid concerns about tighter regulation by Chinese authorities and potential U.S. delistings.Alibaba(BABA) lost 3.4% in premarket action, withJD.com(JD) losing 4.2%,Pinduoduo(PDD) sliding 6% and Didi Global(DIDI) falling 7.1%.

Teva Pharmaceutical – Bernstein upgraded the generic drug maker’s stock to “outperform” from “market perform,” noting an improved balance sheet, new product launches and the potential of settling opioid litigation. Teva rallied 4.2% in the premarket.

Switch Inc. – The technology infrastructure company was downgraded to “equal weight” from “overweight” at Wells Fargo Securities, which said a buyout of Switch is possible but the price would likely be no higher than $32 to $34 per share. Switch closed at $30.24 Thursday and dropped 2.2% in premarket trading.

Fortinet – The cybersecurity company’s shares fell 2.1% in the premarket after Bank of America Securities downgraded Fortinet to “neutral” from “buy,” saying strong results are already reflected in the stock’s price.

Market News

European Union officials agreed Thursday on a landmark provisional agreement aimed at clamping down on the biggest online companies, dubbed digital “gatekeepers,” by laying out a list of dos and don’ts.

Larry Fink, CEO and chairman of the world’s biggest asset manager, BlackRock, said Russia’s invasion of Ukraine has upended the world order that had been in place since the end of the Cold War.

The U.S. House of Representatives plans to vote on a bill to federally legalize marijuana for the second time in history next week, congressional leadership confirmed on Thursday. The body will take up the Marijuana Opportunity, Reinvestment and Expungement (MORE) Act, a bill sponsored by House Judiciary Committee Chairman Jerrold Nadler (D-NY).

Electric vehicle battery makers will need to raise prices by almost 25% due to soaring lithium carbonate prices, leading to crimped margins and possibly demand destruction, according to Morgan Stanley.

MEITUAN on Friday reported a better-than-expected 30.6% rise in fourth-quarter revenue, helped by steady growth in its core business. Revenue rose to 49.5 billion yuan ($7.78 billion) in the quarter ended Dec. 31. Analysts on average had expected revenue of 49.20 billion yuan, Refinitiv Eikon data showed.

Volkswagen AG will delay the launch of its ID.5 electric car by a month to the first week of May because of disruptions in the supply of wire harnesses from Ukraine, a spokesperson said on Friday.

The U.S. Federal Aviation Administration (FAA) warned Boeing earlier this week the planemaker may not gain certification of a lengthened version of the 737 MAX ahead of a key safety deadline set by Congress.

GoTo Group, an Indonesian startup giant, raised about $1.1 billion in one of the world’s largest initial public offerings announced since the Ukraine war, pricing the deal near the middle of the range.

Comments