Market Overview

Wall Street's main indexes ended lower on Wednesday as a grim outlook from Target spurred fresh concerns about retailers heading into the crucial holiday season, while semiconductor shares slid after Micron's supply cut.

The Dow Jones Industrial Average fell 0.12%, the S&P 500 lost 0.83%, and the Nasdaq Composite dropped 1.54%.

Regarding the options market, a total volume of 37,323,100 contracts was traded on Wednesday, down 19.81% from the previous trading day.

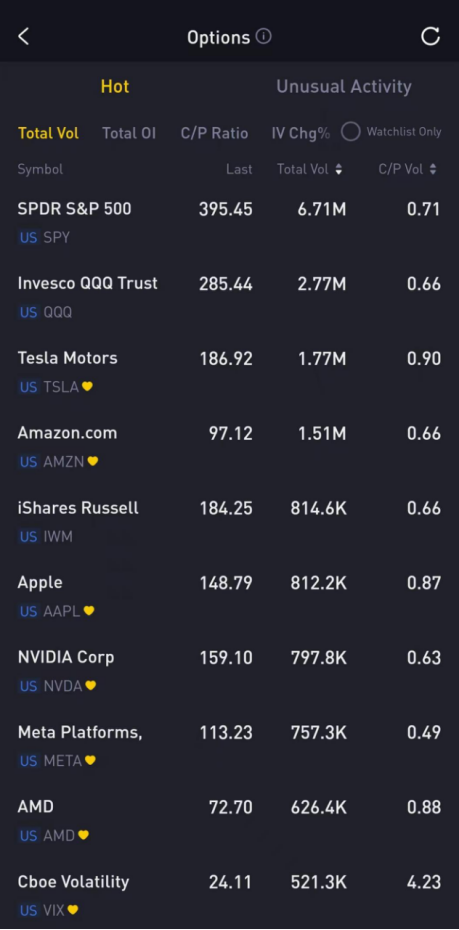

Top 10 Option Volumes

Top 10: SPY, QQQ, TSLA, AMZN, IWM, AAPL, NVDA, META, AMD, VIX

Options related to equity index ETFs are top choices for investors, with 6.71 million SPY and 2.77 million Invesco QQQ Trust options contracts trading on Wednesday.

Total trading volume for SPY and Invesco QQQ Trust slid 33.23% and 21.53%, respectively, from the previous day. 58% of SPY trades bet on bearish options.

Micron Technology slid 6.7% on Wednesday as the company is reducing DRAM and NAND wafer starts by approximately 20% versus fiscal fourth quarter 2022, and the market outlook for calendar 2023 has weakened.

There were 134,300 Micron Technology options trading on Wednesday. Put options account for 61% of overall option trades. Particularly high volume was seen for the $60 strike call option expiring November 18th, with 64,904 contracts trading on Wednesday.

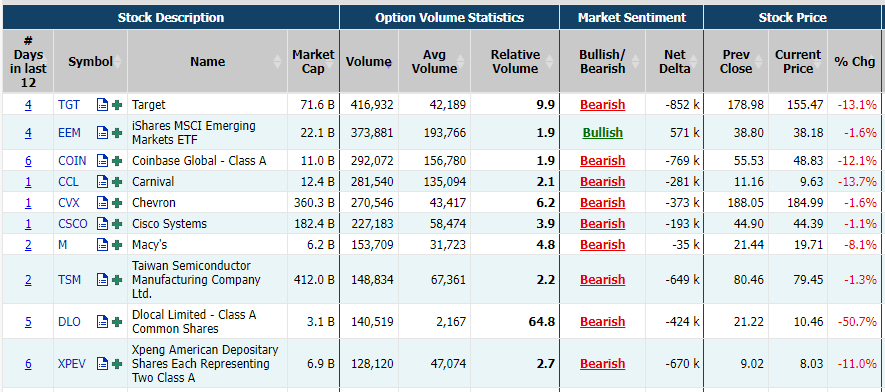

Unusual Options Activity

Target crashed 13.14% on Wednesday after posting its financial results. It said adjusted earnings for the three months ending in October were pegged at $1.54 per share, down 49.2% from the same period last year. Group revenues rose 3.3% to $26.5 billion.

Moreover, it sees a low single-digit decline in same store sales over the holiday quarter, with an overall operating margin of 3%.

There were 417,400 Target options trading on Wednesday, its volumes surged nearly 150% from the previous day. Put options account for53% of overall option trades. Particularly high volume was seen for the $160 strike call option expiring November 18th, with 24,667 contracts trading on Wednesday.

Coinbase Global, Inc. tumbled 12.07% on Wednesday as the company’s CFO Alesia Haas said a fallout of FTX is becoming much more like the 2008 financial crisis where it's exposing poor credit practices and is exposing poor risk management.

It will take a few days or weeks to understand the full contagion of the event, Haas added.

There were 293,000 Coinbase Global, Inc. options trading on Wednesday. Put options account for 68% of overall option trades. Particularly high volume was seen for the $50 strike call option expiring November 18th, with 18,924 contracts trading on Wednesday.

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: SPY, VRM, META, FXI, GSAT, AAPL, LCID, TCOM, EEM, AMZN

Top 10 bearish stocks: HYG, KWEB, XLE, GSK, TGT, SOXL, NVDA, COIN, SLV, XLI

If you are interested in options and you want to:

- Share experiences and ideas on options trading.

- Read options-related market updates/insights.

- Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments