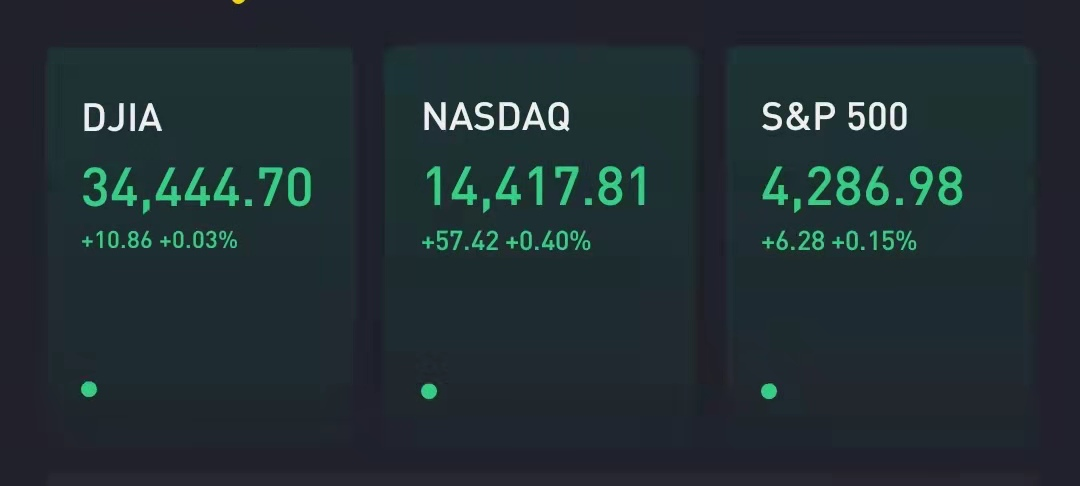

The U.S. stock market was muddled in early trading on Monday, but a strong start for tech stocks pushed the Nasdaq Composite to another record high.

The S&P 500 and The Dow Jones Industrial Average was little changed, while the Nasdaq rose 0.4%.

Tech stocks led in early trading, with shares of Apple and Amazon rising about 1% and Salesforce adding 2%. Aerospace giant Boeing weighed on the Dow, with shares falling 2% after regulators told the company it is not likely to receive certification for its long-range aircraft until at least 2023.

Monday's moves came as Treasury yields retreated across most maturities, with the benchmark 10-year Treasury yield sliding to about 1.49%. Yields move inverse of prices.

Stocks finished their best week in months on Friday as investors are growing more confident the current inflation in the U.S. is not a sustained economic threat, but a temporary uptick.

The S&P 500 ended Friday at a closing record high of 4,280.70, while the Dow rose 237 points. While the Nasdaq Composite closed just lower on Friday, it added 2.35% for the week, its best since April 9 and is up 4.45% for the month of June.

"This is one of the more buoyant markets I've ever seen, and as far as I'm concerned taking money off the table is not advised right now," CNBC's Jim Cramer said on "Squawk on the Street."

The weekly gains came even after the Commerce Department reported that its inflation indicator rose 3.4% in May, the fastest increase since the early 1990s.

Spikes in the core personal consumption expenditures price index can cause heartburn for investors since the Federal Reserve likes to watch it for signs of inflation. Still, the rise actually undershot what economists polled by Dow Jones had forecast and reinforced for investors that the economy-wide price increases are likely to be transient and manageable.

A massive, bipartisan infrastructure deal appeared revitalized as of Sunday evening after President Joe Biden clarified on Saturday thathe doesn’t plan to veto the legislationif it comes without a separate reconciliation bill favored by Democrats. Republican senators then said on Sunday that thedeal can move forward.

The president, flanked by a bipartisan group of senators, declared on Thursday thatthe group had reached a multibillion-dollar dealto improve the nation’s roads, bridges, waterways and broadband after weeks of negotiation. Democrats have been pushing for a second bill that would include funding for issues like climate change, child care, health care and education.

“The bipartisan infrastructure agreement hammered out in Washington DC last week appears to stand some chance of becoming a reality,” wrote John Stoltzfus, chief investment strategist at Oppenheimer Asset Management, in a note. “This program could serve the country near and longer term in generating job creation, boost economic growth, underpin corporate revenue and earnings growth and increase the ability of the US to compete with other nations in the still relatively new but hypercompetitive 21st Century.”

The next major piece of economic datais the June jobs report, which the Labor Department is scheduled to publish on Friday.

Economists are expecting that nonfarm payrolls increased by 683,000 in June. While such a robust reading would top the 559,000 in May, it would still be below the 1 million some had hoped a recovering U.S. economy could post as it emerged from the Covid-19 crisis.

Investors will also pore over the June report for any signs of wage inflation as employers struggle to find workers to fill job openings and pandemic-era jobless benefits taper off in some states.

Comments