ZINGER KEY POINTS

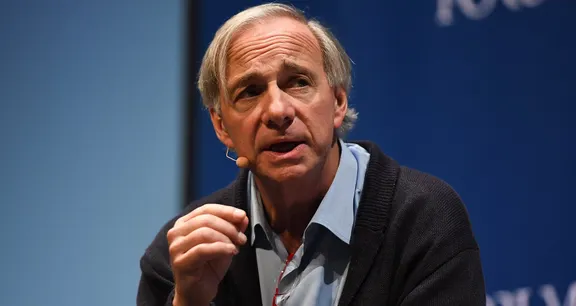

- Ray Dalio-led hedge fund exits Tesla In first quarter

- Bridgewater Associates adds stakes in Nio, Xpeng, Li Auto instead

- More than doubles exposure in Li, Xpeng

Bridgewater Associates, led by billionaire RayDalio, completely exited its position in Tesla Inc in the first quarter and the world’s largest hedge fund significantly doubled down raising exposure in the U.S.- listed Chinese electric vehicle maker Nio, Xpeng Inc and Li Auto Inc instead, regulatory filings showed on Friday.

Pulls Out Of Tesla:The hedge fund sold all of its 25,488 shares that it held in the Elon Musk-led Tesla at a time when shares of the electric vehicle maker traded in volatile territory — at levels as-low-as $766.40 and as high as $1,199.80— in the three months ending March 31.

Despite the volatility, Tesla shares still rose 1.97% in the first quarter to close at $1,077.60 a share on March 31. The stock is down 36% at $769.59 as of Friday’s close.

Scoops Up These Chinese EV Cos:The hedge fund more than doubled stakes in Li Auto and Xpeng while it significantly raised exposure in Nio at a time when shares of the companies have been under pressure.

In Li Auto, the hedge fund bought 1.79 million shares, lifting its exposure by 115.6% quarter-on-quarter to 3.35 million shares in the Beijing-headquartered company.

Li Auto shares fell 19.6% in the first quarter to close at $25.81 a share on March 31. The stock is down 32.5% year-to-date.

Bridgewater bought 2.25 million shares in Nio and 1.08 million shares in Xpeng in the first three months of the year. The new exposure lifted the stake in Nio by 73.5% to 5.32 million shares. The Xpeng stake rose 101.2% during the period to 2.15 million shares.

Nio shares fell 33.5% in the first quarter to close at $21.05 a share, while Xpeng fell 45.2% to $27.6 a share. Shares of the companies are dow 57% and 54.6% respectively so far this year.

Legacy Rivals:The Westport, Connecticut-based hedge fund also raised its exposure in U.S. legacy automakers General Motors Co and Ford Motor.

In GM, Bridgewater bought 28,772 shares, raising its stake by 14.3% to 229,138 shares.

The hedge fund bought 486,840 shares in Ford, lifting its exposure by 28.4% to 2.29 million shares at the end of the first quarter.

GM and Ford shares fell 25.4% and 18.5% in the first quarter.

Comments