U.S. stock index futures enlarged losses on Friday as investors turned cautious after a fresh reading on monthly inflation that could offer clues on further monetary policy tightening by the Federal Reserve.

Key Fed inflation measure rose 0.6% in January, more than expected. The core personal consumption expenditures price index was expected to increase 0.5% from a month ago and 4.4% on an annual basis, according to Dow Jones estimates.

Market Snapshot

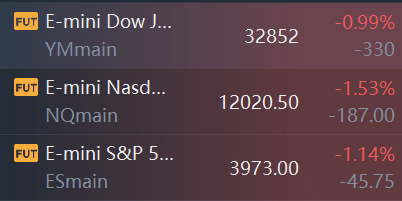

At 8:35 a.m. ET, Dow e-minis were down 330 points, or 0.99%, S&P 500 e-minis were down 45.75 points, or 1.14%, and Nasdaq 100 e-minis were down 187 points, or 1.53%.

Pre-Market Movers

Block (SQ) - The parent company of Square, was rising 5.5% in premarket trading after saying it expected adjusted earnings before interest, taxes, depreciation and amortization of $1.3 billion for the fiscal year, in line with Wall Street estimates.

Boeing (BA) - Boeing declined 3.6% in premarket trading after the aerospace giant halted deliveries of its twin-aisle Dreamliner 787 jets because of a documentation issue.

Carvana (CVNA) - The online used-car seller, was down 13.2% after reporting a wider-than-expected fourth-quarter lossand announcing plans to cut about $1 billion in costs over the next six months. Carvana shares have fallen more than 93% over the past year.

Adobe (ADBE) - The U.S. Justice Department is preparing an antitrust lawsuit to block software maker Adobe Inc's $20 billion bid for cloud-based designer platform Figma, Bloomberg News reported on Thursday, citing people familiar with the matter. Adobe shares dropped 5.4% in premarket trading.

Warner Bros. Discovery (WBD) - Warner Bros. Discovery reported fourth-quarter revenue slightly below expectations and the stock declined 3.4% in premarket trading.

Beyond Meat (BYND) - The plant-based food maker, jumped 12.1% after reporting a narrower-than-expected fourth-quarter loss and issuing stronger-than-expected guidance for the fiscal year.

Hot Chinese ADRs (BABA, JD, PDD, BIDU, NTES) - Hot Chinese ADRs dropped in premarket trading as Alibaba and NetEase's earnings failed to Impress Investors. Alibaba, JD.com and Pinduoduo fell 3%; Baidu fell 4%; NetEase fell 5%.

Farfetch (FTCH) - Farfetch’s year-on-year sales decline continued in the final quarter of 2022 as the luxury e-commerce firm faced sustained geographic challenges in Russia and China. But the company expects new partnerships will help sales grow more than 10 percent in 2023, and reach as high as $10 billion by 2025. The shares jumped 5.1% in premarket trading.

ContextLogic (WISH) - Shares of ContextLogic Inc. fell 13.5% in premarket trading after the mobile e-commerce platform reported a drop in fourth-quarter revenue and said it would reduce its workforce.

MercadoLibre (MELI) - South American e-commerce giant MercadoLibre Inc reported a fourth-quarter net profit of $164.7 million, recovering from a loss a year earlier and beating forecasts on the back of strong growth from its fintech unit. The shares gained 2.9% in premarket trading.

Opendoor Technologies (OPEN) - Real estate platform Opendoor Technologies fell 8.8% after reporting a fourth-quarter loss that was narrower than expected but was down significantly from a year earlier.

Autodesk (ADSK) - Autodesk, which provides design software to architects, engineers and others, fell 6.2% after issuingearnings guidancefor the fiscal first quarter below analysts’ expectations.

Market News

Yellen Says U.S. Inflation Coming Down but Core Measures Remain Elevated

U.S. Treasury Secretary Janet Yellen said on Friday that U.S. inflation was coming down but there was still more work to do to bring it in line with the Federal Reserve's 2% annual target.

Yellen also told reporters on the sidelines of a G20 finance ministers and central bank governors' meeting near the Indian tech hub of Bengaluru that she still believes that a "soft landing" without a recession is possible due to a strong labor market and strong U.S. balance sheets.

JPMorgan's Dimon Says U.S. Interest Rates Could Hit 6%

JPMorgan Chase & Co Chief Executive Jamie Dimon expects U.S. interest rates could hit 6%, he said in an interview with CNBC on Thursday.

The Federal Reserve quickly caught up to out-of-control inflation and would probably pause interest rates at a little over 5%, but they may need to go higher, Dimon told CNBC.

Comments