Wall Street ended down on Tuesday (August 23) as investors focused on data showing a slowing economy ahead of a U.S. Federal Reserve gathering later this week in Jackson Hole, Wyoming. The S&P 500 declined 0.22%, while the Dow declined 0.47%.

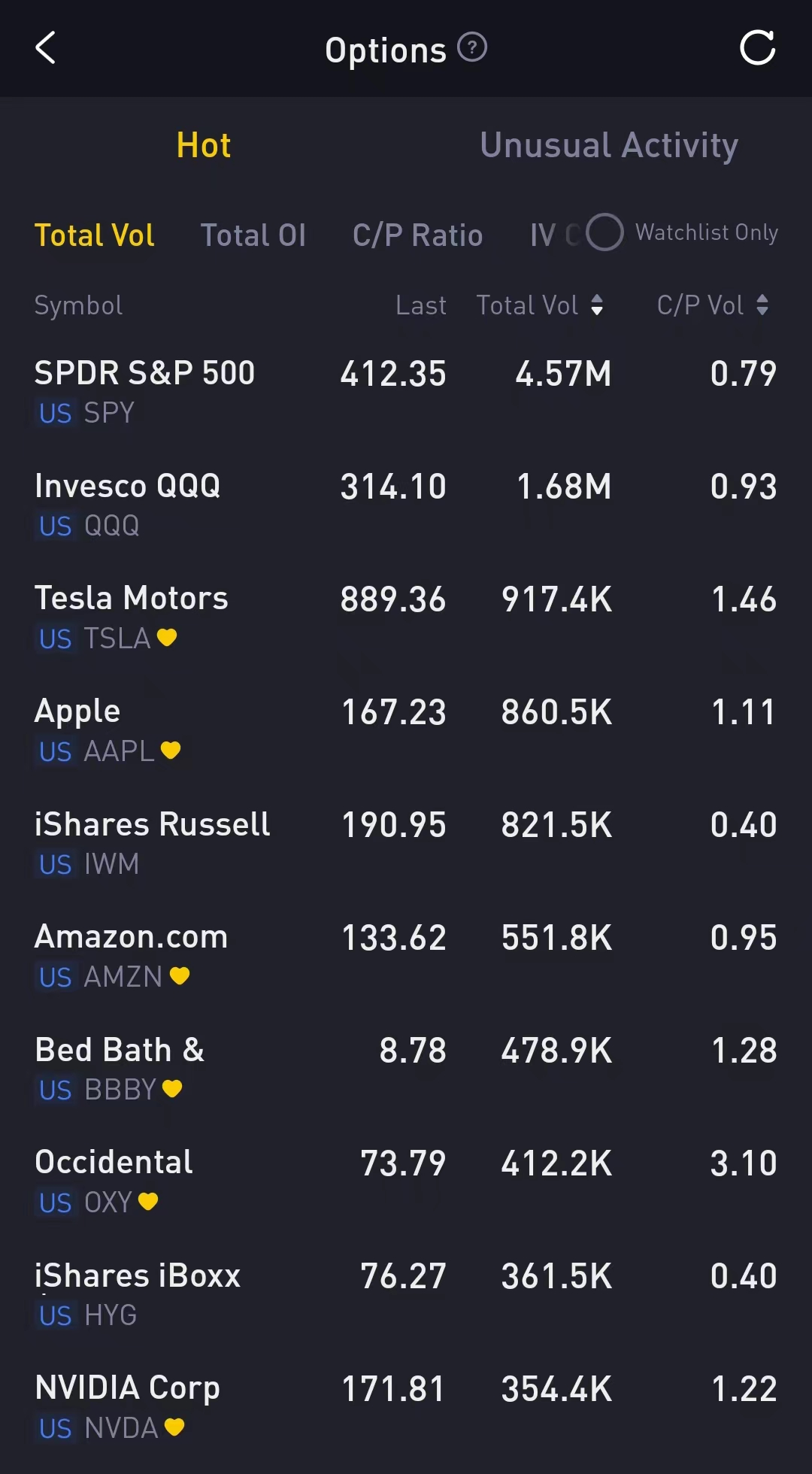

Options Broad View

A total volume of 27,997,986 contracts were traded on Tuesday, down 22% from the previous day. Call options account for 55% of total options trades.

There are 4.57 million SPDR S&P500 ETF Trust options traded on Tuesday. Call options account for 44% in overall option trades. Particularly high volume was seen for the $410 strike put option expiring August 26, with 58,308 contracts trading on Tuesday.

Top 10 Option Volumes

Top 10: SPY, QQQ, TSLA, AAPL, IWM, AMZN, BBBY, OXY, HYG, NVDA

Options related equity indexes are still top choices for investors, with 1.68 million Invest QQQ Trust ETF options contracts trading on Tuesday.

Total trading volume for SPY and QQQ, however, slide sharply from the previous day. SPY only trades 59% of overall options from the previous day, partly for the reason that the private-sector business activity in the United States contracted for a second straight month in August.

Tesla shares gained 2.26% on Tuesday as Tesla is moving forward with its second stock split on August 24. The shares will trade at a split-adjusted price on Aug. 25.

There are 915,457 Tesla options traded on Tuesday. Call options account for 59% in overall option trades. Particularly high volume was seen for the $900 strike call option expiring August 26, with 69,029 contracts trading on Tuesday.

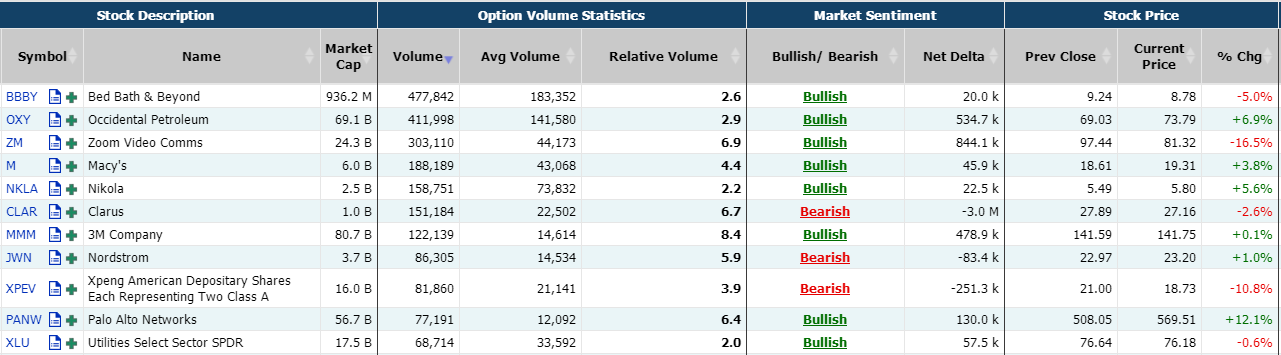

Unusual Options Activity

Occidental Petroleum saw options trading volume of 411,998 contracts, call options account for 76%. Particularly high volume was seen for the $75 strike call option expiring August 26, with 50,605 contracts trading on Tuesday, representing approximately 5,060,500 underlying shares of OXY.

Options interest in meme stocks Bed Bath & Beyond remained high, with 477,842 contracts trading on Tuesday. Particularly high volume was seen for the $10 strike call option expiring August 26, with 15,603 contracts trading on Monday, representing approximately 1,560,300 underlying shares of BBBY.

Macy's also saw usual options activity. There are 188,189 volume contracts trading on Tuesday, call options account for 70%. Particularly high volume was seen for the $20.5 strike call option expiring August 26, with 31,068 contracts trading on Tuesday.

Macy's moved 3.76% higher on Tuesday after topping earnings estimates. Inventory was up 7% year-over-year in Q2, reflecting disciplined inventory management in an environment of continued supply chain volatility.

Xpeng shares dropped 10.81% on Tuesday after the chinese EV maker reported a wider-than-expected loss after Shanghai’s lockdown and supply chain snarls troubled automakers last quarter. There are 81,860 options contracts traded on Tuesday, call options account for 76%.

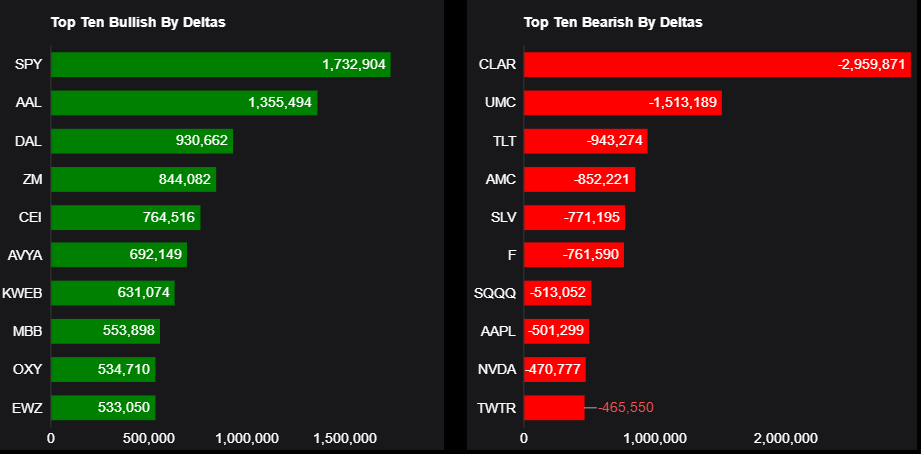

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive there is more bullish pressure. If the net is negative there is more bearish pressure.

Top 10 bullish stocks: SPY, AAL, DAL, ZM, CEI, AVYA, KWEB, MBB, OXY

SPY had the highest bullish wagers, with traders getting long 2 M deltas on balance. AAL and DAL also saw bullish option activities.

To modernize its fleet, American Airlines inked a deal with Boom Supersonic to purchase up to 20 Overture planes from the latter. Delta Air Lines also grabbed the headlines following management’s decision to increase the frequency of flights to Seoul, driven by a strong rebound in international travel.

Top 10 bearish stocks: CLAR, UMC, TLT, AMC, SLV, F, SQQQ, AAPL, NVDA, TWTR

CLAR had the highest bearish wagers, with traders selling 3 M deltas on balance. AMC and F also saw bullish option activities.

AMC stock is in full focus after acclaimed investor Jim Chanos announced that he had opened a short position in the movie theater chain. However, Chanos also announced that he had purchased shares of AMC Preferred Equity Units $(APE)$, resulting in an arbitrage trade. An arbitrage strategy is used when an investor seeks to exploit price differences in the same or identical assets.

Comments