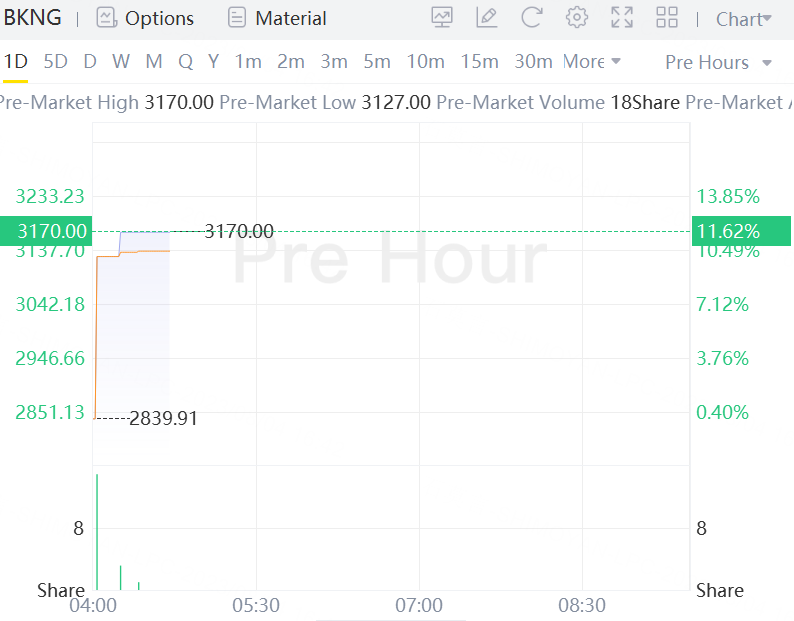

Booking Holdings on Thursday raised its forecast for third-quarter gross bookings as pent-up demand for travel outweighed rising costs and concerns around an uncertain economy, sending its shares up 11.62% in premarket trading.

It now expects gross bookings, which refers to the total dollar value of all travel services booked by customers, to grow slightly more than 20%, up from previous expectations of low-teens growth.

The company also estimates earnings before interest, taxes, depreciation, and amortization (EBITDA) will be 20% higher than last year.

The lifting of pandemic curbs has benefited hotel operators for the past few quarters, but domestic travel demand in the U.S. appears to be softening as more customers opt for vacations abroad, impacting companies such as Hilton Worldwide Holdings that have significant exposure to the region.

Booking, whose biggest market is Europe, beat Wall Street targets for second-quarter profit.

Room nights booked for the quarter ended June rose 9% from last year, while gross travel bookings jumped 15%.

"We have seen these strong trends continue into July, and we are currently preparing for what we expect to be a record summer travel season in the third quarter," said CEO Glenn Fogel in a statement.

In July, bookings in Asia were up 45% year-on-year, driving most of the growth, whereas the U.S. was up by mid-single digits.

The company has been looking to expand its footprint in the vacation rental market in the U.S., where Airbnb and Expedia dominate.

Alternative accommodation nights grew faster than traditional hotel nights for Booking, at about 11% in the second quarter.

However, U.S., "an area of focus", still remains "under index", when compared with overall growth, said Fogel in a post-earnings call with analysts.

Booking's revenue rose 27% to $5.46 billion, compared with analysts' expectations of $5.17 billion, according to Refinitiv data.

The higher revenues more than offset increases in marketing and labor costs.

Booking posted a per-share adjusted profit of $37.62, far above expectations of $28.90 per share.

Comments