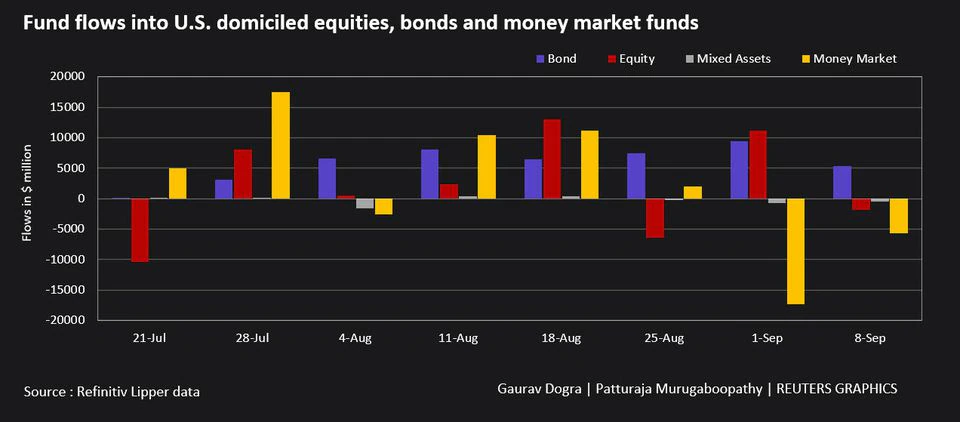

Sept 13 (Reuters) - U.S. equity funds faced an outflow in the week to Sept. 8, on concerns the spread of the Delta coronavirus variant could slow economic growth and uncertainty over the timeline for the Federal Reserve to pull back its accommodative policies.

Data from Lipper showed U.S. equity funds faced an outflow of $1.85 billion in the week to Wednesday, compared with an inflow worth $11.18 billion in the previous week.

Investors also assessed data that showed the U.S economy created the fewest jobs in seven month in August, which affected risk sentiment.

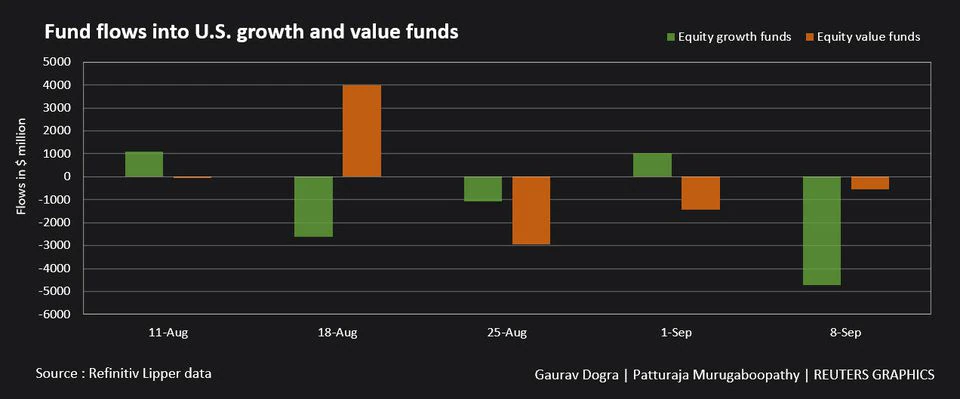

U.S. equity growth funds faced net selling of $4.72 billion, their biggest outflow in seven weeks, while value funds saw outflows for a third straight week, worth a net $541 million.

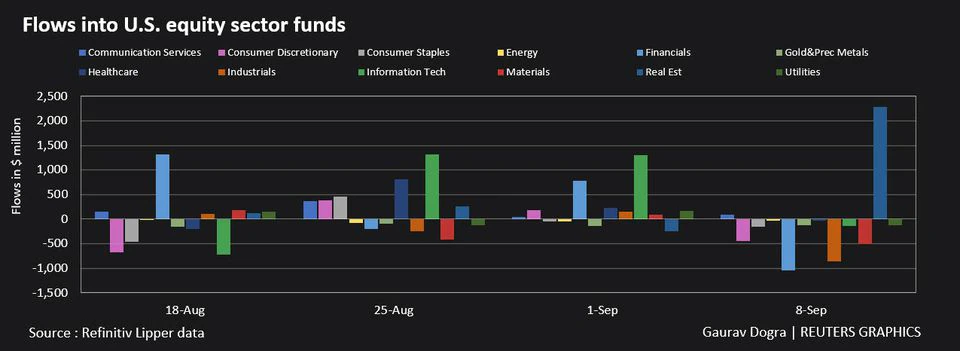

Among equity sector funds, real estate funds lured a net $2.29 billion, the biggest since at least mid-October 2019. However, financials, industrials and materials sectors faced outflows of $1.05 billion, $857 million and $512 million respectively.

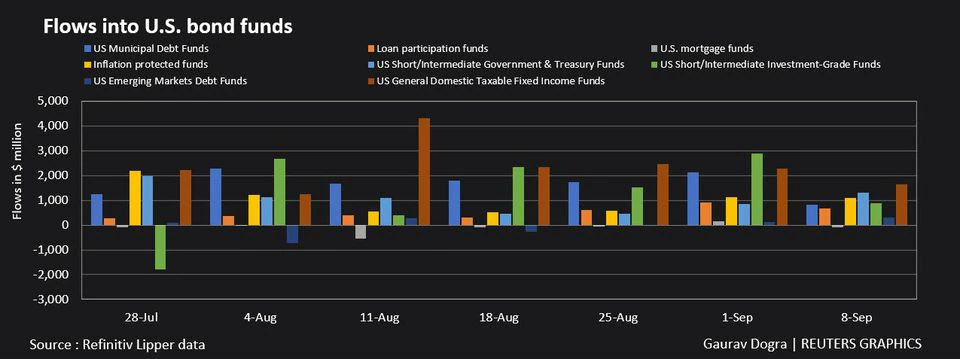

Meanwhile, U.S. bond funds attracted a net $5.29 billion, that marked an eighth consecutive week of inflows.

U.S. taxable bond funds received a net $4.74 billion, a 40% drop from the previous week, while U.S. municipal bond funds attracted $833 million, which was the smallest inflow in nearly four months.

U.S. inflation-protected funds pulled in a net $1.1 billion, marking a seventh week of inflows, while short/intermediate government and treasury funds received a net $1.3 billion, a 53% increase over the previous week.

U.S. money market funds, however, faced a second straight week of outflows, worth a net $5.69 billion.

Comments