- Delta Air Linespress release: Q2 Non-GAAP EPS of $1.44misses by $0.28.

- Revenue of $13.8B (+93.5% Y/Y)beats by $400M.

- Adjusted Revenue of $12.31B vs. consensus of $12.33B.

- The company is on track to achieve 2024 targets ofover $7 adj. EPS and $4B of free cash flow.

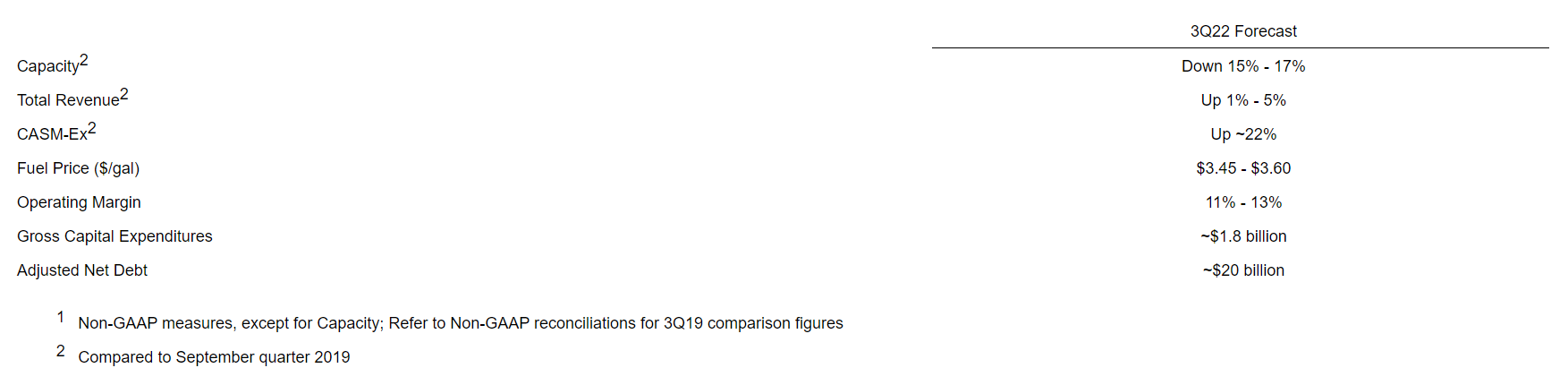

- Q3 Outlook: Capacity to be down ~15% to 17% vs. 3Q19; Total Revenue to grow by 1% to 5% vs. 3Q19; Adjusted Net Debt of ~$20B down from Q2 net debt of $19.6B.

Delta Air Lines (NYSE:DAL) today reported financial results for the June quarter 2022 and provided its outlook for the September quarter 2022. Highlights of the June quarter 2022 results, including both GAAP and adjusted metrics.

Good progress in restoring operational reliability to Delta's leading standards in July

Generated double digit June quarter operating margin

Expect double digit operating margin in September quarter and meaningful full year profitability

On track to achieve 2024 targets of over $7 adj. EPS and $4 billion of free cash flow

Delta Air Lines shares dropped more than 1% in premarket trading.

"I would like to thank our entire team for their outstanding work during a challenging operating environment for the industry as we work to restore our best-in-class reliability. Their performance coupled with strong demand drove nearly $2 billion of free cash flow as well as profitability in the first half of the year, and we are accruing profit sharing, marking a great milestone for our people," said Ed Bastian, Delta's chief executive officer. "For the September quarter, we expect an adjusted operating margin of 11 to 13 percent, supporting our outlook for meaningful full year profitability."

June Quarter 2022 GAAP Financial Results

- Operating revenue of $13.8 billion

- Operating income of $1.5 billion with operating margin of 11.0 percent

- Earnings per share of $1.15

- Operating cash flow of $2.5 billion

- Total debt and finance lease obligations of $24.8 billion

June Quarter 2022 Adjusted Financial Results

- Operating revenue of $12.3 billion, 99 percent recovered versus June quarter 2019 on 82 percent capacity restoration

- Operating income of $1.4 billion with operating margin of 11.7 percent, the first quarter of double-digit margin since 2019

- Earnings per share of $1.44

- Free cash flow of $1.6 billion after investing $864 million into the business

- Payments on debt and finance lease obligations of $1.0 billion

- $13.6 billion in liquidity* and adjusted net debt of $19.6 billion

September Quarter Outlook

Comments