With the disaster earnings last week,Meta Platforms had its biggest losing day in history, shedding over 26% of value and losing over $200 billion in market cap.

This week, the stock has continued to lose ground and is currently down another 8% while sitting on the lows for the week.

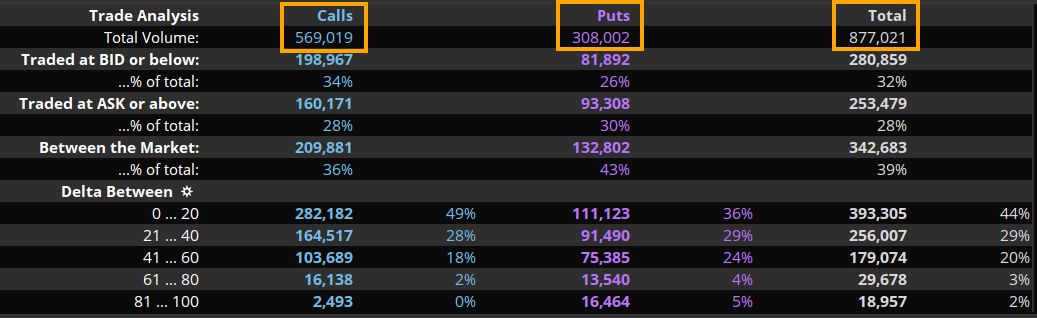

This is in the face of option traders buying up large amounts of calls options across the board. Tuesday alone, traders have moved over 877,000 contracts with over 568,000 calls and 307,000 puts (image below).

What Happened:While the company beat on revenue (slightly), it missed on earnings by about 4.4%. The more ominous details in the earnings release had to do with the new Apple privacy features.

Essentially, any user on an iOS device can now opt out of the tracking features for an app. In terms of Facebook, this is a nightmare as it means their app can no longer track a users data and activity (if they opt out), which means worse advertising and weaker ads, thus reducing their ad revenue models significantly.

Why It Matters:With Facebook saying it expects forward ad revenue to decline signficantly, it means future earnings will be weaker by the tune of billions of dollars.

Needless to say, investors have continued to sell the stock heavily post-earnings, now down over 32% since the earnings release last week.

What's Next:Prior to trading Tuesday, Meta Platforms had over 1.7 million calls and 1.1 million puts for a total of 2.9 million options with a slight bias to the call side. Of those options, about 24% is expiring this Friday, so a fair amount of options coming off the board. This should create volatility going into Friday and Monday next week.

As mentioned above, the stock has moved over 877,000 options with a fair amount of them being calls. Considering the calls are losing value rapidly with the stock falling, it's less likely traders are selling calls, and more likely dip buying calls. Yet through the heavy call buying today, the stock is still down.

It should be noted over 200,000 of the options traded today are short dated (expiring this Friday), which will further exacerbate the volatility by the end of the week.

Also, there is not much call interest below the $220 strike for this weekly op-ex. This means traders aren't bullish if the stock is below $220, and there aren't enough calls to support it. But put interest is robust below $220, so the stock could accelerate to the downside over the next day or two with the next support coming in around $210.

Below this, there is not much support until $200, so potential losses might be in store for the once darling stock.

Comments