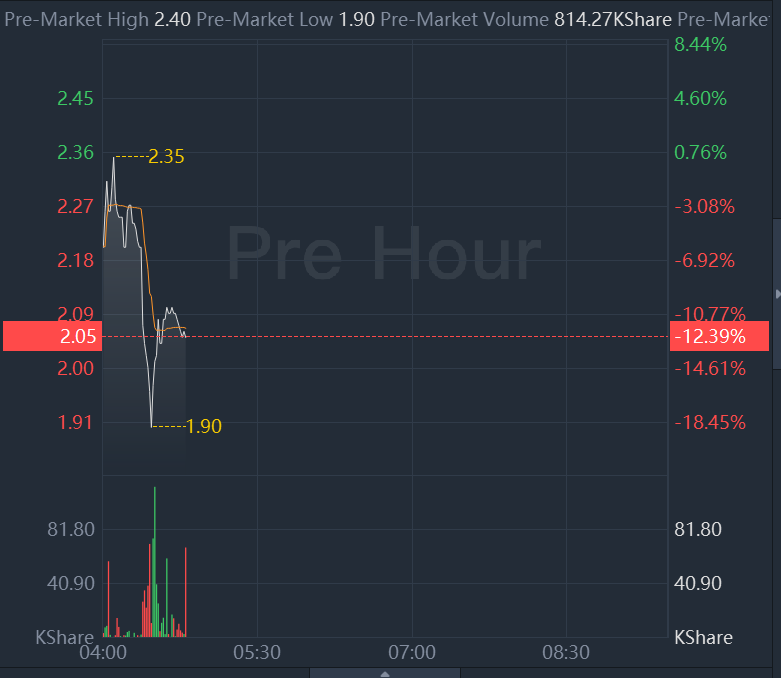

RLX Technology today announced its unaudited financial results for the fourth quarter and the fiscal year ended December 31, 2021. RLX Q4 net revenues were $298.8 million, representing an increase of 17.7% from RMB1,618.5 million in the same period of 2020. RLX Q4 U.S. GAAP net income was $77.6 million, compared with U.S. GAAP net loss of RMB236.7 million in the same period of 2020. RLX shares tumbled 12% in premarket trading.

Fourth Quarter 2021 Financial Highlights

- Net revenues were RMB1,904.4 million (US$298.8 million), representing an increase of 17.7% from RMB1,618.5 million in the same period of 2020.

- Gross margin was 40.2%, compared with 42.9% in the same period of 2020.

- U.S. GAAPnet income was RMB494.4 million (US$77.6 million), compared with U.S. GAAP net loss of RMB236.7 million in the same period of 2020.

- Non-GAAP net income was RMB536.5 million (US$84.2 million), compared with RMB419.3 million in the same period of 2020.

Fiscal Year 2021 Financial Highlights

- Net revenueswere RMB8,521.0 million (US$1,337.1 million) in the fiscal year 2021, representing an increase of 123.1% from RMB3,819.7 million in the prior year.

- Gross marginwas 43.1% in the fiscal year 2021, compared with 40.0% in the prior year.

- U.S. GAAP net incomewas RMB2,028.1 million (US$318.3 million) in the fiscal year 2021, compared with U.S. GAAP net loss of RMB128.1 million in the prior year.

- Non-GAAP net incomewas RMB2,251.5 million (US$353.3 million) in the fiscal year 2021, compared with RMB801.0 million in the prior year.

"We are pleased with our operational and financial performance in the fourth quarter, ending 2021 on a strong note. Despite the evolving industry regulatory framework and challenging backdrop of recurrent COVID-19 outbreaks, we remained focused throughout the year on optimizing our distribution and retail channels, investing in scientific research, new product development, and digitalization upgrades," said Ms. Ying (Kate) Wang, Co-founder, Chairperson of the Board of Directors and Chief Executive Officer of RLX Technology. "The 2021 fiscal year was defined by year-over-year revenue growth of 123.1%, further cementing our leadership as a trusted e-vapor brand for adult smokers. Looking ahead, we are confident that the Company is well-positioned to further explore the enormous potential of this vast yet growing industry and achieve future growth in 2022 and beyond."

"In the fourth quarter of 2021, we delivered net revenues of RMB1,904.4 million, up 17.7% year-over-year, reflecting the momentum behind our efforts to optimize our distribution and retail channel network and enhance our diversified product portfolio," said Mr. Chao Lu, Chief Financial Officer of RLX Technology. "In December 2021, our Board of Directors authorized a share repurchase program under which we may repurchase up to US$500 million of our shares over a period until December 31, 2023. This program demonstrates our continued confidence in the future development of our industry and the strength of our business. As we progress through 2022, we will strive to strengthen our core capabilities, bolster our market leading position, and reinforce our commitment to achieve sustainable growth and generate long-term value for our shareholders."

Comments