U.S. Stocks rose on Tuesday (July 11th), helped by optimism ahead of key inflation reports and as JPMorgan and other financial shares gained before earnings later this week.

Regarding the options market, a total volume of 35,400,861 contracts was traded, up 9.3% from the previous trading day.

Top 10 Option Volumes

Top 10: SPY; QQQ; Tesla; IWM; VIX; Apple; Activision Blizzard; Amazon; AMC Entertainment; Rivian

Among the S&P 500's biggest gainers on the day, shares of videogame maker Activision Blizzard are up 10% Tuesday to $90.99 on hopes that Microsoft will be able to proceed with the merger deal at $95 a share.

The decision by Judge Jacqueline Corley, who turned down the Federal Trade Commission's request for a preliminary injunction to block Microsoft's $75 billion deal to acquire Activision Blizzard, could change all that.

Now, the prospects of deals closing look far better. Wall Street now is putting 80% to 90% odds of the deal closing, perhaps as early as next week. The odds had been closer to 25% when Activision traded in the low 70s in early 2023.

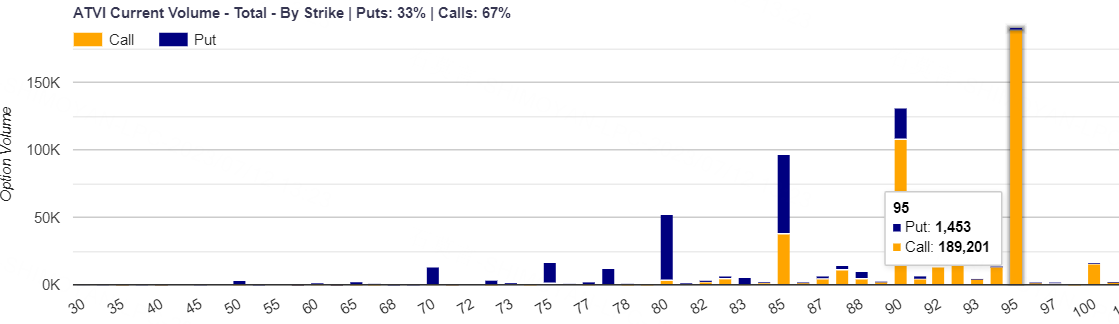

A total number of 680.9K options related to ATVI was traded, of which call options accounted for 67%. A particularly high trading volume was seen for the $95 strike call options expiring July 21, with a total number of 189,201 option contracts trading on Tuesday. $ATVI 20230721 95.0 CALL$

Amazon.com shares edged up 1.3%. An executive said on Tuesday that a key way that Amazon's cloud division aims to set itself apart from rivals perceived to have a leg up on artificial intelligence is by competing on price.

The AI models behind a viral chatbot like ChatGPT require immense computing power to train and operate, the kinds of costs Amazon Web Services (AWS) is good at lowering, said Dilip Kumar, vice president overseeing its applications group.

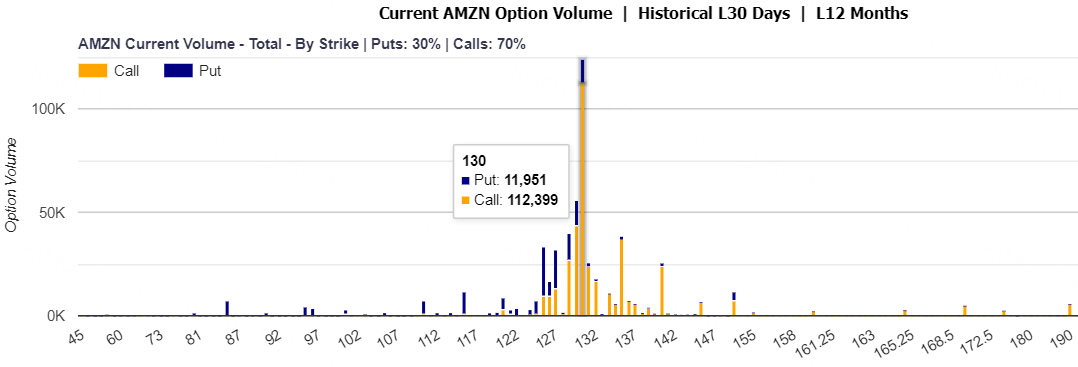

A total number of 572.3K options related to AMZN was traded, of which call options accounted for 70%. A particularly high trading volume was seen for the $130 strike call options expiring July 14, with a total number of 112,399 option contracts trading on Tuesday. $AMZN 20230714 130.0 CALL$

Most Active Equity Options

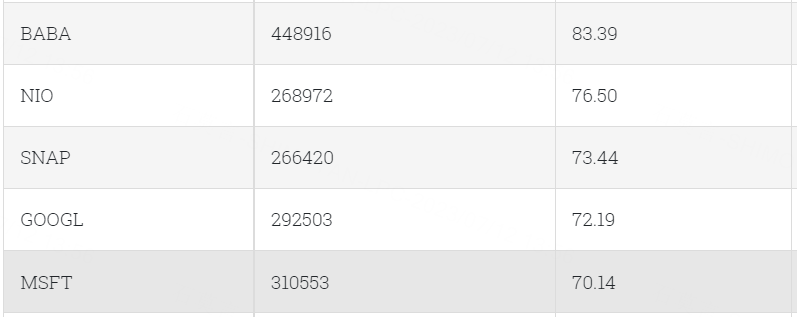

Special %Calls >70%: Alibaba; Nio; Snap;Alphabet; Microsoft

Unusual Options Activity

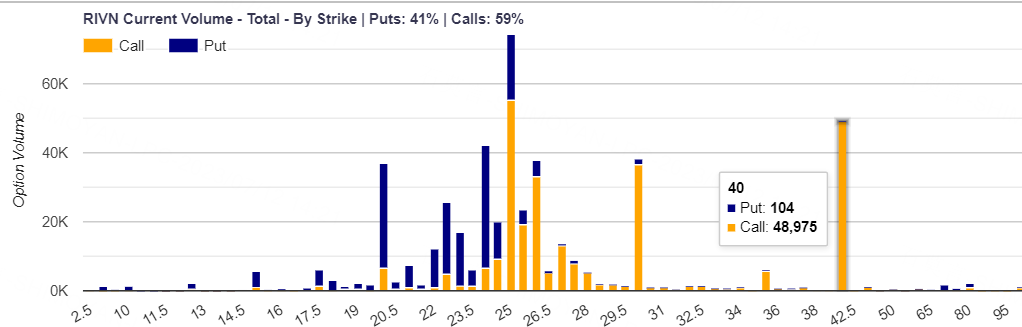

Shares of Rivian Automotive fell 2.6% Tuesday, closing at $24.85. Coming into Tuesday trading, Rivian shares were up for nine consecutive days. Shares rose 90% during the streak, which is the best nine-day stretch for the stock ever.

Shares started rising late in June, but deliveries really kicked things into high gear. Rivian, which produced 9,395 vehicles in the first quarter, announced second quarter production of 13,992 units on July 3. Wall Street expected roughly 11,000. Shares rose roughly 17% in response.

Better production was a catalyst for Wedbush analyst Dan Ives to increase his target price for Rivian shares to $30 from $25 a couple days later. He rates Rivian stock Buy. Shares rose 14% that day.

A total number of 572.3K options related to AMZN was traded, of which call options accounted for 70%. A particularly high trading volume was seen for the $130 strike call options expiring July 14, with a total number of 112,399 option contracts trading on Tuesday. $RIVN 20230915 40.0 CALL$

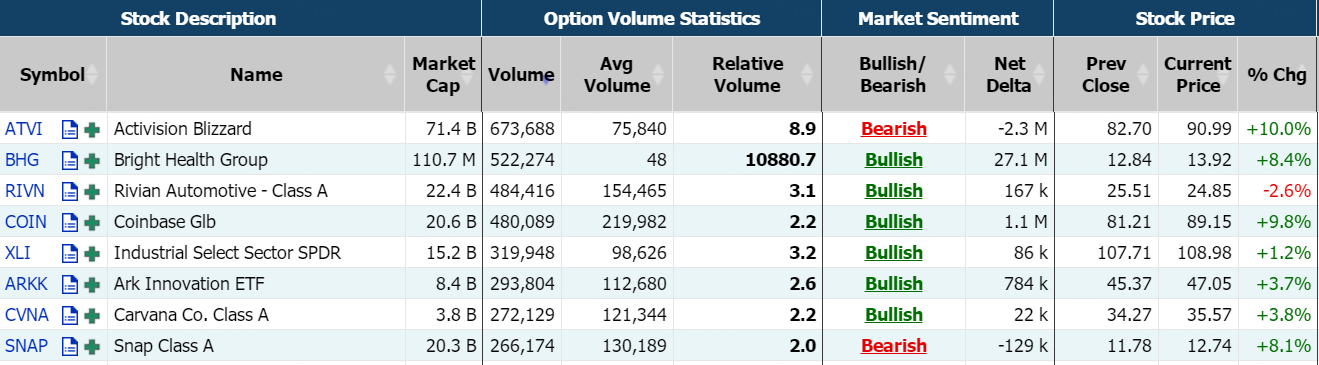

TOP Bullish & Bearish Single Stocks

This report shows stocks with the highest volume of bullish and bearish activity by option delta volume, which converts option volume to an equivalent stock volume (bought or sold).

If we take the total positive option delta volume and subtract the total negative option delta volume, we will get the net imbalance. If the net imbalance is positive, there is more bullish pressure. If the net is negative, there is more bearish pressure.

Top 10 bullish stocks: BHG; COIN; REI; MULN; RKLB; PACW; CGC; TTD; BITF; MVST

Top 10 bearish stocks: AAPL; ATVI; SOFI; AMC; LCID; PYPL; AMZN; META; MSFT

Based on option delta volume, traders sold a net equivalent of -3,231,717 shares of Apple stock. The largest bearish delta came from selling calls. The largest delta volume came from the 14-Jul-23 190 Call, with traders getting short 1,676,672 deltas on the single option contract. $AAPL 20230714 190.0 CALL$

If you are interested in options and you want to:

Share experiences and ideas on options trading.

Read options-related market updates/insights.

Learn more about options trading if you are a beginner in this field.

Please click to join Tiger Options Club

Comments