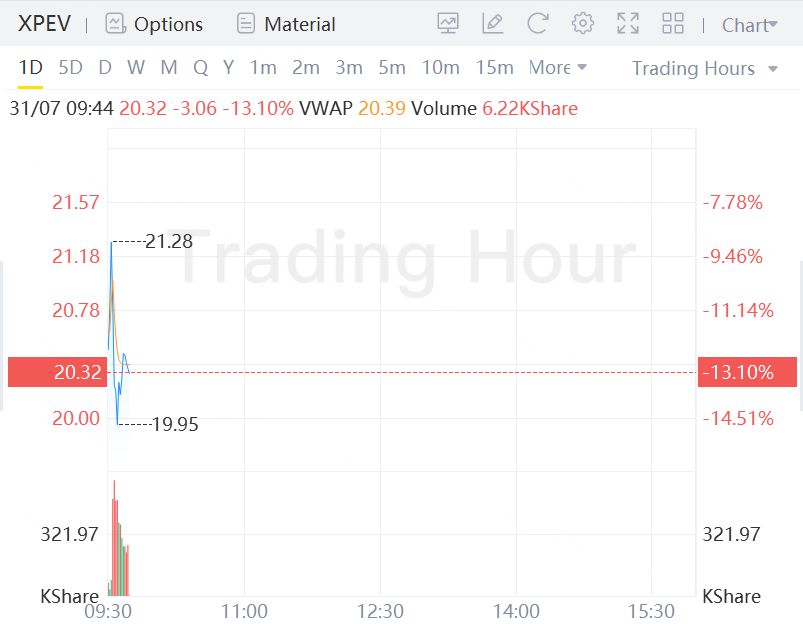

XPeng falls over 13% in morning trading after a 60% rally last week.

UBS downgraded Xpeng to a Neutral rating (From Buy) and raised their 12-month price target on the stock to $23.00 (From $12.00) after the carmaker announced a collaboration with Volkswagen.

“While we share the market's positive view on VW's investment and collaboration, and pricing competitiveness of G6's specs, we believe near-term upside catalysts have been priced in.” wrote analysts.

They believe that XPeng's 4.99% equity investment and technological partnership with VW serves as a testament to XPeng's prowess in vehicle intelligence and autonomous driving. Nonetheless, creating the two medium-size electric vehicles for VW, built upon G9's platform, will demand a minimum of three years to execute.

“While the VW collaboration will proceed over the next three years, the company remains vulnerable in a fiercely competitive market and needs to recover its profitability,” added analysts.

Due to the volume declines experienced in the first half of 2023 (H123) and the challenging mass-market competition encountered by older models, UBS decided to revise down their volume estimates for 2023 and 2024 by 26% and 14%, respectively. Consequently, UBS has also adjusted their projected topline figures for the same period, lowering them by 30% and 19%, and their net income estimates by 32% and 60% for 2023 and 2024, respectively.

Comments