U.S. stocks ended sharply higher on Friday and the S&P 500 registered an all-time closing high as strong earnings and a blowout January employment report boosted confidence in the economy, even while lowering the likelihood that the Federal Reserve will cut interest rates any time soon.

Market Snapshot

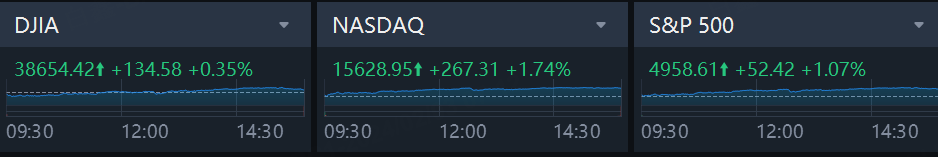

The S&P 500 climbed 1.07% to end the session at 4,958.61 points. The Nasdaq gained 1.74% to 15,628.95 points, while Dow Jones Industrial Average rose 0.35% to 38,654.42 points.

Market Movers

Shares of Meta Platforms surged 20% after the parent company of Facebook and Instagram issued a better-than-expected revenue forecast for the first quarter and declared its first-ever dividend, of 50 cents a share. The company also said it was authorized to boost its buyback program by $50 billion. Meta’s fourth-quarter adjusted earnings of $5.33 a share beat consensus estimates of $4.82. Meta said fourth-quarter revenue jumped 25% to $40.11 billion; advertising revenue made up $38.71 billion of the total.

Meta Platforms added $196 billion in stock market value on Friday, marking the biggest one-day gain by any company in Wall Street history.

Amazon.com rose 7.9% after the e-commerce and cloud computing company posted better-than-expected fourth-quarter profit and sales, driven by strength in its core e-commerce business and continued growth in ad revenue. The company’s Amazon Web Services saw revenue jump 13% in the quarter to $24.2 billion, which was in line with Wall Street estimates. For the first quarter, Amazon said it sees revenue of $138 billion to $143.5 billion, up 8% to 13%, with operating income of between $8 billion as $12 billion. Wall Street had been calling for revenue of $142.3 billion and operating income of $8.8 billion.

Apple declined 0.5% after the company reported fiscal first-quarter earnings that topped Wall Street estimates, with strength in iPhones, but lower-than-expected growth in services. Apple also reported a decline in its China business, where it is seeing new competition in the smartphone market from Samsung and others. Greater China sales were $20.8 billion, down 13% from a year earlier.

Chevron reported fourth-quarter adjusted earnings of $3.45 a share, beating analysts’ estimates of $3.19. Revenue fell to $47.2 billion from $56.5 billion a year earlier and missed forecasts. Chevron raised its quarterly dividend by 8% to $1.63 a share. The stock rose 2.9%.

Exxon Mobil ‘s fourth-quarter adjusted earnings of $2.48 a share beat analysts’ estimates of $2.20. Exxon reported revenue in the period of $84.34 billion, missing expectations of $90.03 billion. The stock rose fell 0.4%.

Gen Digital fell 11% after the security software company cut its fiscal-year outlook following a decline in fiscal third-quarter profit.

Deckers Outdoor posted fiscal third-quarter earnings of $15.11 a share, beating estimates of $11.48, and announced that Chief Executive and President Dave Powers would be leaving the maker of Hoka and Ugg shoes and would be replaced by Stefano Caroti, the company’s chief commercial officer. Shares rose 14%.

Sneakers maker Skechers was down 10% after reporting weaker-than-expected fourth-quarter sales and issuing a forecast for first-quarter earnings that was below analysts’ estimates.

Charter Communications declined 17% after the company lost 61,000 internet customers in the fourth quarter, with most of the declines coming from residential customers. Analysts expected an increase of 6,000 internet customers. Charter reported fourth-quarter earnings of $7.07 a share while analysts expected $8.76.

Atlassian reported second-quarter adjusted earnings of 73 cents a share, topping Wall Street estimates, and a revenue increase of 21% to $1.06 billion. The software company’s guidance also was above expectations but the stock fell 15%.

Fiscal second-quarter revenue at Clorox topped forecasts and the cleaning-products maker raised its fiscal 2024 adjusted earnings outlook to $5.30 to $5.50 a share, up from previous guidance of between $4.30 and $4.80 a share. The stock jumped 5.6%.

Intel is delaying the construction timetable for its $20 billion chip-manufacturing project in Ohio, The Wall Street Journal reported. Intel had planned to begin making chips at the plant next year but it’s likely the plant won’t be completed until late 2026, the Journal said. A company spokesman confirmed the report, telling the Journal that “decisions are based on business conditions, market dynamics and being responsible stewards of capital.” The stock fell 1.8%.

Market News

Bezos to sell up to 50 mln Amazon shares by Jan. 31 next year - filing

Amazon.com founder Jeff Bezos will sell up to 50 million shares in the online retail and cloud services firm over the next one year, according to a company filing on Friday.

The securities are worth $8.6 billion at the current price of $171.8 share. The sale plan, which is subject to certain conditions, was adopted on Nov. 8 last year and will be completed by Jan. 31, 2025, according to the company's latest annual report.

Apple’s Vision Pro virtual reality headset launches in U.S.

Apple’s Vision Pro virtual reality headset officially launched in the U.S. on Friday. Customers who preordered the headset will begin to receive it or pick it up at Apple Store locations.

Apple CEO Tim Cook appeared at the company’s flagship Fifth Avenue store in New York City on Friday morning to celebrate the headset’s release. Speaking to CNBC’s Jim Cramer at the event about the Vision Pro’s high sticker price, Cook called it “tomorrow’s technology today.” The Vision Pro starts at $3,500.

Comments