ASML Holding NV, a key equipment supplier to computer chip manufacturers, on Wednesday reported better-than-expected third-quarter sales and profit and record new bookings.

"There is uncertainty in the market due to a number of global macro-economic concerns including inflation, consumer confidence and the risk of a recession," said CEO Peter Wennink in a statement.

Despite weakness in the end market for memory chips, however, "the overall demand for our systems continues to be strong. This resulted in record bookings in the third quarter of around 8.9 billion euros," he said.

ASML, Europe's largest technology company, makes lithography systems, large machines that cost up to $160 million each and are used by chipmakers such as Taiwan Semiconductor (TMSC), Samsung and Intel to create the circuitry of computer chips.

It is currently unable to keep up with demand from these companies as they seek to build new manufacturing plants, and with ASML's backlog now at more than 30 billion euros, ASML is seeking to expand its own production capacity by 2025.

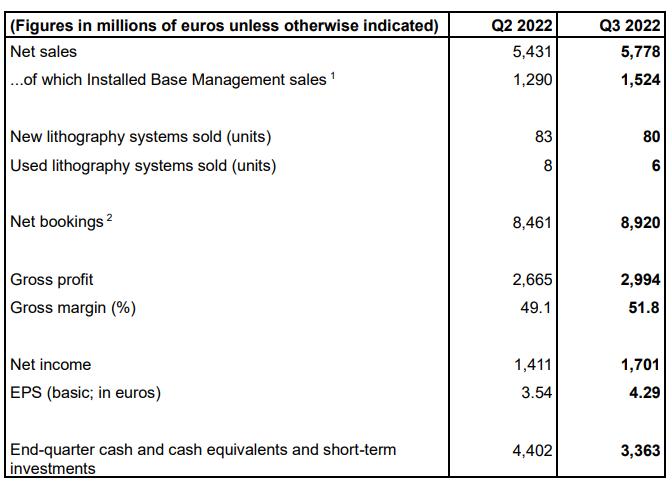

ASML's third-quarter net profit was 1.7 billion euros ($1.7 billion), on sales of 5.8 billion euros, beating analyst forecasts of profit of 1.42 billion euros, on sales of 5.41 billion euros.

By comparison in the second quarter of 2022, ASML had income of 1.70 billion euros on sales of 5.78 billion euros.

Earnings Highlight

- ASML Holding press release Q3 GAAP EPS of €4.29.

- Revenue of €5.8B (+10.7% Y/Y) beats by €410M.

- Gross margin of 51.8%.

- Record quarterly net bookings in Q3 of €8.9B.

- ASML expects Q4 2022 net sales between €6.1B and €6.6B vs. €4.98B in Q4 2021 and a gross margin around 49%.

- Expected sales for the full year €21.1B at the midpoint of the Q4 guidance.

- The value of fast shipments in 2022 leading to delayed revenue recognition into 2023 is expected to be around €2.2B.

Comments