U.S. stock index futures rose on Thursday, led by Tesla and other growth shares following a broad selloff on Wall Street on worries over surging inflation and the path for interest rate hikes.

Market Snapshot

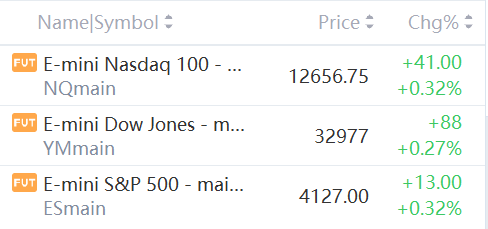

At 8:00 a.m. ET, Dow e-minis were up 88 points, or 0.27%, S&P 500 e-minis were up 13 points, or 0.32%, and Nasdaq 100 e-minis were up 41 points, or 0.32%.

Pre-Market Movers

Target – The retailer’s stock gained 1% in the premarket after it announced a 20% dividend hike. Target will increase its quarterly payout to $1.08 per share from 90 cents.

Signet Jewelers – The jewelry retailer’s stock rallied 5.1% in the premarket after it posted better-than-expected quarterly profit and revenue, and issued an upbeat full-year forecast. Signet also expanded its share repurchase authorization by $500 million.

Novavax – The drug maker’s shares slid 5.3% in premarket trading following news that an FDA decision on approval of Novavax’s Covid-19 vaccine could be delayed. An FDA spokesperson told CNBC that the agency needs to review changes in the company’s manufacturing process.

Nio – Nio shares lost 5.7% in the premarket after the China-based electric vehicle maker’s quarterly report highlighted shrinking profit margins and a downbeat outlook due to supply chain challenges. Nio posted a smaller-than-expected quarterly loss with revenue topping analyst forecasts.

Intel – Intel announced a hiring freeze at its Client Computing Group as it reassesses spending priorities amid global macroeconomic uncertainty. The move comes amid a slide in worldwide personal computer demand.

Tesla – Tesla shares jumped 3.2% in premarket trading after UBS upgraded the stock to “buy” from “neutral,” saying the recent share price decline has provided an attractive entry point given a strong operational outlook.

Five Below – Five Below reported a quarterly profit of 59 cents per share, a penny above estimates, but revenue fell below analyst forecasts. The discount retailer also cut its full-year guidance. The stock slumped 7.6% in the premarket.

Ollie’s Bargain Outlet – Ollie’s was upgraded to “outperform” from “sector perform” at RBC Capital Markets, setting up the discount retailer’s stock for a possible sixth straight day of gains. The upgrade follows the company’s quarterly earnings report, which fell short of analyst forecasts but also contained an upbeat current-quarter forecast. Ollie’s gained 3.5% in premarket trading.

Skillsoft – Skillsoft tumbled 9.3% in premarket action after the digital learning company’s quarterly sales fell below Wall Street forecasts, although it reported a smaller-than-expected loss. Skillsoft said it was trending toward the lower end of its prior full-year forecast due to macroeconomic headwinds.

Market News

Bilibili Tumbled as its net loss in Q1 reached $360.3 million

The company posted a net loss of 2.28 billion yuan, or around $360 million, compared with a loss of CNY904.9 million a year earlier. Per-share loss widened to CNY5.80, or 91 U.S. cents per ADR, compared with CNY2.54 a year earlier.

Stripping out one-time items, the company's adjusted loss was 66 cents a share. Analysts surveyed by FactSet had been expecting adjusted earnings of 61 cents a share.

Total net revenue for the quarter rose 30% to $797.3 million, or CNY5.05 billion. Analysts surveyed by FactSet had been looking for sales of $759.8 million.

NIO stock drops after downbeat outlook, steep drop in gross margin

Shares of NIO fell Thursday, after the China-based electric vehicle maker reported a narrower-than-expected first-quarter loss and revenue that topped expectations, but a sharp contraction in gross margin and a downbeat outlook due to volatilities in the supply chain and vehicle delivery challenges resulting from the recent COVID-19 resurgence.

The net loss narrowed to RMB1.27 billion ($200.5 million), or RMB1.12 a share, from RMB4.95 billion, or RMB3.14 a share, in the year-ago period. Excluding nonrecurring items, the adjusted per-share loss was RMB0.79, beating the FactSet consensus of RMB0.94.

Cathie Wood's Ark Invest Scoops Up $2.3M Worth Of Tesla

Cathie Wood-led Ark Invest Investment Management added more Tesla stock to its portfolio on Wednesday, raising its exposure to the electric vehicle maker for the third time this month.

Ark Invest bought 3,162 shares, estimated to be worth $2.29 million, in Tesla on Wednesday.

The popular investment firm last month scooped up 45,003 shares in Tesla and has bought 13,862 shares in June so far.

Abbott, FDA were warned about formula plant a year before recall

Abbott and the Food and Drug Administration were alerted to a whistleblower complaint about Abbott's Sturgisinfant formulaplant as far back as February 2021.

This complaint, filed with the U.S. Labor Department's Occupational Safety and Health Administration, alleges quality control concerns atAbbott's formula plantin Sturgis, Michigan -- a year before the company's massive recall and shutdown in February 2022 following contamination concerns, which helped exacerbate a nationwide shortage in baby formula, according to sources familiar with the matter.

Intel Freezes Hiring in PC Chip Division for at Least Two Weeks

Intel Corp has frozen hiring in the division responsible for PC desktop and laptop chips, according to a memo reviewed by Reuters, as part of a series of cost-cutting measures.

Intel is "pausing all hiring and placing all job requisitions on hold" in its client computing group, according to the memo sent on Wednesday. The memo said that some hiring could resume in as little as two weeks after the division re-evaluates priorities and that all current job offers in its systems will be honored.

Comments